Updater Share Price Target Tomorrow 2025 To 2030

Updater Services Ltd. (UDS) is a prominent Indian company specializing in integrated facilities management and business support services. Established in 1990 and headquartered in Chennai, UDS has expanded its operations across India, serving over 1,300 clients in various sectors, including manufacturing, healthcare, IT, BFSI, logistics, and infrastructure. The company’s service portfolio encompasses housekeeping, engineering services, production support, staffing, warehouse management, institutional catering, and sales enablement. Updater Share Price on NSE as of 6 May 2025 is 277.80 INR.

Updater Share Market Overview

- Open: 272.60

- High: 278.35

- Low: 267.10

- Previous Close: 272.80

- Volume: 257,457

- Value (Lacs): 714.19

- 52 Week High: 438.60

- 52 Week Low: 244.50

- Mkt Cap (Rs. Cr.): 1,857

- Face Value: 10

Updater Share Price Chart

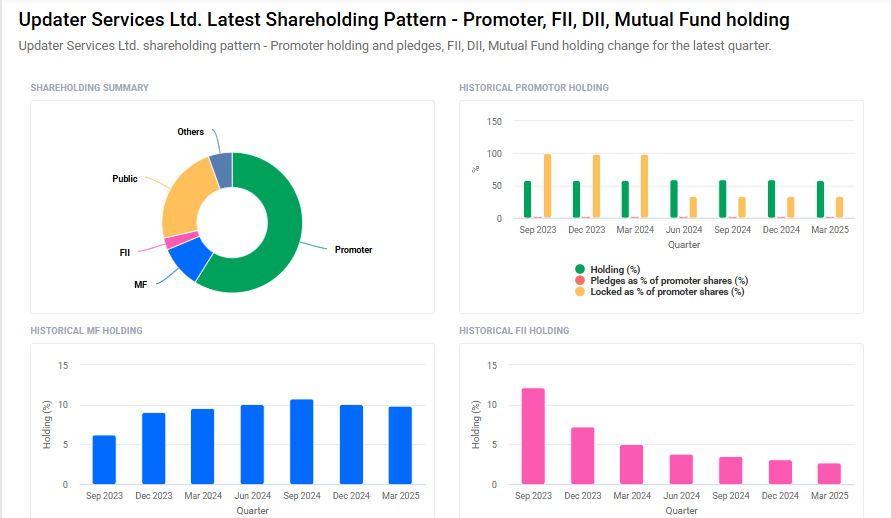

Updater Shareholding Pattern

- Promoters: 58.9%

- FII: 2.7%

- DII: 15.5%

- Public: 23.1%

Updater Share Price Target Tomorrow 2025 To 2030

| Updater Share Price Target Years | Updater Share Price |

| 2025 | ₹440 |

| 2026 | ₹460 |

| 2027 | ₹480 |

| 2028 | ₹500 |

| 2029 | ₹520 |

| 2030 | ₹540 |

Updater Share Price Target 2025

Updater share price target 2025 Expected target could ₹440. Here are four key factors that could influence the growth of Updater Services Ltd. and its share price target for 2025:

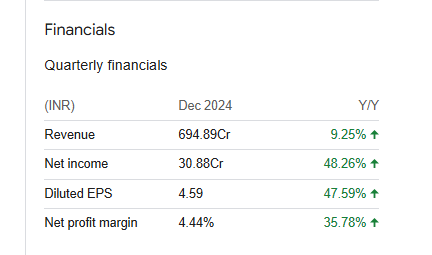

1. Consistent Revenue and Profit Growth

Updater Services has demonstrated strong financial performance, with consolidated net sales reaching ₹694.89 crore in December 2024, marking a 9.25% year-over-year increase. The company’s net profit for the same period rose by 48.25% to ₹30.88 crore, reflecting efficient operations and robust demand for its services.

2. Diversified Service Portfolio

The company operates in two main segments: Integrated Facilities Management (IFM) and Business Support Services (BSS). IFM contributes approximately 65% of total revenue, offering services like housekeeping, engineering, and production support. BSS, accounting for the remaining 35%, includes higher-margin services such as sales enablement, audit and assurance, and background verification. This diversification allows Updater Services to cater to various industries and mitigate sector-specific risks.

3. Strategic Acquisitions and Expansion Plans

Updater Services is actively seeking strategic acquisitions, particularly in the BSS segment, to enhance its capabilities and margins. The company has earmarked ₹80–150 crore from its IPO proceeds for potential acquisitions in areas like sales enablement and audit and assurance, aiming to bolster its service offerings and market presence.

4. Positive Industry Outlook and Market Position

The facilities management industry in India is experiencing significant growth, driven by increased outsourcing and infrastructural developments. Updater Services, being the second-largest facilities management company in the country, is well-positioned to capitalize on this trend. The company’s focus on automation and technological advancements, such as AI and IoT integration, further strengthens its competitive edge.

Updater Share Price Target 2030

Updater share price target 2030 Expected target could ₹540. Here are 4 key risks and challenges that could impact the Updater Services Ltd. share price by 2030:

1. Dependence on Labor-Intensive Operations

As a facilities and support services provider, Updater relies heavily on human resources. Rising labor costs, attrition, or workforce management issues could affect profitability and service quality over the long term.

2. Margin Pressure in IFM Segment

The Integrated Facilities Management (IFM) business contributes a major share of revenue but generally operates on thin margins. Increased competition or price wars could compress margins further, especially if costs rise faster than pricing adjustments.

3. Regulatory and Compliance Risks

Being involved in staffing, audit, and verification services, the company is subject to frequent regulatory changes, especially in labor laws and data protection. Any non-compliance or legal issues could result in penalties and reputational damage.

4. Scalability and Technological Adaptation

To sustain growth till 2030, Updater must invest in automation, AI, and digital solutions. Failure to innovate or adapt to technological shifts could leave the company lagging behind more tech-savvy competitors in the facilities and BPO sectors.

Updater Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 24.44B | 16.46% |

| Operating expense | 3.46B | 75.79% |

| Net income | 679.46M | 89.87% |

| Net profit margin | 2.78 | 63.53% |

| Earnings per share | 13.59 | — |

| EBITDA | 1.27B | -3.21% |

| Effective tax rate | 21.66% | — |

Read Also:- Titan Intech Share Price Target Tomorrow 2025 To 2030