South Indian Bank Share Price Target Tomorrow 2025 To 2030

South Indian Bank is one of the oldest private sector banks in India, with a strong presence mainly in South India. Founded in 1929, the bank has built a wide network of branches and ATMs across the country. It offers a range of services like savings and current accounts, loans, insurance, and investment products. In recent years, the bank has focused on strengthening its digital banking services and improving asset quality. South Indian Bank Share Price on NSE as of 28 April 2025 is 25.35 INR.

South Indian Bank Share Market Overview

- Open: 26.20

- High: 26.35

- Low: 25.10

- Previous Close: 26.06

- Volume: 16,746,068

- Value (Lacs): 4,240.10

- 52 Week High: 40.15

- 52 Week Low: 16.50

- Mkt Cap (Rs. Cr.): 6,624

- Face Value: 1

South Indian Bank Share Price Chart

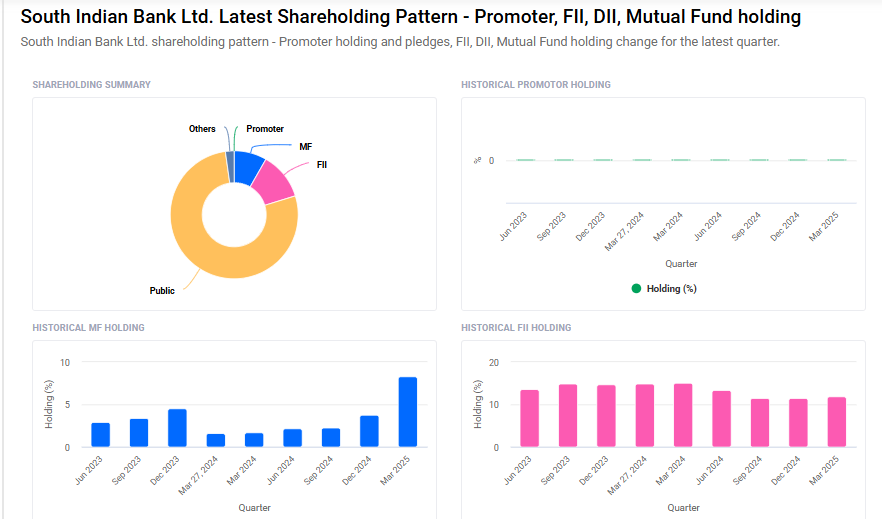

South Indian Bank Shareholding Pattern

- Promoters: 0%

- FII: 12%

- DII: 10.4%

- Public: 77.6%

South Indian Bank Share Price Target Tomorrow 2025 To 2030

| South Indian Bank Share Price Target Years | South Indian Bank Share Price |

| 2025 | ₹32 |

| 2026 | ₹40 |

| 2027 | ₹50 |

| 2028 | ₹60 |

| 2029 | ₹70 |

| 2030 | ₹80 |

South Indian Bank Share Price Target 2025

Here are four key factors that could influence the growth of South Indian Bank’s share price by 2025:

1. Strong Growth in Retail Loans

South Indian Bank has shown impressive growth in its retail loan segments. For instance, housing loan disbursals increased by 112% year-on-year, and auto loans grew by 67%. This significant expansion in retail lending indicates a robust demand and effective lending strategy, which can positively impact the bank’s profitability and share price.

2. Improvement in Asset Quality

The bank has made notable progress in reducing its non-performing assets (NPAs). Over the past four years, the gross NPA percentage has decreased to 4.5%, and the net NPA has fallen to 1.46%. This improvement in asset quality reflects better credit risk management and can enhance investor confidence.

3. Consistent Increase in Gross Advances

As of March 31, 2025, South Indian Bank’s gross advances reached ₹88,447 crore, marking a 9.97% increase compared to the previous year. This consistent growth in lending activities demonstrates the bank’s expanding business operations and its ability to meet customer credit needs.

4. Attractive Valuation Metrics

The bank’s stock is trading at a price-to-earnings (P/E) ratio of approximately 4.97, which is lower than the sector average of 8.80. This suggests that the stock may be undervalued, presenting a potential investment opportunity for investors seeking value in the banking sector.

South Indian Bank Share Price Target 2030

Here are 4 Risks and Challenges for South Indian Bank Share Price Target 2030:

1. High Competition in Banking Sector

South Indian Bank faces strong competition from bigger private banks and new-age digital banks. If it cannot keep up with better technology, customer service, and new products, it may lose market share, which could slow down its growth and impact its share price in the long term.

2. Risk of Rising Bad Loans

Although the bank has improved its asset quality recently, there is always a risk that bad loans (NPAs) could rise again, especially if the economy weakens. Higher NPAs can hurt the bank’s profits and reduce investor confidence, putting pressure on its share price.

3. Dependence on Interest Income

A large part of South Indian Bank’s income comes from interest earned on loans. If interest rates fall or if there is pressure to lower loan rates to stay competitive, the bank’s earnings might get affected. This could slow down share price growth over time.

4. Economic Uncertainties

Economic challenges like inflation, global financial instability, or slowdown in business activity can affect the entire banking sector, including South Indian Bank. Such uncertainties might lead to lower loan demand and higher defaults, which would negatively impact the bank’s financial health and future share price.

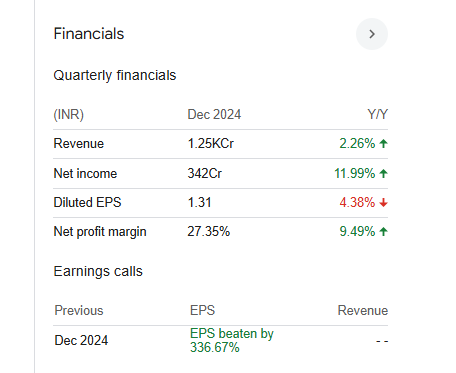

South Indian Bank Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 45.08B | 31.64% |

| Operating expense | 28.96B | 28.63% |

| Net income | 10.70B | 38.03% |

| Net profit margin | 23.74 | 4.86% |

| Earnings per share | 5.09 | 37.57% |

| EBITDA | — | — |

| Effective tax rate | 30.00% | — |

Read Also:- Titan Share Price Target Tomorrow 2025 To 2030