Praj Industries Share Price Target From 2025 to 2030

Praj Industries Share Price Target From 2025 to 2030: Investing in the stock market is not merely a matter of having a sense of growth but also having sufficient knowledge of the market positioning, finances, and vision of a company. One such stock that has been in the view of retail as well as institutional investors is Praj Industries Ltd., a sector leader in the business of bioenergy and environmental technologies.

With growing attention to green manufacturing processes, decarbonisation, and renewable energy globally, Praj Industries can best capitalize on the trend. Praj Industries’ consistent innovation in compressed biogas, ethanol, water treatment, and other cleaner technologies puts it ahead of India’s green economy.

This article gives an extensive Praj Industries analysis covering its current market performance, technical analysis, fundamental analysis, shareholding patterns, and estimated share price targets for 2025-2030.

Company History and Industry Stand

Praj Industries Ltd. is a world-renowned process and project engineering company. Having expertise in ethanol plants, water and wastewater solutions, critical process equipment, and high-purity systems, Praj is the industry leader in bioeconomy solutions.

Key Growth Drivers:

- Renewable Energy Drive: India government’s ambitious plans for ethanol blending and carbon footprint reduction align with Praj’s offerings.

- Worldwide Demand: Countries across the globe are looking to transition to renewable fuels, offering export market opportunities.

- Technology Advantage: Praj’s home-grown technologies such as Enfinity, Bio-Mobility™, and Bio-Prism™ present a compelling competitive advantage.

- Solid Order Book: Existing projects and strategic partnerships present healthy revenue visibility.

Recent Stock Market Performance

Here’s a summary of Praj Industries’ stock and market performance as of the latest available update:

- Open Price: ₹494.10

- Day High: ₹497.20

- Day Low: ₹484.15

- Previous Close: ₹488.60

- Market Cap: ₹8,970 Cr

- 52-Week High: ₹875.00

- 52-Week Low: ₹452.10

- P/E Ratio: 33.10

- Dividend Yield: 1.23%

- Volume Traded: 3,72,291

- Total Traded Value: ₹18.12 Cr

- Upper Circuit: ₹583.90

- Lower Circuit: ₹389.30

Despite trading so low compared to its 52-week high, the stock has good fundamentals and positive long-term sentiment.

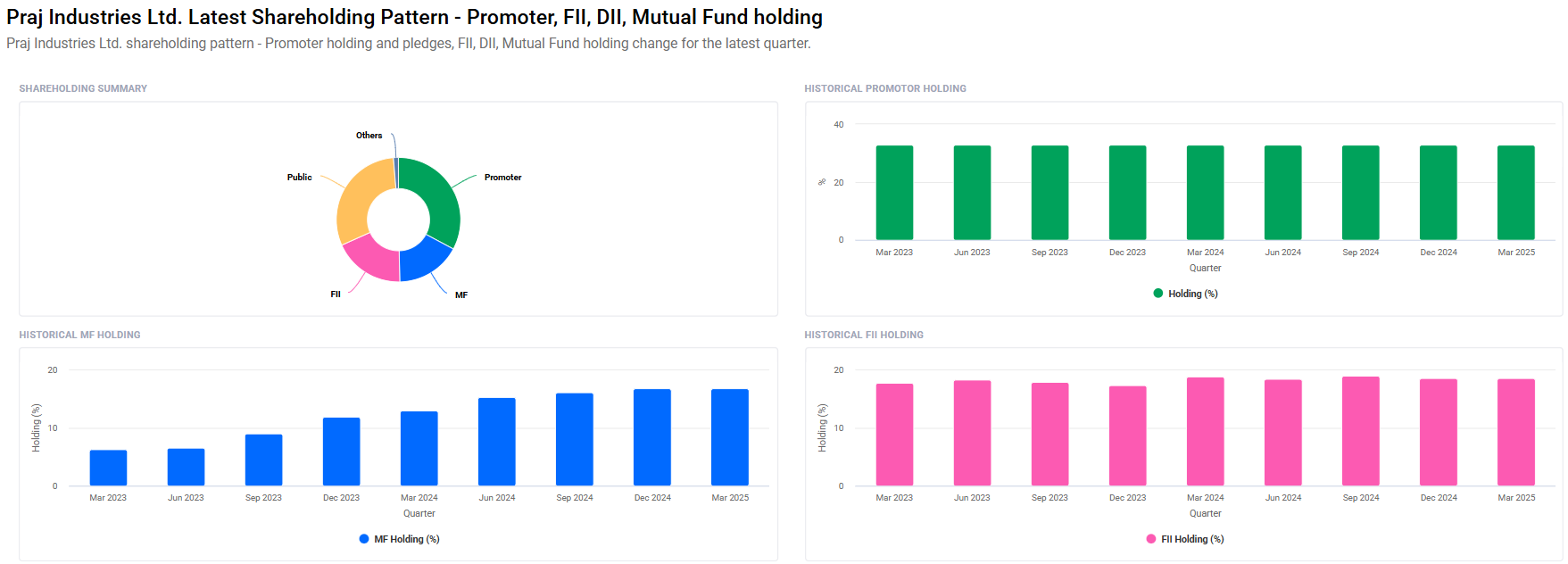

Ownership Structure and Institutional Confidence

The March 2025 quarter numbers display a classy ownership structure:

- Promoters: 32.81% (no change)

- Retail & Others: 30.37%

- Foreign Institutional Investors (FII/FPI): 18.63% (no change)

- Mutual Funds: 16.85% (24 funds)

- Other Domestic Institutions: 1.35%

- Institutional Holding (Total): 36.82%

Both promoters’ and institutional investors’ consistent holding demonstrates long-term belief in the business proposition.

