Vikas Ecotech Share Price Target From 2025 to 2030

Vikas Ecotech Share Price Target From 2025 to 2030: Market investment is all about prudent observation of the company’s fundamentals, technicals, and growth opportunities. Among these kinds of stocks, which retail investors have preferred in recent years, is the stock of Vikas Ecotech Ltd., a speciality chemical player dealing in green technology and sustainability.

We will present here a comprehensive analysis of the finances, recent performance, technical levels, shareholding pattern, and 2025-2030 target price estimates for Vikas Ecotech in this report. We would like to make investors well-informed decision-makers through all key points of data as well as estimates based on the opinions of experts.

Overview of the company: What business is Vikas Ecotech engaged in?

Vikas Ecotech Ltd. is one of the small-cap players in the space of specialty chemicals and polymer additives manufacturing green and environmentally friendly products that find usage across industries including agriculture, packaging, electronics, automotive, and infrastructure.

Its emphasis on green chemistry, product development, and minimal debt make it one such compelling play in the small-cap universe with the globe looking towards green industrial solutions more and more.

Recent Market Performance

Vikas Ecotech has seen high volatility common to most small-cap stocks of emerging sectors. Here is its recent past history:

- Open Price=₹2.34

- High=₹2.45

- Low=₹2.34

- Current Price=₹2.38

- 52-Week High=₹4.50

- 52-Week Low=₹2.16

- Market Capitalization=₹419.18 Cr

- P/E Ratio (TTM)=24.04

- Industry P/E=23.80

- EPS (TTM)=₹0.08

- Book Value=₹3.11

- Dividend Yield=0.00%

- Debt-to-Equity Ratio=0.08 (very low)

- Return on Capital (ROC)=3.05%

Even with a loss of about 39.75% in the past year, low debt and a strong EPS place Vikas Ecotech as a value investment for the long-term investor.

Technical Indicators: What the Indicators Indicate?

Vikas Ecotech technical indicators indicate a weak short-term trend, but value buying and swing trading opportunities for both:

- MACD: -0.1 Bearish, below center line

- ADX (Average Directional Index): 33.5 Trend strength exists but losing strength

- RSI (Relative Strength Index): 45.9 Neutral (not bought/oversold)

- ROC (21 Day): -5.6 Negative momentum

- ROC (125 Day): -32.5 Strong downtrend on the mid-term

- MFI (Money Flow Index):: 55.0 Moderate inflow of funds

- ATR (Average True Range): 0.15 Moderate volatility

- Momentum Score: 34.0 Technically weak zone

These signals suggest that while the stock is short term weak, it is moving towards levels where it will stabilize or qualify as an accumulation candidate.

