BPCL Share Price Target Tomorrow 2025 To 2030

Bharat Petroleum Corporation Limited (BPCL) is one of India’s leading oil and gas companies, known for its strong presence in fuel refining, marketing, and distribution. It plays a vital role in supplying petrol, diesel, and other petroleum products across the country through a wide network of retail outlets. As a government-backed company, BPCL has earned the trust of millions of customers over the years. BPCL Share Price on NSE as of 24 April 2025 is 302.65 INR.

BPCL Share Market Overview

- Open: 302.95

- High: 305.50

- Low: 300.30

- Previous Close: 300.45

- Volume: 4,834,483

- Value (Lacs): 14,624.31

- VWAP: 302.88

- UC Limit: 330.45

- LC Limit: 270.40

- 52 Week High: 376.00

- 52 Week Low: 234.01

- Mkt Cap (Rs. Cr.): 131,239

- Face Value: 10

BPCL Share Price Chart

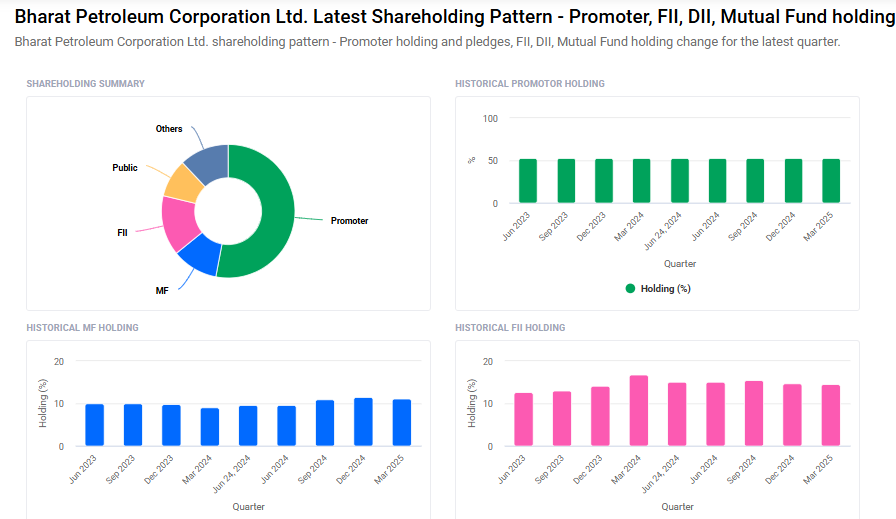

BPCL Shareholding Pattern

- Promoters: 53%

- FII: 14.6%

- DII: 23.2%

- Public: 9.3%

BPCL Share Price Target Tomorrow 2025 To 2030

| BPCL Share Price Target Years | BPCL Share Price |

| 2025 | ₹380 |

| 2026 | ₹400 |

| 2027 | ₹420 |

| 2028 | ₹440 |

| 2029 | ₹460 |

| 2030 | ₹480 |

BPCL Share Price Target 2025

Here are four key factors that could influence the growth of Bharat Petroleum Corporation Limited (BPCL) and its share price target for 2025:

1. Major Refinery and Petrochemical Expansion

BPCL is undertaking a significant investment of $11 billion to establish a new refinery and petrochemical complex in Andhra Pradesh. This facility, with a planned capacity of at least 9 million metric tons per year, aims to meet the rising fuel demand in India and position the country as a global refining hub. The project is expected to enhance BPCL’s production capabilities and contribute positively to its financial performance.

2. Diversification into Renewable Energy

In line with global energy transition trends, BPCL is expanding its footprint in the renewable energy sector. The company has formed a joint venture with Sembcorp to boost its renewable energy portfolio, targeting 10 gigawatts of clean energy projects by 2035. This strategic move is anticipated to open new revenue streams and reduce dependence on traditional fossil fuels.

3. Analyst Price Targets and Market Sentiment

Analysts have set varying price targets for BPCL’s stock, reflecting different perspectives on its growth prospects. For instance, Antique has maintained a “Buy” rating with a revised target price of ₹425, suggesting a potential upside of 62% from the last traded price. Such optimistic projections can influence investor sentiment and drive share price appreciation.

4. India’s Growing Energy Demand

India’s energy consumption is projected to rise significantly due to factors like urbanization and industrial growth. This increasing demand presents an opportunity for BPCL to expand its market share and profitability. By investing in infrastructure and diversifying its energy portfolio, BPCL is well-positioned to capitalize on this trend.

BPCL Share Price Target 2030

Here are 4 different points highlighting the risks and challenges that could impact BPCL’s share price target by 2030:

1. Uncertain Global Oil Market

BPCL’s performance is closely linked to international oil prices. If crude oil prices become highly unstable due to global conflicts or supply issues, it can increase the company’s costs and reduce its profits, which may negatively affect its share price.

2. Dependence on Government Policies

As a public sector company, BPCL is influenced by government decisions. Any changes in fuel pricing policies, subsidies, or regulations can impact its revenue and earnings. Too much government control may limit the company’s flexibility to respond to market changes.

3. Environmental Regulations and Clean Energy Shift

With rising global concerns about climate change, stricter environmental laws are being introduced. Also, the growing focus on clean and renewable energy might reduce the demand for petrol and diesel over time. This transition could slow down BPCL’s traditional business growth.

4. Privatization Uncertainty

The ongoing discussions about BPCL’s privatization may bring both hopes and concerns. Delays, lack of clarity, or a change in government approach could create confusion among investors, leading to volatility in the share price and future expectations.

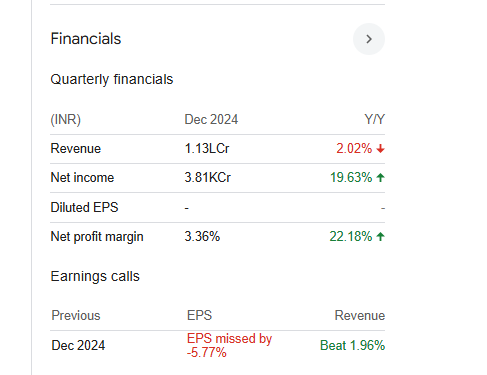

BPCL Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 4.48T | -5.31% |

| Operating expense | 344.13B | 1.57% |

| Net income | 268.59B | 1,160.36% |

| Net profit margin | 5.99 | 1,231.11% |

| Earnings per share | 65.59 | 728.15% |

| EBITDA | 433.33B | 276.86% |

| Effective tax rate | 25.79% | — |

Read Also:- DOMS Share Price Target Tomorrow 2025 To 2030