Fundamental Analysis

- Book Value: ₹70.89

- Face Value: ₹2

- EPS (TTM): ₹14.74

- Debt-to-Equity Ratio: 0.13 (Low leverage)

- ROE (Return on Equity): 23.11% (Strong profitability)

- P/B Ratio: 6.89

- Industry P/E: 37.57 (Praj quotes slightly lower than industry average)

Fundamentally, Praj Industries is a good company with healthy profits, consistent dividend payouts, and minimal debt. These are extremely attractive attributes for long-term investors.

Technical Analysis – Is It a Good Entry Point Now?

- Momentum Score: 26.9 (Technically weak at current moment)

- MACD: -15.6 (Below Signal and Center Line – bearish)

- RSI (14): 33.8 (Near oversold zone)

- ADX: 27.8 (Weak trend strength)

- ROC (21): -6.6 (Negative momentum)

- MFI: 37.1 (Weak buying pressure)

- ATR: 24.5 (High volatility)

Technical pattern shows a weak trend in the short run. But because RSI is near 30 and MACD is at the bottom, reversal signals will soon start appearing. This is the time for long-term investors to accumulate.

Praj Industries Share Price Target (2025 to 2030)

Based on its fundamentals, industry tailwinds, and long-term drivers of growth, the following share price targets can be estimated:

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹900 |

| 2026 | ₹1300 |

| 2027 | ₹1700 |

| 2028 | ₹2100 |

| 2029 | ₹2500 |

| 2030 | ₹3000 |

These are estimated on optimistic assumptions of steady order wins, international foray in markets, policy tailwinds (specifically for ethanol blending), and growing adoption of bioeconomy solutions.

Investment Strategy

Short-Term Investors (1-2 Years)

- Risk Level: High

- Recommendation: Wait for technical reversal; entry suggested above ₹500 with tight stop-loss.

- Target: ₹900 in 2025

Medium-Term Investors (3-5 Years)

- Risk Level: Moderate

- Advice: Build up on dips; monitor quarterly earnings and ethanol rules.

- Target: ₹1700 by 2027

Long-Term Investors (5+ Years)

- Risk Level: Low

- Advice: Strong Buy for ESG funds and long-term sustainable investment policies.

- Target: ₹3000 by 2030

Risks and Challenges

Despite with bright prospects, there are some challenges:

- Volatility in Crude Prices: Competitiveness of ethanol might be affected by volatility in crude oil prices.

- Regulatory Risks: Policies can change with fresh government regulations or global market fluctuations.

- Execution Delays: Project-based revenue models are susceptible to implementation.

- Technical Weakness: Bearish short-term indications on the current scenario represent probable short-term weakness.

Final Verdict – Invest in Praj Industries or Not?

Praj Industries has a great long-term story fueled by the green revolution in India, improving the world’s demand for green fuel alternatives, and strong executional hands. The situation is also favorable with narrow margins, zero debt, and very high ROE. Technicals are poor in the short term, but these declines would be great times for long-term investors to step in and take a stake.

The company will benefit significantly from India’s ethanol goal blending, global net-zero targets, and increasing investment in green engineering and biofuels.

Praj Industries Share Price Target FAQs

Q1: Praj Industries target price in 2025 is?

A: Praj Industries’ target price by 2025 is estimated at ₹900, assuming that the business matures further and gains from policy push.

Q2: Can Praj Industries reach ₹3000 by 2030?

A: After high growth potential, ESG relevance, and increasing interest in clean energy alternatives, the stock can reach ₹3000 by 2030.

Q3: Is Praj Industries to be bought currently?

A: The stock is technically bearish in the short term. Nevertheless, it is a safe long-term buy with favorable fundamentals and sectoral tailwinds.

Q4: What is Praj Industries’ dividend yield?

A: The dividend yield at present is at 1.23%, hence adding value to long-term holding.

Q5: What are the most important investment risks of Praj Industries?

A: Important risks are fluctuations in crude prices, delay in execution of projects, and change in biofuel policies.

Q6: Who are the major shareholders of Praj Industries?

A: Promoters hold 32.81%, and institutionally invested funds (FIIs, MFs, DIIs) hold together more than 36%.

Q7: Is Praj Industries debt-free?

A: Yes, it is debt-free. It is nearly debt-free with a very minor debt-equity ratio of 0.13, which is strong financially.

If you want to diversify your portfolio with a future-proof and sustainable business that is in sync with India’s vision for the green economy, Praj Industries is definitely worth a serious thought. If you are a medium-term conservative investor or a long-term growth-oriented investor, this stock is a good bet with enormous upside potential.