Zomato Share Price Target Tomorrow 2025 To 2030

Zomato is a popular Indian company that helps people order food online and discover great places to eat. Started in 2008, it began as a simple restaurant search platform and has now grown into a leading food delivery and quick commerce brand. Zomato connects customers with restaurants and delivery partners through its easy-to-use app. It also runs Blinkit, which delivers groceries and other items in just a few minutes. Zomato Share Price on NSE as of 28 May 2025 is 224.79 INR.

Zomato Share Market Overview

- Open: 226.40

- High: 227.47

- Low: 221.10

- Previous Close: 226.80

- Volume: 224,659,198

- Value (Lacs): 505,011.41

- 52 Week High: 304.70

- 52 Week Low: 146.30

- Mkt Cap (Rs. Cr.): 216,930

- Face Value: 1

Zomato Share Price Chart

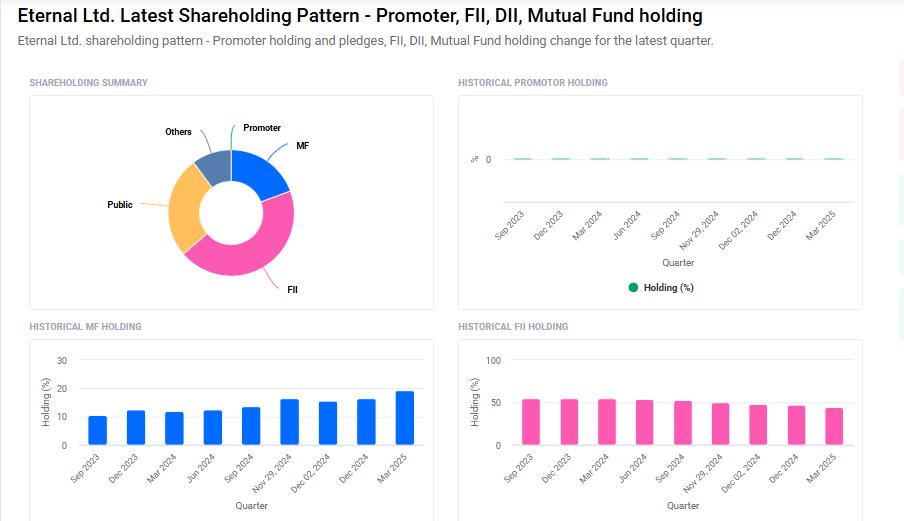

Zomato Shareholding Pattern

- Promoters: 0%

- FII: 44.4%

- DII: 23.6

- Public: 26.1

- Others: 6%

Zomato Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹310 |

| 2026 | ₹410 |

| 2027 | ₹520 |

| 2028 | ₹615 |

| 2029 | ₹730 |

| 2030 | ₹822 |

Zomato Share Price Target 2025

Zomato share price target 2025 Expected target could ₹310. Here are five key factors that could influence Zomato’s share price target by 2025:

-

Expansion in Quick Commerce through Blinkit

Zomato’s quick commerce arm, Blinkit, has been rapidly expanding, contributing significantly to the company’s revenue. Despite initial losses, Blinkit’s growth trajectory and improving contribution margins indicate potential for profitability as operations scale. -

Dominance in Food Delivery Market

Zomato continues to lead the Indian food delivery market with over 60% market share. The company anticipates a 30% annual growth rate in its meal delivery sector over the next five years, driven by expansion into tier 2 and tier 3 cities. -

Strategic Acquisitions and Diversification

The acquisition of Paytm’s movie and event ticketing businesses for $244 million aims to strengthen Zomato’s position in India’s online ticketing market. This diversification could open new revenue streams and reduce dependency on core food delivery services. -

Improving Financial Metrics

Zomato’s profitability is improving, particularly in food delivery and Hyperpure segments. The company has achieved positive EBITDA margins in its core food delivery business, enhancing investor confidence. -

Analyst Confidence and Market Sentiment

Despite some recent downgrades, several brokerages maintain a positive outlook on Zomato’s stock. For instance, ICICI Securities has a “Buy” rating with a price target of Rs 310 per share, implying a potential upside of 47% from current levels.

Zomato Share Price Target 2030

Zomato share price target 2030 Expected target could ₹822. Here are five key risks and challenges that could impact Zomato’s share price target by 2030:

-

Regulatory Scrutiny and Antitrust Investigations

Zomato has faced antitrust investigations by the Competition Commission of India (CCI) for alleged practices such as favoring certain restaurants through exclusivity contracts and imposing pricing restrictions. Such regulatory challenges can lead to penalties and necessitate changes in business practices, potentially affecting profitability and growth. -

Intense Market Competition

The quick commerce sector, where Zomato operates through Blinkit, is highly competitive with players like Swiggy’s Instamart and Zepto. This intense competition can lead to price wars and reduced margins, posing challenges to sustaining profitability. -

Sustainability of Quick Commerce Model

Industry experts have expressed concerns about the long-term sustainability of the quick commerce model, citing its heavy reliance on venture capital funding and challenges in achieving profitability. If the model proves unsustainable, it could impact Zomato’s growth prospects. -

Dependence on Gig Economy Workforce

Zomato’s operations heavily rely on gig workers, who often face issues like low pay and lack of job security. Growing awareness and potential regulatory changes to protect gig workers’ rights could increase operational costs and affect service delivery. -

Data Security and Privacy Concerns

Zomato has experienced data breaches in the past, compromising user information. As data privacy regulations become stricter, any future breaches could lead to legal consequences and damage to the company’s reputation, affecting user trust and investor confidence.

Read Also:- LIC Share Price Target Tomorrow 2025 To 2030