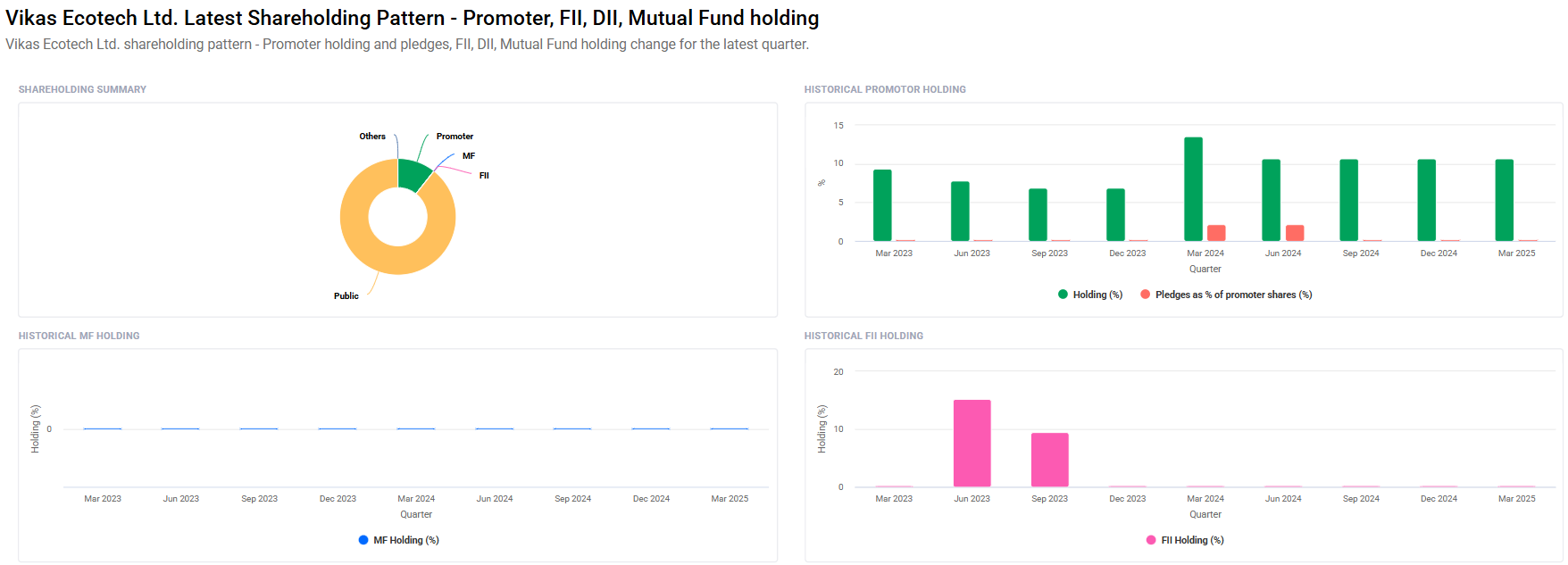

Shareholding Pattern as of March 2025

- Retail and Others: 89.33%

- Promoters: 10.65%

- FII/FPI: 0.02% (3 institutional investors)

Promoters and FII holdings have remained steady, i.e., no significant offloading has occurred even in the event of stock volatility. Low promoter pledge of just 0.04% also strengthens the argument of stability.

Vikas Ecotech Share Price Forecast 2025 to 2030

Based on a mix of current fundamentals, sector trend, past volatility, and anticipated recovery, below is year-by-year share price target forecast for Vikas Ecotech Ltd.

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹5 |

| 2026 | ₹8 |

| 2027 | ₹11 |

| 2028 | ₹14 |

| 2029 | ₹17 |

| 2030 | ₹20 |

Note: These estimates are directional in nature and subject to external economic fundamentals, global demand for chemicals, and the capacity to deliver in Vikas Ecotech.

Why Vikas Ecotech May Be A Great Long-Term Bet

Low Debt: Its 0.08 debt-equity ratio is better than its peers.

Environmentally Friendly Portfolio: Rising global demand for environment-friendly chemicals may drive top-line growth.

Low Cost Entry Point: Share price less than ₹3, and thus appropriate for diversified accumulation with lesser capital.

Improving Fundamentals: Positive EPS consistently, increase in book value, and scope for improvement in margins.

Low Promoter Pledge: Indicates confidence on the management’s part.

Risks to Consider

Low Liquidity & Small Cap Risk: Sudden price movements and speculative demand are the hallmark.

No Institutional Participation: Rarely any FII or mutual fund investment till now.

Technically Weak Phase: Momentum and MACD indicate a bear phase would dominate in the short term.

No Dividend History: Income investors cannot choose this.

Investment Strategy

Short-Term (2025–2026)

Risk Level: High

Strategy: Dips to buy, target of ₹5 to ₹8. Suitable for risk-taking investors.

Medium-Term (2027–2028)

Risk Level: Moderate

Strategy: Ride on the consolidations. Exit target: ₹11 to ₹14.

Long-Term (2029–2030)

Risk Level: Low

Strategy: A suitable scrip for long-term investors to take a ride on the tale of eco-chemical growth. Potential of 4x–5x today’s levels.

FAQs on Vikas Ecotech Share Price Target

Q1: Is Vikas Ecotech fundamentally strong?

A1: Low debt, healthy EPS, and green chemistry momentum despite small market cap and miserable institutional coverage render it fundamentally attractive.

Q2: Why the stock has slipped so sharply of late?

A2: Industry correction, market volatility, and weak technicals have all played their part. No significant changes in promoter and FII holdings, however.

Q3: What type of risk is involved in an investment in Vikas Ecotech?

A3: Since it is a small-cap stock, it is more volatile and lower liquidity. Technicals are weak right now as well.

Q4: Will Vikas Ecotech touch ₹20 by 2030?

A4: With consistent growth in earnings, sectoral backing, and enhanced investor sentiments, achieving ₹20 by 2030 is possible.

Q5: When is the best time to invest in the stock?

A5: Falling at ₹2–₹2.5 levels can be good for long-term investors. Zooming above ₹3 could signal a bull turn.

Q6: Does Vikas Ecotech provide dividend?

A6: No dividend yield is being provided by the company now, a behavior seen usually among growth- and expansion-focused small-cap firms.

Final Verdict: Is Vikas Ecotech Worth Investing in?

Vikas Ecotech Ltd. is a good small-cap bet for investors to bet on green innovation in the chemical space. Even though its shares are in poor technical health right now, its low leverage, innovation-driven portfolio, and long-term growth potential make it a worthy contender for investors’ attention if they are willing to invest on a 5–6 year timeline.

Short-term investors should be cautious, but long-term wealth creators and value seekers can regard Vikas Ecotech as relatively cheap stock with the potential to turn into multi-bagger.