TV18 Share Price Target Tomorrow 2025 To 2030

TV18 Broadcast Limited, founded in 2005 and headquartered in Mumbai, is a prominent Indian media company specializing in television broadcasting. As a subsidiary of Network18 Media & Investments Limited, TV18 operates a diverse portfolio of news channels across various languages and regions. Their offerings include CNBC TV18 for business news, CNN-News18 for English general news, and a suite of regional channels under the News18 brand, such as News18 India, News18 Lokmat, and News18 Bangla. TV18 Share Price on NSE as of 1 May 2025 is 45.34 INR.

TV18 Share Market Overview

- Open: 42.70

- High: 45.95

- Low: 42.70

- Previous Close: 45.27

- 52 Week High: 54.29

- 52 Week Low: 38.65

- Mkt Cap (Rs. Cr.): 7,761

- Face Value: 2.00

TV18 Share Price Chart

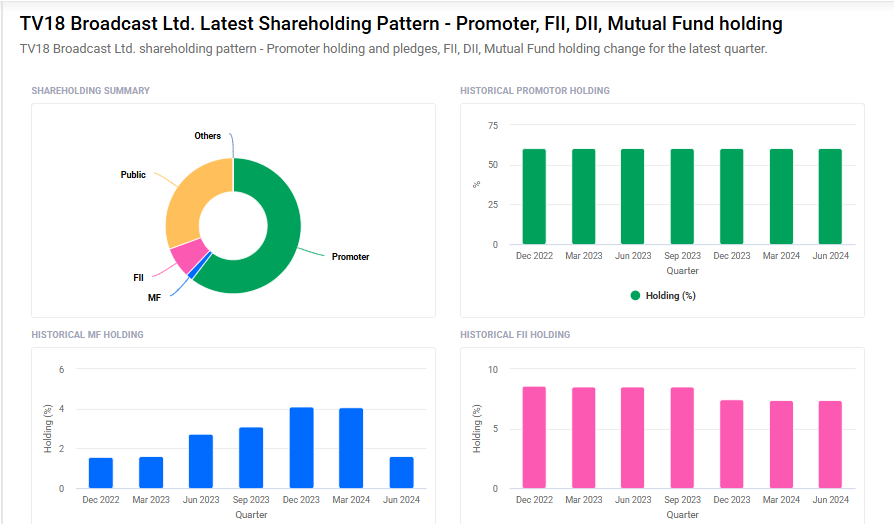

TV18 Shareholding Pattern

- Promoters: 60.4%

- FII: 7.4%

- DII: 1.7%

- Public: 30.6%

TV18 Share Price Target Tomorrow 2025 To 2030

| TV18 Share Price Target Years | TV18 Share Price |

| 2025 | ₹55 |

| 2026 | ₹70 |

| 2027 | ₹90 |

| 2028 | ₹110 |

| 2029 | ₹130 |

| 2030 | ₹150 |

TV18 Share Price Target 2025

TV18 share price target 2025 Expected target could ₹55. Here are four key factors influencing the growth of TV18 Broadcast Ltd:

1. Robust Revenue Growth Driven by Sports and Elections

TV18 Broadcast Ltd. is projected to experience significant revenue growth, with expectations of a 50%-60% year-on-year increase in FY2024, moderating to 15%-20% in FY2025. This growth is primarily attributed to the company’s sports broadcasting ventures and the anticipated surge in advertising revenue during upcoming state and general elections.

2. Expanding Television Broadcasting Market

The global television broadcasting market is on an upward trajectory, projected to grow from $314.16 billion in 2024 to $335.29 billion in 2025, reflecting a compound annual growth rate (CAGR) of 6.7%. This expansion is fueled by increased TV show budgets, rising popularity of audio-visual content, and higher disposable incomes, providing a favorable environment for broadcasters like TV18.

3. Strong Financial Health and Operational Efficiency

TV18 maintains a healthy financial profile, characterized by low leverage with a debt-to-equity ratio of 0.05 and negative net debt of ₹81.9 billion. The company has also demonstrated positive gross profits and a 22% revenue growth over the past three years, indicating operational efficiency and financial stability.

4. Strategic Content Partnerships and Diversified Portfolio

TV18’s strategic alliances with global media entities, such as NBCUniversal and WarnerMedia, enhance its content offerings across various genres. The company’s diversified portfolio, including channels like CNBC TV18, CNN-News18, and regional networks, positions it to cater to a wide audience base, thereby strengthening its market presence.

TV18 Share Price Target 2030

TV18 share price target 2030 Expected target could ₹150. Here are four key Risks and Challenges that could affect TV18 Broadcast Ltd:

-

High Dependence on Advertising Revenue

A significant portion of TV18’s income comes from advertisements. Any downturn in the economy, changes in advertiser behavior, or reduced ad spending—especially in non-election years—can directly impact the company’s financial performance. -

Rising Competition from OTT Platforms

With the growing popularity of streaming services like Netflix, Amazon Prime, and JioCinema, traditional TV viewership is declining. This shift in consumer preferences poses a major challenge to TV18’s traditional broadcast model. -

Regulatory and Licensing Risks

The media and broadcasting sector in India is highly regulated. Changes in government policies, content restrictions, or licensing costs could disrupt operations or increase compliance costs for TV18. -

Volatility in Content Costs and Partnerships

Securing broadcasting rights for sports or premium content often involves high costs. Failure to manage these expenses or the loss of key content partnerships may reduce competitiveness and profitability.

Read Also:- Hondapower Share Price Target Tomorrow 2025 To 2030