Yes Bank Share Price Target Tomorrow 2025 To 2030

Yes Bank is a prominent private sector bank in India, established in 2004 by Rana Kapoor and Ashok Kapur. Headquartered in Mumbai, the bank offers a comprehensive range of financial products and services, including retail banking, corporate banking, and digital solutions, catering to individuals, small and medium enterprises (SMEs), and large corporations. Over the years, Yes Bank has expanded its presence across the country, operating numerous branches and ATMs to serve its growing customer base. Yes Bank Share Price on NSE as of 27 May 2025 is 21.00 INR.

Yes Bank Share Market Overview

- Open: 21.21

- High: 21.22

- Low: 20.95

- Previous Close: 21.15

- Volume: 59,611,150

- Value (Lacs): 12,512.38

- 52 Week High: 27.44

- 52 Week Low: 16.02

- Mkt Cap (Rs. Cr.): 65,826

- Face Value: 2

Yes Bank Share Price Chart

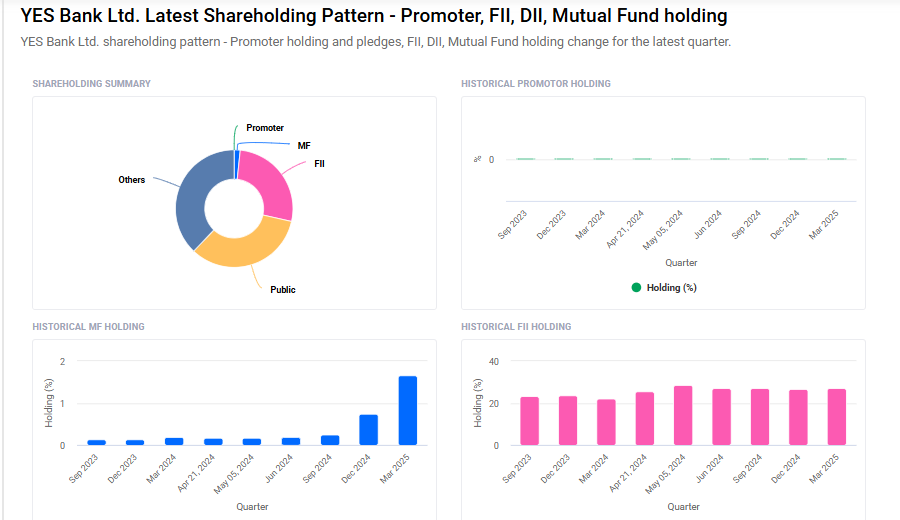

Yes Bank Shareholding Pattern

- Promoters: 0%

- FII: 26.9%

- DII: 39.5%

- Public: 33.6%

Yes Bank Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹30 |

| 2026 | ₹40 |

| 2027 | ₹50 |

| 2028 | ₹60 |

| 2029 | ₹70 |

| 2030 | ₹80 |

Yes Bank Share Price Target 2025

Yes Bank share price target 2025 Expected target could ₹30. Here are 5 key factors that could influence Yes Bank’s share price target for 2025:

-

Improved Asset Quality and Profitability

Yes Bank has significantly reduced its Gross Non-Performing Assets (GNPA) from 12.9% to 2.0% and Net NPA to 0.8%. The bank aims for a Return on Assets (RoA) of 1% by FY27, indicating a positive trajectory in profitability. -

Growth in Retail and SME Lending

The bank is focusing on expanding its retail and SME loan portfolios, expecting retail growth between 10% and 12% in fiscal year 2026. This diversification can lead to more stable earnings and reduced risk exposure. -

Digital Transformation Initiatives

Investments in digital banking are yielding cost savings and improved customer experiences. A ₹1,250 crore investment has resulted in 28% cost savings per transaction, positioning the bank for enhanced operational efficiency. -

Strong Capital Adequacy

With a Capital Adequacy Ratio of 17.8%, Yes Bank is well-capitalized, providing a buffer for growth and resilience against potential economic downturns. -

Strategic Partnerships and Investments

The acquisition of a 20% stake by Sumitomo Mitsui Banking Corporation (SMBC) for ₹13,482 crore underscores confidence in Yes Bank’s turnaround strategy and can lead to enhanced capabilities and market reach.

Yes Bank Share Price Target 2030

Yes Bank share price target 2030 Expected target could ₹80. Here are 5 key risks and challenges that could impact Yes Bank’s share price target by 2030:

-

Slow Improvement in Return Ratios

Despite efforts to enhance profitability, Yes Bank’s return on equity (RoE) and return on assets (RoA) have shown gradual improvement. Analysts from Kotak Institutional Equities and ICICI Securities have expressed concerns that the bank’s current valuations may already reflect its financial turnaround, suggesting limited upside potential unless there is a significant enhancement in return ratios. -

Intense Competition in the Banking Sector

The Indian banking industry is highly competitive, with numerous private and public sector banks vying for market share. Yes Bank faces challenges in differentiating itself and attracting new customers, especially in the retail and SME segments, which could impact its growth trajectory. -

Regulatory and Compliance Risks

Yes Bank has previously faced regulatory scrutiny, including actions by the Securities and Exchange Board of India (SEBI) for alleged mis-selling of bonds. Ongoing compliance with regulatory requirements is crucial, and any lapses could lead to penalties or reputational damage, affecting investor confidence. -

Dependence on Economic Conditions

The bank’s performance is closely tied to the broader economic environment. Economic slowdowns, inflationary pressures, or changes in interest rates can affect loan demand and asset quality, posing risks to profitability and share price stability. -

Execution Risks in Strategic Initiatives

While Yes Bank has outlined plans for digital transformation and expansion into new business areas, the successful execution of these strategies is critical. Delays or failures in implementing key initiatives could hinder growth prospects and negatively impact the bank’s valuation by 2030.

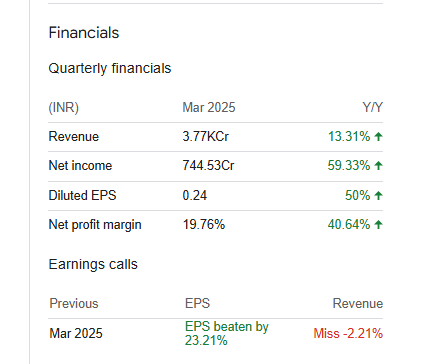

Yes Bank Financials Statement

| (INR) | 2025 | Y/Y change |

| Revenue | 139.92B | 21.17% |

| Operating expense | 107.68B | 7.58% |

| Net income | 24.46B | 90.36% |

| Net profit margin | 17.49 | 57.14% |

| Earnings per share | 0.77 | 79.07% |

| EBITDA | — | — |

| Effective tax rate | 24.11% | — |

Read Also:- Dixon Share Price Target Tomorrow 2025 To 2030