Zodiac Energy Share Price Target Tomorrow 2025 To 2030

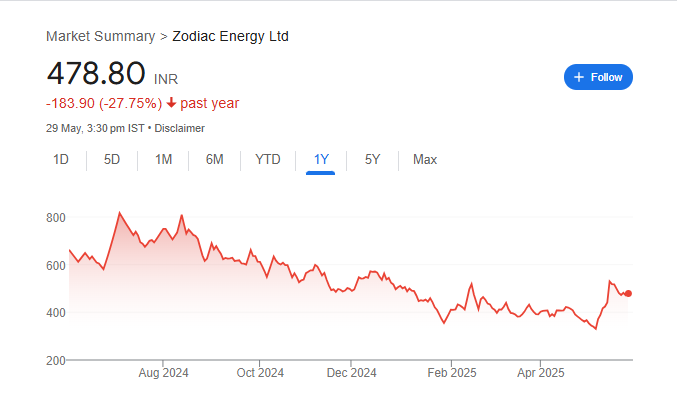

Zodiac Energy Limited is a well-established renewable energy company based in Ahmedabad, Gujarat, with over 30 years of experience in the power generation sector. Originally incorporated as Zodiac Genset Private Limited in 1992, the company transitioned into the solar energy space in 2012 and became a public limited company in 2017 . Zodiac Energy specializes in providing comprehensive turnkey solutions, including design, supply, installation, testing, commissioning, and maintenance of solar power systems for residential, commercial, and industrial clients. Zodiac Energy Share Price on NSE as of 30 May 2025 is 478.80 INR.

Zodiac Energy Share Market Overview

- Open: 475.00

- High: 480.40

- Low: 462.40

- Previous Close: 471.30

- Volume: 57,410

- Value (Lacs): 273.76

- 52 Week High: 816.50

- 52 Week Low: 318.80

- Mkt Cap (Rs. Cr.): 719

- Face Value: 10

Zodiac Energy Share Price Chart

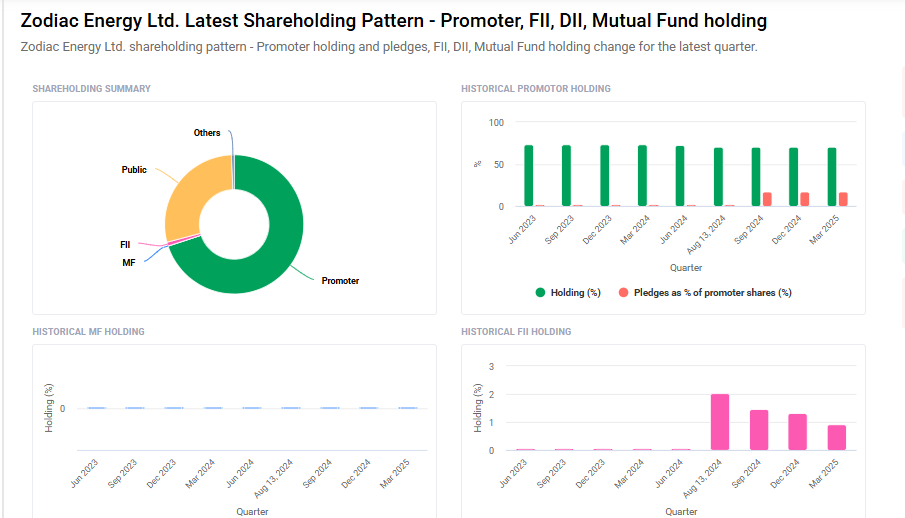

Zodiac Energy Shareholding Pattern

- Promoters: 70%

- FII: 0.9%

- DII: 0.6%

- Public: 28.5%

Zodiac Energy Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹820 |

| 2026 | ₹1034 |

| 2027 | ₹1273 |

| 2028 | ₹1415 |

| 2029 | ₹1650 |

| 2030 | ₹1890 |

Zodiac Energy Share Price Target 2025

Zodiac Energy share price target 2025 Expected target could ₹820. Here are five key factors influencing the growth of Zodiac Energy’s share price target for 2025:

-

Robust Financial Performance

Zodiac Energy has demonstrated significant financial growth. In FY 2024-25, the company’s net sales surged to ₹220.06 crore from ₹137.66 crore in the previous year, marking a substantial increase. Profit after tax also rose to ₹10.97 crore from ₹3.19 crore, indicating improved profitability. -

Expansion into International Markets

The company has expanded its operations internationally, including the commissioning of a 4 MWp hybrid power plant in Africa. This strategic move not only diversifies its revenue streams but also positions Zodiac Energy as a global player in the renewable energy sector. -

Improved Operational Efficiency

Zodiac Energy has enhanced its operational efficiency, evidenced by a reduction in debtor days from 93.5 to 51.1. This improvement indicates better cash flow management and operational effectiveness, contributing to overall financial health. -

Positive Investor Sentiment

The company’s strong financial results have positively influenced investor sentiment. Notably, a non-executive director recently purchased ₹4.9 million worth of stock, reflecting confidence in the company’s future prospects. -

Strategic Participation in Industry Events

Zodiac Energy actively participates in industry expos, such as the GCCI Trade Expo 2025. These events enhance the company’s visibility, foster industry connections, and potentially lead to new business opportunities, supporting growth.

Zodiac Energy Share Price Target 2030

Zodiac Energy share price target 2030 Expected target could ₹1890. Here are five key risks and challenges that could impact Zodiac Energy’s share price target by 2030:

-

High Debt Levels and Financial Leverage

As of September 2024, Zodiac Energy’s debt increased to ₹791.4 million from ₹377.1 million the previous year, resulting in a net debt of ₹649.0 million after accounting for ₹142.3 million in cash reserves. This significant rise in debt may lead to increased interest obligations and financial strain, potentially affecting the company’s profitability and investor confidence. -

Overvaluation Concerns

Analyses suggest that Zodiac Energy’s stock may be overvalued by approximately 43% compared to its intrinsic value, which is calculated at ₹273.59 against a market price of ₹476.85. Such overvaluation could lead to market corrections, impacting the share price adversely. -

Limited Institutional Investment

Despite past returns, Zodiac Energy has seen limited interest from domestic mutual funds, raising concerns about its long-term fundamental strength. The lack of institutional backing may affect the stock’s stability and growth prospects. -

Intense Industry Competition

The renewable energy sector in India is highly competitive, with major players like Waaree, Tata Power, and Adani Green dominating the market. Zodiac Energy, being a microcap company, may face challenges in scaling operations and maintaining market share against such established competitors. -

Market Volatility and Valuation Pressures

The renewable energy sector has experienced significant stock surges, leading to concerns about inflated valuations. Such market volatility could result in corrections that negatively impact Zodiac Energy’s share price.

Zodiac Energy Financials Statement

| (INR) | 2025 | Y/Y change |

| Revenue | 4.08B | 85.30% |

| Operating expense | 356.50M | 103.50% |

| Net income | 199.70M | 82.01% |

| Net profit margin | 4.90 | -1.80% |

| Earnings per share | — | — |

| EBITDA | 370.37M | 97.15% |

| Effective tax rate | 27.46% | — |

Read Also:- IOC Share Price Target Tomorrow 2025 To 2030