Waaree Energies Share Price Target Tomorrow 2025 To 2030

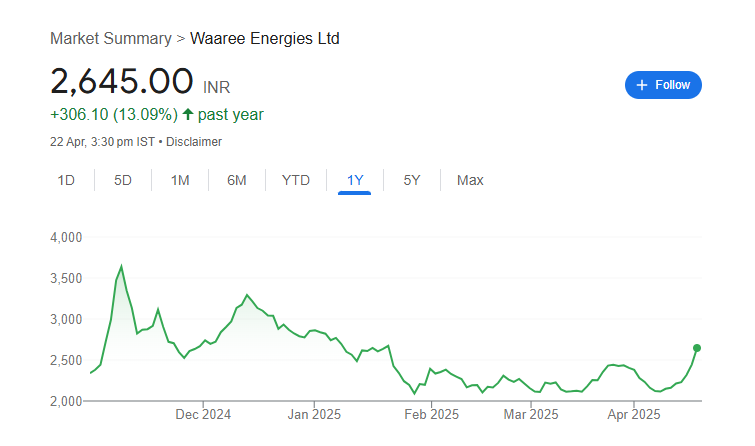

Waaree Energies is a leading solar energy company in India, known for manufacturing solar panels and providing clean energy solutions. The company plays a key role in the growing renewable energy sector and has a strong presence in both domestic and international markets. With increasing demand for solar power, especially in countries like the United States, Waaree Energies has been expanding its production capacity and working on new technologies. Waaree Energies Share Price on NSE as of 23 April 2025 is 2,645.00 INR.

Waaree Energies Share Market Overview

- Open: 2,520.00

- High: 2,649.00

- Low: 2,508.00

- Previous Close: 2,444.20

- Volume: 6,040,348

- Value (Lacs): 158,009.46

- 52 Week High: 3,743.00

- 52 Week Low: 1,863.00

- Mkt Cap (Rs. Cr.): 75,150

- Face Value: 10

Waaree Energies Share Price Chart

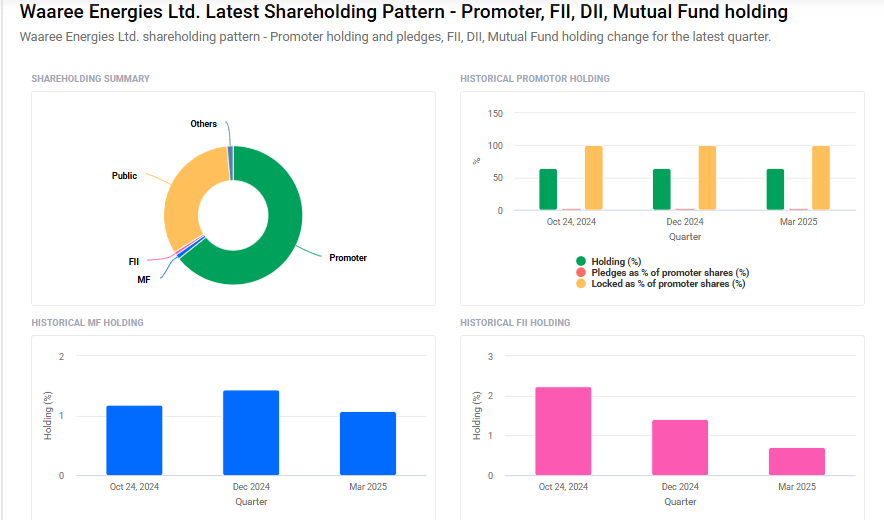

Waaree Energies Shareholding Pattern

- Promoters: 64.3%

- FII: 0.7%

- DII: 2.5%

- Public: 32.5%

Waaree Energies Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹3750

- 2026 – ₹4050

- 2027 – ₹4350

- 2028 – ₹4650

- 2030 – ₹5000

Major Factors Affecting Waaree Energies Share Price

Here are six key factors that influence the share price of Waaree Energies Ltd:

1. Strong Financial Performance

Waaree Energies has demonstrated impressive financial results. In the fourth quarter of FY25, the company reported a 29% increase in net profit, reaching ₹619 crore, and a 31% rise in revenue, totaling ₹4,004 crore. Such consistent growth often boosts investor confidence and positively impacts the share price.

2. Robust Order Book and Global Demand

The company’s strong order book and increasing global demand for solar products contribute significantly to its share price. Waaree Energies has secured substantial orders, including a notable presence in the U.S. market, which accounted for nearly 20% of its revenue in the past nine months. This global footprint supports revenue growth and investor optimism.

3. Industry Growth and Renewable Energy Focus

The growing emphasis on renewable energy, both in India and globally, positively affects Waaree Energies. Government initiatives and policies promoting clean energy sources increase demand for solar products, benefiting companies like Waaree and potentially driving up their share prices.

4. Recent IPO and Market Perception

Waaree Energies’ recent IPO in October 2024 was well-received, with the company raising ₹4,321.44 crore. The successful listing and subsequent market performance have enhanced investor perception, contributing to share price appreciation.

5. Analyst Ratings and Market Sentiment

Analyst opinions can influence investor behavior. For instance, Bernstein recently rated Waaree Energies as ‘Underweight’ due to competitive disadvantages and valuation concerns, suggesting a potential downside in the stock. Such assessments can impact market sentiment and share prices.

6. Regulatory Developments and Tax Implications

Regulatory actions, such as tax searches at company premises, can affect investor confidence. Waaree Energies experienced a tax search at its headquarters and subsidiary, which may raise concerns about compliance and governance, potentially influencing its share price.

Risks and Challenges for Waaree Energies Share Price

Here are six key risks and challenges that could influence the share price of Waaree Energies Ltd:

1. Heavy Dependence on the U.S. Market

Waaree Energies relies significantly on the U.S. for its export revenue, with the U.S. accounting for nearly 20% of its revenue in the past nine months. This heavy dependence means that any changes in U.S. trade policies, such as the reinstatement of tariffs on solar imports, could adversely affect the company’s sales and profitability.

2. Reliance on Chinese Imports for Raw Materials

The company sources a substantial portion of its raw materials from China, with 54.1% of its total imported goods coming from there in FY24. Any disruptions in supply chains or changes in import regulations could impact Waaree’s manufacturing operations and cost structures.

3. Intense Competition from Larger Players

Waaree faces stiff competition from well-capitalized companies like Reliance and Adani Enterprises. These larger players have more resources to invest in technology and capacity expansion, which could challenge Waaree’s market share and profitability.

4. Exposure to Global Market Volatility

With export sales accounting for 57.6% of Waaree’s total revenue in FY24, the company is exposed to global market risks. Economic downturns, geopolitical tensions, or changes in international trade policies could affect demand for its products and impact financial performance.

5. Potential Oversupply in the Solar Module Market

Analysts have raised concerns about a potential oversupply in the solar module market, which could lead to price reductions and margin pressures for manufacturers like Waaree. Such market dynamics may affect the company’s revenue and share price.

6. Regulatory and Policy Risks

Waaree’s operations are influenced by government policies and regulations related to renewable energy. Any unfavorable changes in policies, subsidies, or import/export regulations could pose challenges to the company’s growth and profitability.

Read Also:- Astral Share Price Target Tomorrow 2025 To 2030