Titan Intech Share Price Target Tomorrow 2025 To 2030

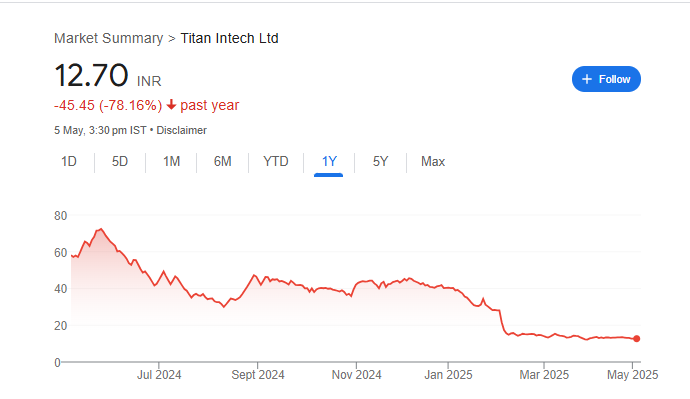

Titan Intech Limited is a Hyderabad-based technology company established in 1984, specializing in software development, LED-based products, and IT services for both domestic and international clients. The company offers solutions such as the Central Control and Monitoring System (CCMS), which optimizes street lighting operations for enhanced energy efficiency. Titan Intech Share Price on BOM as of 6 May 2025 is 12.70 INR.

Titan Intech Share Market Overview

- Open: 12.99

- High: 12.99

- Low: 12.45

- Previous Close: 12.76

- Volume: 126,496

- Value (Lacs): 16.00

- VWAP: 12.59

- 52 Week High: 75.00

- 52 Week Low: 12.00

- Mkt Cap (Rs. Cr.): 38

- Face Value: 10

Titan Intech Share Price Chart

Titan Intech Shareholding Pattern

- Promoters: 16.6%

- FII: 0%

- DII: 0%

- Public: 83.4%

Titan Intech Share Price Target Tomorrow 2025 To 2030

| Titan Intech Share Price Target Years | Titan Intech Share Price |

| 2025 | ₹80 |

| 2026 | ₹100 |

| 2027 | ₹120 |

| 2028 | ₹140 |

| 2029 | ₹160 |

| 2030 | ₹180 |

Titan Intech Share Price Target 2025

Titan Intech share price target 2025 Expected target could ₹80. Here are four key factors that could influence the growth of Titan Intech Ltd. and its share price target for 2025:

1. Strong Financial Metrics and Profitability

Titan Intech has demonstrated robust financial health with a Return on Equity (ROE) of 26.04% and a Return on Capital Employed (ROCE) of 20.2%. The company maintains a low debt-to-equity ratio of 0.07, indicating prudent financial management. Additionally, its operating profit margin stands at 22.67%, and the net profit margin is 12.78%, reflecting efficient operations and profitability.

2. Positive Stock Performance and Growth Potential

Despite market volatility, Titan Intech’s stock has shown resilience. Analysts forecast a long-term increase in the stock price, with projections suggesting it could reach ₹26.401 by April 2030, indicating a positive growth trajectory.

3. Operational Efficiency and Low Debt Levels

The company boasts a quick ratio of 5.6, signifying strong short-term liquidity. Its interest coverage ratio is notably high at 159.03, suggesting that earnings are sufficient to cover interest obligations multiple times over. These metrics highlight Titan Intech’s operational efficiency and financial stability.

4. Market Position and Valuation

Titan Intech is trading at a Price-to-Earnings (P/E) ratio of 6.11 and a Price-to-Book (P/B) ratio of 0.5, which may indicate undervaluation compared to industry peers. This positioning could attract value investors seeking growth opportunities in the IT services sector.

Titan Intech Share Price Target 2030

Titan Intech share price target 2030 Expected target could ₹180. Here are 4 key risks and challenges that could impact the Titan Intech share price target by 2030:

1. Limited Market Presence

Titan Intech operates in a relatively niche space with limited brand visibility compared to major tech players. This can restrict its ability to scale rapidly and compete in larger markets, affecting long-term growth potential.

2. High Valuation Sensitivity

Even though the company may appear undervalued now, any fluctuations in earnings or changes in investor sentiment can lead to sharp corrections. Small-cap stocks like Titan Intech are especially vulnerable to such volatility.

3. Technology Disruption Risk

In the fast-evolving IT and tech space, failure to innovate or adapt to newer technologies could make Titan Intech’s services outdated. This poses a significant threat to its competitiveness and customer retention over the long run.

4. Dependency on a Few Revenue Streams

The company may depend heavily on a small number of contracts or clients. Any loss or delay in these can impact revenue significantly and lead to stock price instability.

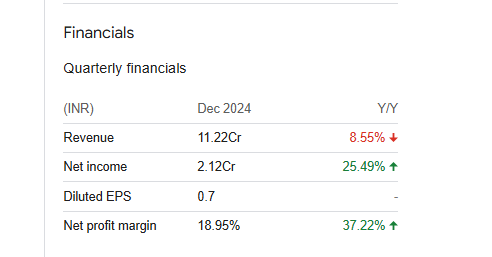

Titan Intech Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 440.50M | 199.08% |

| Operating expense | 102.63M | 305.14% |

| Net income | 56.28M | 221.26% |

| Net profit margin | 12.78 | 7.49% |

| Earnings per share | — | — |

| EBITDA | 99.87M | 224.29% |

| Effective tax rate | 15.00% | — |

Read Also:- Paras Defence Share Price Target Tomorrow 2025 To 2030