Veedol Share Price Target Tomorrow 2025 To 2030

Veedol is a well-known brand in the lubricant industry, offering high-quality engine oils and automotive fluids for cars, bikes, and commercial vehicles. Originally established in 1928 and now known as Veedol Corporation Ltd., the company has a strong presence in India and exports to many countries around the world. Veedol focuses on providing reliable and efficient lubrication solutions that help engines run smoothly and last longer. Veedol Share Price on NSE as of 6 May 2025 is 1,445.70 INR.

Veedol Share Market Overview

- Open: 1,445.20

- High: 1,464.10

- Low: 1,438.00

- Previous Close: 1,449.80

- Volume: 10,091

- Value (Lacs): 146.24

- 52 Week High: 2,800.00

- 52 Week Low: 1,305.00

- Mkt Cap (Rs. Cr.): 2,525

- Face Value: 2

Veedol Share Price Chart

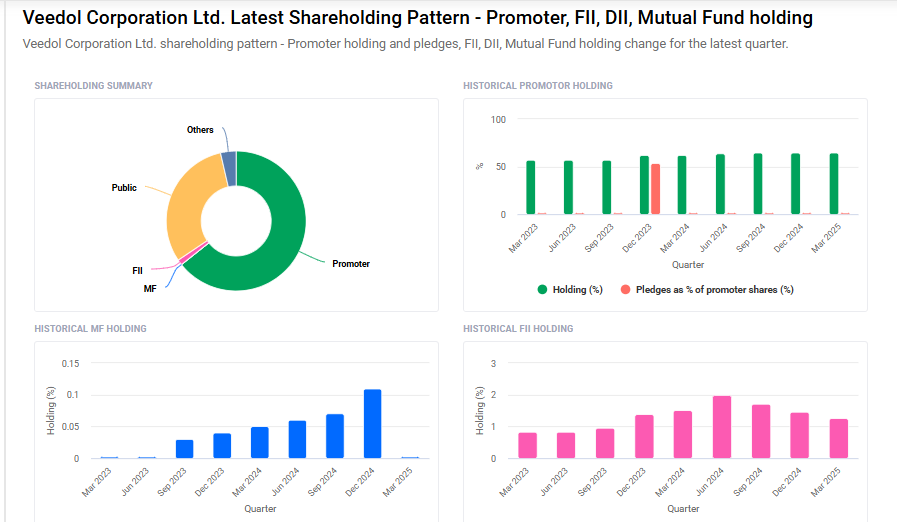

Veedol Shareholding Pattern

- Promoters: 64.3%

- FII: 1.3%

- DII: 1.2%

- Public: 30.8%

Veedol Share Price Target Tomorrow 2025 To 2030

| Veedol Share Price Target Years | Veedol Share Price |

| 2025 | ₹2800 |

| 2026 | ₹3000 |

| 2027 | ₹3200 |

| 2028 | ₹3400 |

| 2029 | ₹3600 |

| 2030 | ₹3800 |

Veedol Share Price Target 2025

Veedol share price target 2025 Expected target could ₹2800. Here are four key factors that could influence the growth of Veedol Corporation Ltd. and its share price target for 2025:

1. Established Brand with Global Presence

Veedol, formerly known as Tide Water Oil Co. (India) Ltd., has been a prominent player in the lubricants industry since 1928. The company markets its products in over 70 countries, catering to both automotive and industrial segments. Its extensive distribution network in India includes more than 500 direct distributors and dealers servicing over 50,000 retail outlets and workshops.

2. Strategic Partnerships and Acquisitions

Veedol has engaged in strategic collaborations to enhance its market position. In 2014, it formed a 50:50 joint venture with Eneos Corporation, Japan’s largest petroleum conglomerate, to market Eneos brand lubricants in India. Additionally, in 2016, Veedol acquired UK-based Price Thomas Associates, owners of Granville Oil & Chemicals Ltd., expanding its footprint in the UK and international markets.

3. Consistent Financial Performance

The company has demonstrated steady financial growth. For the fiscal year ending March 2024, Veedol reported a net profit of ₹111 crore, reflecting a 30.4% year-over-year increase. Operating revenue for the same period stood at ₹1,924.3 crore.

4. Positive Stock Forecast

Analysts have a favorable outlook on Veedol’s stock performance. WalletInvestor predicts that the stock price could reach approximately ₹1,754.91 in one year, suggesting a potential upside of over 21% from its current price of ₹1,447.90 as of May 5, 2025.

Veedol Share Price Target 2030

Veedol share price target 2030 Expected target could ₹3800. Here are 4 key risks and challenges that could affect Veedol Corporation Ltd.’s share price target by 2030:

1. Raw Material Price Volatility

Veedol’s profitability heavily depends on the prices of base oils and additives, which are derived from crude oil. Any sharp rise in crude oil prices or supply disruptions can increase input costs and squeeze margins.

2. Increasing Competition

The lubricant industry is highly competitive, with global players like Castrol, Shell, and Indian Oil operating in the same space. Aggressive pricing, marketing strategies, or technological advancements by competitors can impact Veedol’s market share.

3. Shift Toward Electric Vehicles (EVs)

As the automobile industry moves toward EVs, the demand for traditional engine lubricants may decline. If Veedol does not diversify or adapt to this transition, it may face reduced demand over the long term.

4. Regulatory and Environmental Pressures

Tighter environmental regulations and policies favoring cleaner alternatives could pose a challenge. Compliance costs and the need for sustainable, eco-friendly product lines might impact profitability if not addressed proactively.

Veedol Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 19.31B | 4.17% |

| Operating expense | 5.51B | 14.64% |

| Net income | 1.43B | 24.74% |

| Net profit margin | 7.40 | 19.74% |

| Earnings per share | — | — |

| EBITDA | 1.69B | 18.92% |

| Effective tax rate | 23.64% | — |

Read Also:- Updater Share Price Target Tomorrow 2025 To 2030