Udaipur Cement Share Price Target Tomorrow 2025 To 2030

Udaipur Cement Works Limited (UCWL) is a prominent cement manufacturer based in Udaipur, Rajasthan. Established in 1993, UCWL operates as a subsidiary of JK Lakshmi Cement Limited, which is part of the esteemed JK Organisation—a conglomerate with a legacy spanning over 135 years across various industries. With a production capacity of 4.7 million tonnes per annum, UCWL offers premium cement products under the brand names Platinum Heavy Duty Cement and Platinum Supremo Cement. Udaipur Cement Share Price on NSE as of 1 May 2025 is 28.00 INR.

Udaipur Cement Share Market Overview

- Open: 28.05

- High: 28.20

- Low: 27.85

- Previous Close: 28.08

- Volume: 282,378

- Value (Lacs): 79.09

- VWAP: 27.94

- UC Limit: 33.69

- LC Limit: 22.46

- 52 Week High: 48.60

- 52 Week Low: 23.10

- Mkt Cap (Rs. Cr.): 1,570

- Face Value: 4

Udaipur Cement Share Price Chart

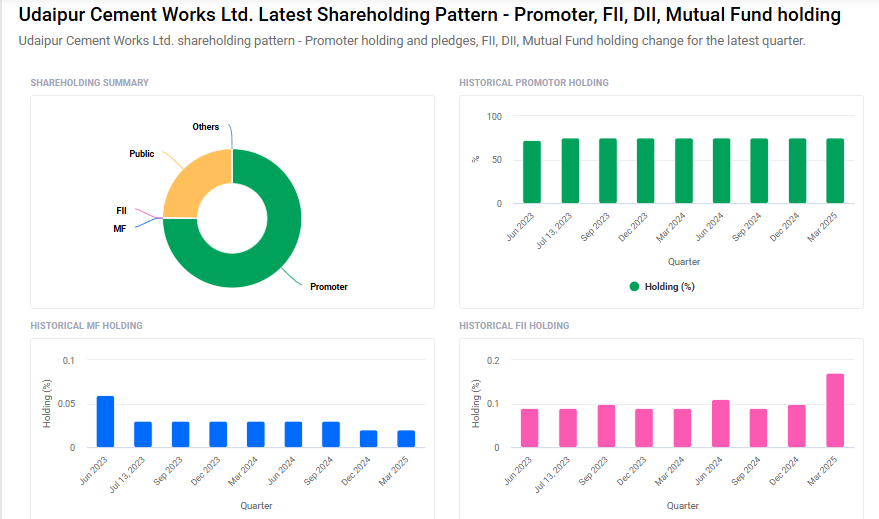

Udaipur Cement Shareholding Pattern

- Promoters: 75%

- FII: 0.2%

- DII: 0.1%

- Public: 24.7%

Udaipur Cement Share Price Target Tomorrow 2025 To 2030

| Udaipur Cement Share Price Target Years | Udaipur Cement Share Price |

| 2025 | ₹50 |

| 2026 | ₹70 |

| 2027 | ₹90 |

| 2028 | ₹110 |

| 2029 | ₹120 |

| 2030 | ₹140 |

Udaipur Cement Share Price Target 2025

Udaipur Cement share price target 2025 Expected target could ₹50. Here are four key factors influencing the growth of Udaipur Cement Works Limited (UCWL):

1. Strong Revenue Growth and Market Recognition

UCWL has demonstrated impressive revenue growth, achieving a 20% increase in the last year and a cumulative 59% rise over the past three years. This robust performance has earned the company recognition as India’s fastest-growing cement company in the small category at the Indian Cement Review Awards.

2. Expansion in Production Capacity

The company has expanded its production capacity from 1.95 million tonnes per annum (MTPA) in FY23 to 2.49 MTPA in FY24. This increase enables UCWL to meet the rising demand driven by growth in the residential real estate sector and government-led infrastructure projects.

3. Support from Parent Company

UCWL benefits from strategic importance and strong operational linkages with its parent company, JK Lakshmi Cement Limited. This relationship provides financial stability and operational support, enhancing UCWL’s ability to navigate market challenges and pursue growth opportunities.

4. Positive Industry Outlook

The cement industry in India is expected to grow steadily, with projections indicating an increase in cement volume to 440–450 million tonnes by FY25. This growth is driven by sustained demand from housing and infrastructure sectors, providing a favorable environment for UCWL’s expansion.

Udaipur Cement Share Price Target 2030

Udaipur Cement share price target 2030 Expected target could ₹140. Here are four key Risks and Challenges that could affect Udaipur Cement Works Limited (UCWL) and its share price target by 2030:

-

High Dependence on a Single Region

UCWL operates mainly in Rajasthan and nearby states. This regional concentration could limit growth opportunities and expose the company to demand fluctuations or policy changes specific to that region. -

Raw Material and Fuel Cost Volatility

Cement production relies heavily on raw materials like limestone and fuels such as coal and pet coke. Price volatility or supply disruptions in these inputs could affect profit margins and overall financial performance. -

Environmental Regulations and Compliance Costs

Stricter environmental norms related to emissions, waste management, and energy usage may require significant investments in cleaner technologies, increasing operating costs and capital expenditure. -

Intense Industry Competition

The cement industry in India is highly competitive, with several large players like UltraTech, Shree Cement, and ACC dominating the market. Smaller companies like UCWL may face pricing pressure and challenges in expanding market share.

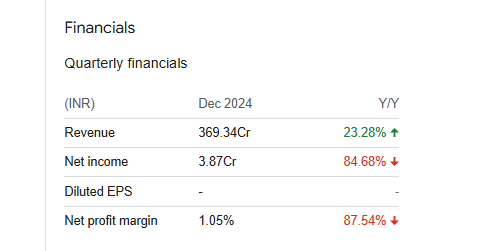

Udaipur Cement Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 11.64B | 12.86% |

| Operating expense | 2.56B | 31.66% |

| Net income | 614.10M | 71.25% |

| Net profit margin | 5.28 | 51.72% |

| Earnings per share | — | — |

| EBITDA | 1.86B | 38.74% |

| Effective tax rate | 27.57% | — |

Read Also:- BEL Share Price Target Tomorrow 2025 To 2030