Bajaj Housing Share Price Target Tomorrow 2025 To 2030

Bajaj Housing Finance Limited is a part of the well-known Bajaj Finserv group and offers a wide range of home financing solutions. The company provides home loans, loans against property, and balance transfer options to individuals and businesses. It focuses on customer satisfaction by offering competitive interest rates, flexible repayment options, and fast loan processing. Bajaj Housing has built a strong presence across India by using both digital and offline channels to reach customers. Bajaj Housing Share Price on NSE as of 23 April 2025 is 131.34 INR.

Bajaj Housing Share Market Overview

- Open: 131.35

- High: 133.95

- Low: 130.95

- Previous Close: 130.72

- Volume: 15,295,254

- Value (Lacs): 20,061.26

- 52 Week High: 188.50

- 52 Week Low: 103.10

- Mkt Cap (Rs. Cr.): 109,286

- Face Value: 10

Bajaj Housing Share Price Chart

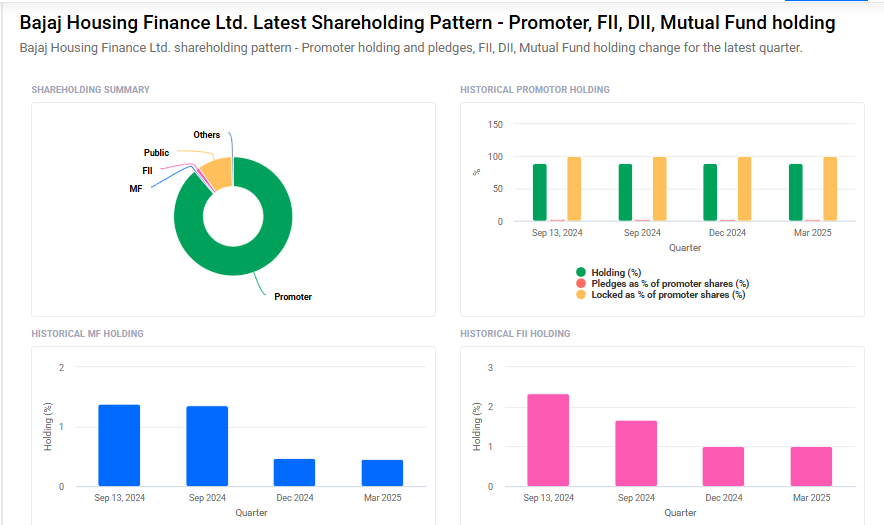

Bajaj Housing Shareholding Pattern

- Promoters: 88.8%

- FII: 1%

- DII: 0.8%

- Public: 9.4%

Bajaj Housing Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹190

- 2026 – ₹210

- 2027 – ₹230

- 2028 – ₹250

- 2030 – ₹270

Major Factors Affecting Bajaj Housing Share Price

Here are six key factors that influence the share price of Bajaj Housing Finance Ltd:

1. Strong Financial Growth

Bajaj Housing Finance has shown impressive financial performance, with a 25% increase in net profit to ₹548 crore in the December 2024 quarter compared to the previous year. Additionally, the company’s Assets Under Management (AUM) grew by 25.5% to ₹1.14 lakh crore, indicating robust business expansion.

2. Low Non-Performing Assets (NPAs)

The company maintains a low Gross Non-Performing Assets (GNPA) ratio of under 0.35%, reflecting strong asset quality and effective risk management. This stability enhances investor confidence and positively impacts the share price.

3. Impact of Lock-In Period Expiry

The expiration of lock-in periods for anchor investors has led to significant share price movements. For instance, the release of 12 million shares (about 2% of total equity) into the market created selling pressure, affecting the stock price.

4. Market Valuation Concerns

Analysts have expressed concerns about the company’s high valuation, with some considering the stock overvalued by approximately 44% compared to its intrinsic value. Such perceptions can influence investor sentiment and share price.

5. Analyst Recommendations

Market analysts have mixed opinions on Bajaj Housing Finance’s stock, with some recommending a “sell” due to valuation concerns, while others suggest a “buy” based on growth prospects. These recommendations can sway investor decisions and impact the share price.

6. Macroeconomic Factors

Broader economic conditions, such as interest rate changes and housing market trends, can affect the company’s performance. For example, rising interest rates may impact loan demand, influencing the company’s revenue and share price.

Risks and Challenges for Bajaj Housing Share Price

Here are six key risks and challenges that could influence the share price of Bajaj Housing Finance Ltd:

1. High Valuation Concerns

Some analysts believe that Bajaj Housing Finance’s stock is currently priced higher than its actual worth. For instance, Kotak Institutional Equities has given a ‘sell’ rating, suggesting a potential 21% downside risk due to expensive valuations. Such high valuations can make the stock more susceptible to price corrections if the company’s performance doesn’t meet investor expectations.

2. Interest Rate and Liquidity Risks

The company may face challenges due to mismatches between the interest rates and maturities of its assets and liabilities. If Bajaj Housing Finance cannot secure funding on acceptable terms or at competitive rates when needed, it could lead to liquidity concerns. Such situations can adversely affect the company’s financial stability and share price.

3. Exposure to Real Estate Market Fluctuations

Bajaj Housing Finance’s operations are closely tied to the real estate market. Fluctuations in property prices can impact the value of collateral and the company’s ability to recover loans. Delays in foreclosures and declining collateral values pose risks to the company’s financial performance.

4. Intense Competition in the Housing Finance Sector

The housing finance industry is highly competitive, with many players vying for market share. Customers often choose lenders offering the lowest interest rates, making it challenging for companies to maintain profitability. Bajaj Housing Finance must continuously innovate and manage costs to stay ahead in this competitive landscape.

5. Regulatory and Policy Risks

As a non-banking financial company (NBFC), Bajaj Housing Finance is subject to regulatory oversight. Changes in regulations or non-compliance can adversely affect the company’s operations and reputation. Additionally, the company must adhere to financial covenants under its debt arrangements, and any inability to comply could impact its financial condition.

6. Impact of Lock-In Period Expiry

The expiration of lock-in periods for certain shareholders can lead to increased selling pressure on the stock. For example, when a three-month lock-in period ended, approximately 12.5 crore shares (about 2% of total equity) became eligible for sale, leading to a 6% drop in the share price.

Read Also:- Waaree Energies Share Price Target Tomorrow 2025 To 2030