Titan Share Price Target Tomorrow 2025 To 2030

Titan Company is one of India’s leading lifestyle and retail brands, well known for its strong presence in the jewellery, watch, and eyewear segments. A part of the Tata Group, Titan was founded in 1984 and has since grown into a trusted name, especially through its popular brands like Tanishq, Fastrack, and Titan Watches. The company is recognized for its focus on quality, customer trust, and innovation in design. Titan Share Price on NSE as of 26 April 2025 is 3,357.00 INR.

Titan Share Market Overview

- Open: 3,382.60

- High: 3,419.50

- Low: 3,316.00

- Previous Close: 3,382.60

- Volume: 704,325

- Value (Lacs): 23,701.94

- VWAP: 3,364.76

- UC Limit: 3,720.80

- LC Limit: 3,044.40

- 52 Week High: 3,867.00

- 52 Week Low: 2,925.00

- Mkt Cap (Rs. Cr.): 298,757

- Face Value: 1

Titan Share Price Chart

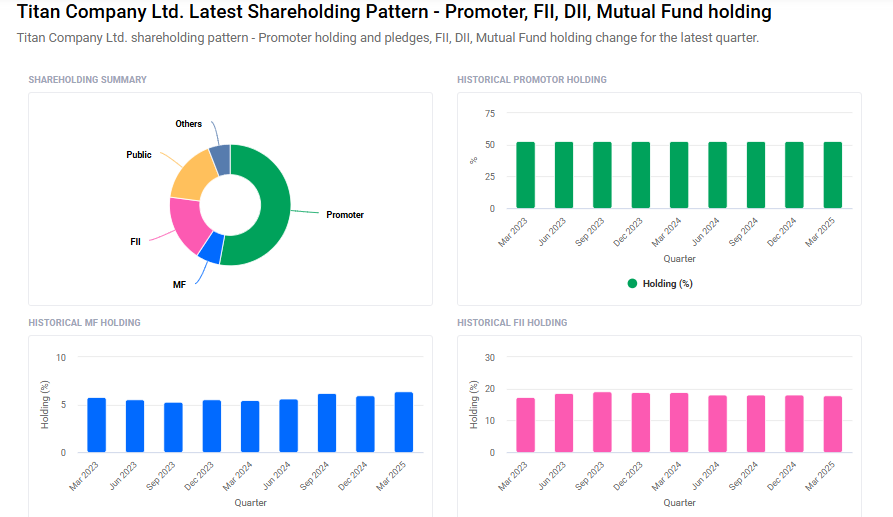

Titan Shareholding Pattern

- Promoters: 52.9%

- FII: 17.8%

- DII: 12.2%

- Public: 17%

Titan Share Price Target Tomorrow 2025 To 2030

| Titan Share Price Target Years | Titan Share Price |

| 2025 | ₹3870 |

| 2026 | ₹4000 |

| 2027 | ₹4200 |

| 2028 | ₹4400 |

| 2029 | ₹4600 |

| 2030 | ₹4800 |

Titan Share Price Target 2025

Here are 4 key factors that could affect the growth of Titan Company’s share price by 2025:

1. Strong Demand in the Jewellery Segment

Titan’s flagship brand, Tanishq, continues to see strong customer demand, especially during festive and wedding seasons. With India’s growing middle class and increasing gold consumption, Titan’s jewellery business plays a major role in boosting its overall growth and earnings.

2. Expansion of Retail Network

Titan is consistently expanding its presence in both urban and smaller towns across India. More stores in more locations mean better market reach, higher brand visibility, and potential for increased sales, which can positively impact its share price.

3. Growth in Watches and Eyewear Businesses

While jewellery is the core, Titan’s other segments like watches (Fastrack, Sonata) and eyewear (Titan Eyeplus) are also growing steadily. New product launches, brand collaborations, and affordable pricing help attract younger customers and support overall business growth.

4. Digital and Omnichannel Strategy

Titan is investing heavily in digital transformation and online sales. Its omnichannel strategy allows customers to browse and shop across physical stores and digital platforms, improving convenience and customer engagement, which can drive revenue and investor interest.

Titan Share Price Target 2030

Here are four risks and challenges that could influence Titan Company’s share price by 2030:

1. High Valuation Concerns

Titan’s stock is currently trading at a high valuation, with price-to-earnings (P/E) ratios of 80x for FY25E, 61x for FY26E, and 51x for FY27E. Such elevated valuations may limit the stock’s upside potential and make it more susceptible to market corrections if the company fails to meet growth expectations.

2. Margin Pressures in Jewellery Segment

The jewellery segment, a significant contributor to Titan’s revenue, has experienced margin pressures due to an inferior product mix, with a lower proportion of high-margin studded jewellery. Additionally, cuts in custom duties, while boosting jewellery growth, have negatively impacted margins.

3. Intense Market Competition

Titan faces stiff competition from both organized and unorganized players in the jewellery, watches, and eyewear markets. This intense competition can affect Titan’s market share and profitability, especially if competitors offer similar products at more competitive prices.

4. Dependence on Consumer Spending Trends

Titan’s performance is closely tied to consumer spending patterns, particularly in discretionary segments like jewellery and watches. Economic downturns, inflation, or changes in consumer preferences can adversely impact sales and, consequently, the company’s share price.

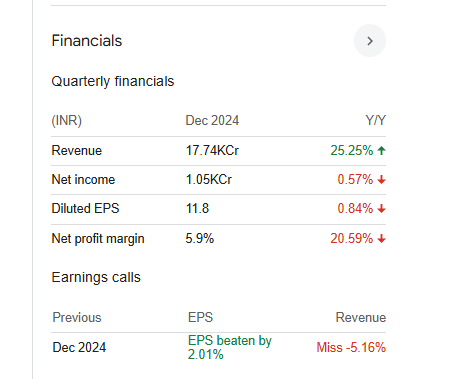

Titan Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 510.84B | 25.90% |

| Operating expense | 68.83B | 20.02% |

| Net income | 34.96B | 7.57% |

| Net profit margin | 6.84 | -14.61% |

| Earnings per share | 39.92 | 9.04% |

| EBITDA | 49.45B | 7.36% |

| Effective tax rate | 24.38% | — |

Read Also:- Tata Motors Share Price Target Tomorrow 2025 To 2030