Zydus Share Price Target From 2025 to 2030

Zydus Share Price Target From 2025 to 2030: Investment in the share market is needed with sufficient information about the financial position of a firm, its industry position, and opportunities for future growth. Among those shares which have attracted investors are Zydus Lifesciences Ltd., a leading drug firm.

Zydus Lifesciences became a decent player in the health care industry on the back of its innovation, R&D, and international presence. Zydus Lifesciences share price forecast from 2025-2030 on the basis of its fundamentals and technical information, prevailing trends, and investment opportunities is as follows:

Zydus Lifesciences Company Share Overview

Zydus Lifesciences Ltd. is a big pharma company involved in the production and marketing of generic medicines, vaccines, and biologics. With diversified international exposure in different countries, the company aims to offer low-cost healthcare products and thereby become a force to be reckoned with in the pharma industry.

Growth Drivers

- Aggressive R&D Expenditure: Expenditure on advanced research on new drugs and biosimilars.

- Global Expansion: Diversified in different global markets, expanding revenue stream.

- Government Policies: Favorable regulatory environment and rising healthcare expenditures.

- Increased Demand for Generics: Affordable medicine demand to fuel growth.

- Healthy Finances: Low debt-equity ratio and long-term profitability reflect healthy finances.

Recent Stock Market Performance

- Open Price: ₹949.65

- High Price: ₹949.65

- Low Price: ₹905.00

- Market Cap: ₹91,510 Cr

- P/E Ratio: 20.20

- Dividend Yield: 0.33%

- 52-Week High: ₹1,324.30

- 52-Week Low: ₹855.10

Market Depth and Investor Sentiment

- Buy Order Quantity: 38.27%

- Sell Order Quantity: 61.73%

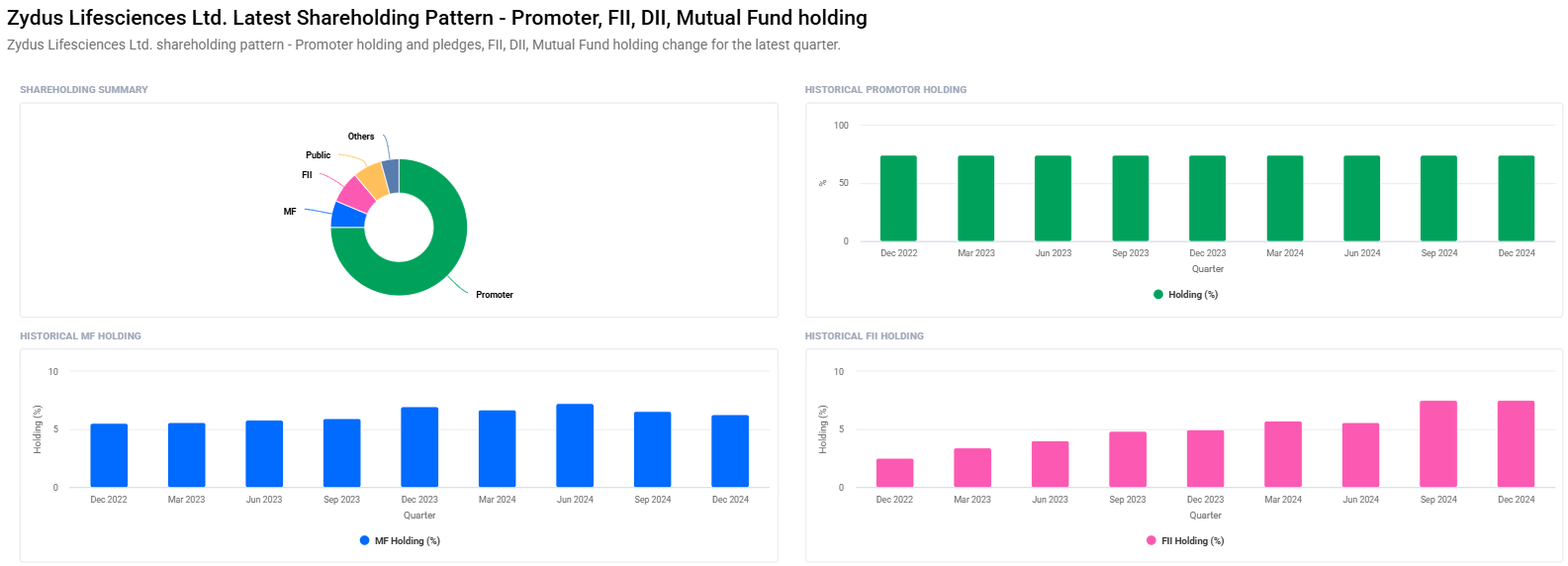

Institutional Holdings

- Promoters: 74.98% (no change)

- Foreign Institutions (FIIs): 7.52% to 7.53%

- Mutual Funds: 6.57% to 6.32%

Institutional investors continue to believe in the stock, even though mutual and retail funds have relaxed holding by a margin.

Technical Analysis

Key Indicators:

- Momentum Score: 31.6 (Technically weak)

- MACD (12,26,9): -6.7 (Bearish)

- ADX (Average Directional Index): 17.7 (Weak strength of trend)

- RSI (Relative Strength Index): 45.0 (Zone of neutrality)

- MFI (Money Flow Index): 42.3 (Neither oversold nor overbought)

The technical levels indicate a weak trend with bearish sentiments in the short term. Traders are recommended to be cautious while observing price action prior to entry.

Zydus Lifesciences Share Price Target (2025-2030)

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹1400 |

| 2026 | ₹1900 |

| 2027 | ₹2400 |

| 2028 | ₹3000 |

| 2029 | ₹3600 |

| 2030 | ₹4200 |

Investment Strategy

- Short-Term (1-2 years): High-risk, keep close observation on entry points and market movement.

- Medium-Term (3-5 years): Moderate-risk, accumulate during market declines.

- Long-Term (5+ years): Low-risk, invest in tranches to benefit from future growth opportunities.

Risks and Challenges

- Regulatory Risks: Norm changes in drug approval and drug price control affect revenues.

- Market Competition: Growing competition from pharma leaders from all ends of the world.

- Macroeconomic Factors: Currency movements, geopolitical environment, and inflation pressures may affect profitability.

- Stock Volatility: Emotion swing of the sector and market sentiment to crash would drive price volatility.

Frequently Asked Questions (FAQs)

1. Is Zydus Lifesciences an appropriate long-term choice to make an investment?

Yes, Zydus Lifesciences has good fundamentals, growing global presence, and growing product pipeline and thus a good long-term investment wager.

2. What is the estimated 2025 share price of Zydus Lifesciences?

The estimated share price in 2025 will be approximately ₹1,400 based on the company performance and the market trend.

3. Why has the stock been volatile in recent times?

Global economic environment, industrial trend, and market adjustment have led to the current short-run volatility.

4. How does Zydus stand out compared to other pharma shares?

It is low debt-to-equity, high return on equity, and increasing global presence, and hence a case of apples-and-oranges in the market.

5. What is the long-term vision of Zydus Lifesciences?

The share will be valued at ₹4,200 in 2030 if it is increasing slowly and there is a positive tilt in the market.

Zydus Lifesciences stands in the right place at the right time for the pharma sector with favorable finances, overseas businesses on the rise, and R&D-backed development plans. While many near-term price dips are unavoidable, long-term players would be thoroughly rewarded if the company continues on the growth trajectory that it’s on right now.

As a long-term investor (2025-2030), Zydus Lifesciences is a company which can be added to the portfolio since there are growth opportunities with stable revenues and growing business.