Vi Share Price Target Tomorrow 2025 To 2030

Vodafone Idea, also known as Vi, is one of the leading telecom service providers in India. It was formed after the merger of Vodafone India and Idea Cellular. Vi offers mobile and internet services to millions of users across the country. The company has a wide network and is working on expanding its 4G and 5G services to provide better connectivity. Vi is also trying to improve its financial health with help from the government and fresh investments. Vi Share Price on NSE as of 23 May 2025 is 6.76 INR.

Vi Share Market Overview

- Open: 6.69

- High: 6.82

- Low: 6.65

- Previous Close: 6.76

- Volume: 390,483,755

- Value (Lacs): 26,357.65

- 52 Week High: 19.18

- 52 Week Low: 6.46

- Mkt Cap (Rs. Cr.): 73,131

- Face Value: 10

Vi Share Price Chart

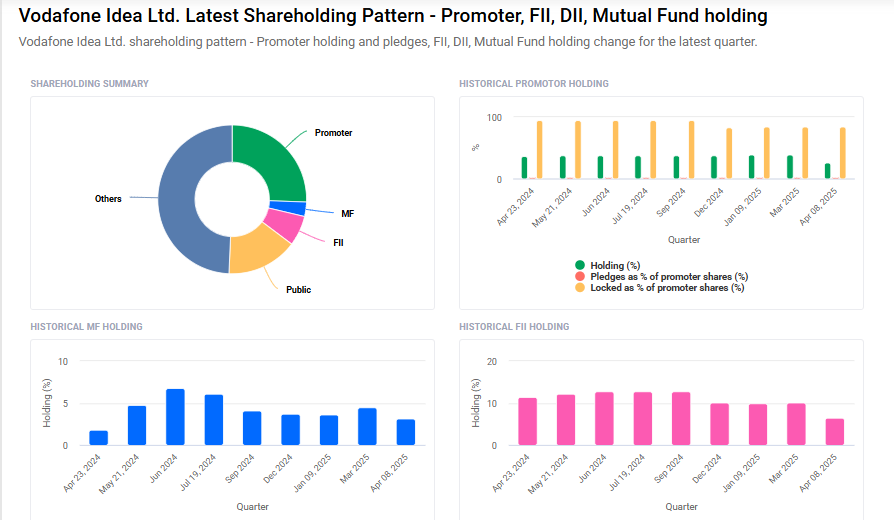

Vi Shareholding Pattern

- Promoters: 25.6%

- FII: 6.6%

- DII: 52.4%

- Public: 15.4%

Vi Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹20 |

| 2026 | ₹25 |

| 2027 | ₹30 |

| 2028 | ₹35 |

| 2029 | ₹40 |

| 2030 | ₹45 |

Vi Share Price Target 2025

Vi share price target 2025 Expected target could ₹20. Here are five key factors that could influence the growth of Vodafone Idea (Vi) and its share price by 2025:

1. Government’s Equity Conversion Enhancing Liquidity

The Indian government’s decision to convert ₹36,950 crore of Vodafone Idea’s dues into equity, increasing its stake to 48.99%, has significantly improved the company’s liquidity position. This move is expected to aid Vi in securing additional debt funding and support its capital expenditure plans.

2. Expansion of 5G Services

Vi has initiated the rollout of its 5G services in regions like Delhi NCR, Mumbai, Chandigarh, and Patna, with plans to expand across all 17 telecom circles where it holds 5G spectrum by August 2025. This strategic expansion aims to enhance network capabilities and attract a broader customer base.

3. Stabilization of Customer Base

Recent investments in strengthening its 4G network infrastructure have helped Vi maintain the majority of its active user base as of March 2025. This stabilization in customer attrition indicates progress in the company’s efforts to improve network quality and user experience.

4. Anticipated ARPU Growth

Analysts project a 13% increase in Average Revenue Per User (ARPU) by FY27, reaching ₹200. This growth is expected to be driven by tariff hikes and improved service offerings, contributing to enhanced profitability.

5. Potential for Capital Infusion and Debt Raising

The improved financial position post-government equity conversion positions Vi to potentially secure additional debt funding and equity infusion. Such financial strengthening is crucial for sustaining capital expenditures and operational enhancements.

Vi Share Price Target 2030

Vi share price target 2030 Expected target could ₹45. Here are five key risks and challenges that could impact Vodafone Idea (Vi) and its share price target by 2030:

1. Mounting Debt and Unresolved AGR Dues

Vi faces a significant financial burden, with a net debt of approximately $25 billion. The Supreme Court’s recent rejection of Vi’s plea to waive over $5 billion in adjusted gross revenue (AGR) dues exacerbates this challenge. Without relief, the company has warned it may not sustain operations beyond FY26.

2. Intensifying Market Competition

The Indian telecom sector is highly competitive, dominated by players like Reliance Jio and Bharti Airtel. These competitors continue to invest heavily in network expansion and technology upgrades, potentially eroding Vi’s market share and revenue base.

3. Delayed 5G Rollout and Technological Lag

While Vi has initiated 5G services in select regions, its rollout lags behind competitors. This delay may result in the loss of high-value customers seeking faster and more reliable services, impacting long-term growth prospects.

4. Regulatory and Policy Uncertainties

The telecom industry is subject to regulatory changes, including spectrum pricing and service obligations. Unfavorable policy shifts could increase operational costs or impose additional compliance burdens on Vi.

5. Challenges in Capital Infusion and Investor Confidence

Despite the government’s equity conversion, Vi’s financial instability may deter potential investors. Difficulty in securing additional funding could hinder necessary investments in infrastructure and technology, affecting service quality and competitiveness.

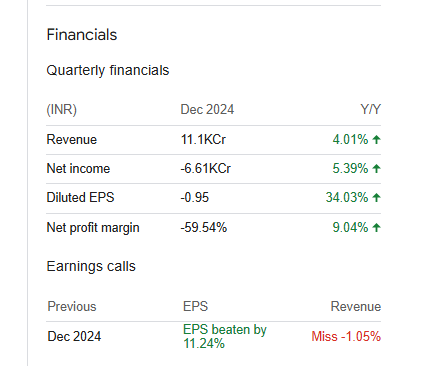

Vi Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 425.73B | 1.02% |

| Operating expense | 238.85B | -2.70% |

| Net income | -312.38B | -6.61% |

| Net profit margin | -73.38 | -5.54% |

| Earnings per share | -6.57 | 22.06% |

| EBITDA | 105.53B | 3.19% |

| Effective tax rate | -2.72% | — |

Read Also:- Sun TV Share Price Target Tomorrow 2025 To 2030