Tech Mahindra Share Price Target Tomorrow 2025 To 2030

Tech Mahindra Ltd. is a leading global IT services and consulting company headquartered in Pune, India. Established in 1986 as a joint venture between Mahindra & Mahindra and British Telecom, it has grown into a prominent player in the technology sector. The company operates in over 90 countries, offering a wide range of services including digital transformation, consulting, cloud computing, artificial intelligence, and enterprise solutions. Tech Mahindra Share Price on NSE as of 15 April 2025 is 1,290.30 INR.

Tech Mahindra Share Market Overview

- Open: 1,314.20

- High: 1,314.20

- Low: 1,288.50

- Previous Close: 1,282.25

- Volume: 551,612

- Value (Lacs): 7,110.28

- VWAP: 1,297.53

- UC Limit: 1,410.50

- LC Limit: 1,154.10

- 52 Week High: 1,807.70

- 52 Week Low: 1,162.95

- Mkt Cap (Rs. Cr.): 126,192

- Face Value: 5

Tech Mahindra Share Price Chart

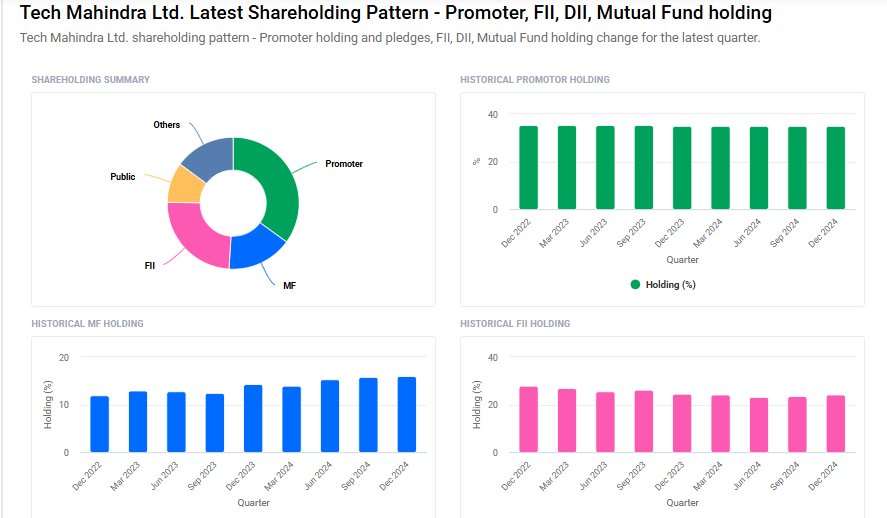

Tech Mahindra Shareholding Pattern

- Promoters: 35%

- FII: 24.2%

- DII: 30.9%

- Public: 9.9%

Tech Mahindra Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹1810

- 2026 – ₹1900

- 2027 – ₹2000

- 2028 – ₹2100

- 2029 – ₹2200

- 2030 – ₹2300

Major Factors Affecting Tech Mahindra Share Price

Here are six key factors that influence the share price of Tech Mahindra Ltd:

1. Performance in Key Business Segments

Tech Mahindra’s revenue is significantly influenced by its performance in various sectors. For instance, in Q3 FY25, the company experienced a 5.6% decline in telecom revenue, which impacted overall earnings. Conversely, the banking, financial services, and insurance (BFSI) segment grew by 8.3%, and media revenue increased by 3.5%. These sector-specific performances play a crucial role in shaping investor sentiment and, consequently, the share price.

2. Strategic Focus on BFSI Sector

Under the leadership of CEO Mohit Joshi, Tech Mahindra aims to increase its revenue share from the BFSI sector to 25% by March 2027, up from the current 16%. This strategic shift is intended to reduce reliance on the telecom sector and tap into the lucrative BFSI market, potentially leading to more stable and diversified revenue streams.

3. Financial Metrics and Valuation

As of April 15, 2025, Tech Mahindra’s stock is trading at approximately ₹1,282.25. The company’s price-to-earnings (P/E) ratio stands at 34.54, which is higher than the industry average of 25.58, indicating that investors expect higher future growth. However, the stock is considered slightly overvalued by about 1% compared to its intrinsic value of ₹1,265.74.

4. Cost Management and Profitability

Employee and subcontractor costs are significant for Tech Mahindra, comprising 56.6% and 11.5% of revenue, respectively, in Q3 FY24. In the first half of FY24, the company’s profit after tax declined by 51% year-on-year due to lower revenue growth and higher expenses. Effective cost management is essential for maintaining profitability and positively influencing the share price.

5. Market Performance and Investor Sentiment

Tech Mahindra’s stock has experienced fluctuations, with a 2.86% decline over the past week and a 13.42% drop over the past month. Such movements reflect investor sentiment and market dynamics, which can be influenced by various factors, including company performance, industry trends, and broader economic conditions.

6. Dividend Policy and Shareholder Returns

The company has a history of rewarding shareholders, with a dividend yield of approximately 3.08% and a healthy dividend payout ratio of 96%. Such consistent returns can attract investors seeking income, thereby supporting the share price.

Risks and Challenges for Tech Mahindra Share Price

Here are six key risks and challenges that could influence the share price of Tech Mahindra Ltd:

1. Dependence on the Telecom Sector

A significant portion of Tech Mahindra’s revenue comes from the telecom industry. In the third quarter of FY25, the company experienced a 5.6% decline in telecom revenue, which impacted overall earnings. This reliance means that any downturn in the telecom sector can adversely affect the company’s financial performance and, consequently, its share price.

2. High Employee Costs

Tech Mahindra allocates a substantial part of its revenue to employee expenses. In the fiscal year ending March 31, 2024, employee costs accounted for 56.02% of the company’s operating revenues. Such high costs can pressure profit margins, especially if revenue growth slows down.

3. Stock Underperformance Compared to Peers

Over the past three years, Tech Mahindra’s stock has delivered a return of -9.09%, underperforming the Nifty 100 index, which returned 31.03% during the same period. This underperformance may reflect investor concerns about the company’s growth prospects and competitiveness.

4. Market Volatility and Economic Factors

Tech Mahindra’s share price is susceptible to broader market trends and economic conditions. For instance, on April 9, 2025, the stock fell by 3.25% during a generally negative trading session, underperforming some of its competitors. Such volatility can impact investor confidence and the stock’s valuation.

5. Elevated Valuation Metrics

As of April 15, 2025, Tech Mahindra’s stock is trading at a price-to-earnings (P/E) ratio of 34.54, which is higher than the industry average of 25.58. This elevated valuation suggests that the stock may be overvalued, potentially limiting its upside and making it more vulnerable to market corrections.

6. Environmental and Operational Risks

Tech Mahindra faces environmental challenges, such as heatwaves affecting its facilities in cities like Hyderabad, Bangalore, and Noida. These events can disrupt operations and increase costs, posing risks to the company’s performance and, by extension, its share price.

Read Also:- Denta Water and Infra Solutions Share Price Target Tomorrow 2025 To 2030