ITDCEM Share Price Target Tomorrow 2025 To 2030

ITD Cementation India Limited is a well-established engineering and construction company in India, with a rich history dating back to 1931. Over the decades, it has built a strong reputation for delivering complex infrastructure projects across various sectors, including maritime structures, mass rapid transit systems, airports, highways, bridges, tunnels, dams, and industrial buildings. ITDCEM Share Price on NSE as of 26 April 2025 is 516.20 INR.

ITDCEM Share Market Overview

- Open: 544.70

- High: 544.70

- Low: 510.10

- Previous Close: 541.55

- Volume: 566,771

- Value (Lacs): 2,938.14

- VWAP: 521.89

- UC Limit: 649.85

- LC Limit: 433.25

- 52 Week High: 694.30

- 52 Week Low: 352.00

- Mkt Cap (Rs. Cr.): 8,905

- Face Value: 1

ITDCEM Share Price Chart

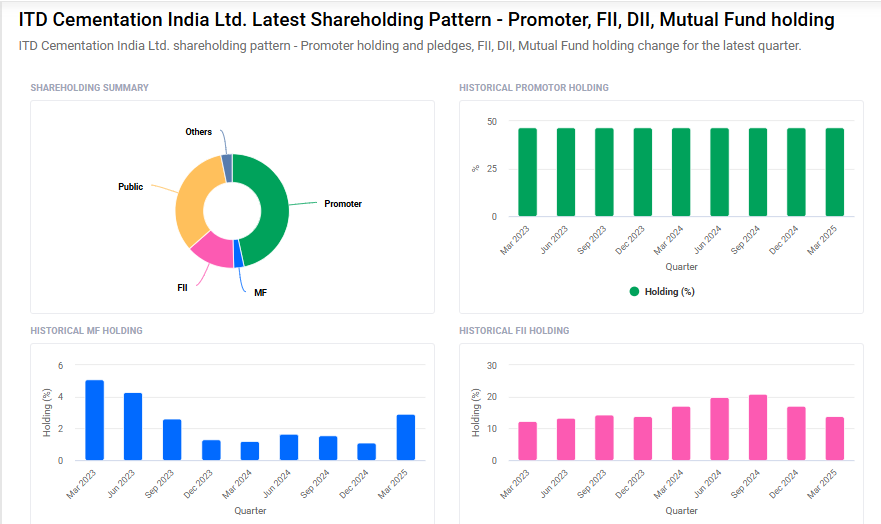

ITDCEM Shareholding Pattern

- Promoters: 46.6%

- FII: 14%

- DII: 6.1%

- Public: 33.3%

ITDCEM Share Price Target Tomorrow 2025 To 2030

| ITDCEM Share Price Target Years | ITDCEM Share Price |

| 2025 | ₹700 |

| 2026 | ₹850 |

| 2027 | ₹1000 |

| 2028 | ₹1150 |

| 2029 | ₹1300 |

| 2030 | ₹1450 |

ITDCEM Share Price Target 2025

Here are four key factors that could influence the growth of ITD Cementation India Ltd (ITDCEM) share price by 2025:

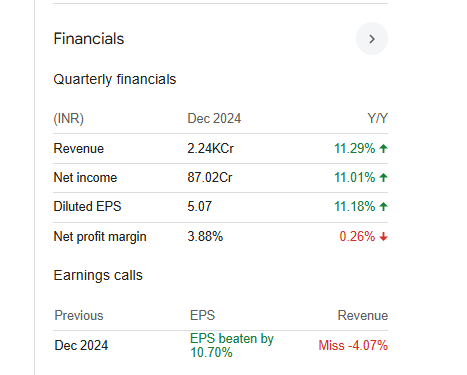

1. Strong Financial Performance

ITD Cementation has demonstrated consistent financial growth. In the third quarter of FY2025, the company reported a revenue of ₹22.5 billion, marking a 12% increase from the same period in the previous year. Net income also rose by 11%, reaching ₹870.2 million. These figures reflect the company’s robust operational efficiency and market demand for its services.

2. Robust Order Book

The company has a strong order book, which provides revenue visibility for the medium term. This backlog of projects ensures a steady stream of work, contributing to financial stability and potential growth in share value.

3. Improved Profit Margins

ITD Cementation has improved its operating profit margin to 9.6% in the first nine months of FY2024, up from 7.3% in the same period the previous year. This improvement is attributed to the closure of legacy loss-making projects and better operational efficiency.

4. Positive Market Outlook

Analysts have a favorable outlook for ITD Cementation’s stock, with price targets suggesting potential growth. For instance, forecasts indicate a price target of ₹593.50, with estimates ranging between ₹554.00 and ₹633.00.

ITDCEM Share Price Target 2030

Here are four risks and challenges that could affect the ITDCEM (ITD Cementation India Ltd) share price target for 2030:

1. Project Execution Delays

Delays in completing large infrastructure projects due to factors like weather, labor shortages, or supply chain disruptions can affect the company’s revenue and reputation. If projects are not delivered on time, it could lead to cost overruns and penalties, which might impact the share price.

2. High Competition in the Industry

The infrastructure and construction industry in India is very competitive, with many players bidding for government and private contracts. Increased competition can lead to lower profit margins for ITDCEM and affect its ability to secure new projects, which may limit future growth.

3. Dependence on Government Projects

A significant portion of ITDCEM’s business comes from government infrastructure projects. Any slowdown in government spending, change in policies, or delays in approvals could directly affect the company’s performance and investor sentiment.

4. Financial Leverage and Debt Risks

If the company takes on more debt to finance large-scale projects, it could face pressure on its financials. Rising interest rates or challenges in repayment can hurt profitability and reduce investor confidence in the long term.

ITDCEM Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 77.18B | 51.60% |

| Operating expense | 21.53B | 38.63% |

| Net income | 2.74B | 120.32% |

| Net profit margin | 3.55 | 45.49% |

| Earnings per share | 15.93 | 120.33% |

| EBITDA | 7.25B | 89.99% |

| Effective tax rate | 28.42% | — |

Read Also:- KRN Heat Exchanger Share Price Target Tomorrow 2025 To 2030