PCBL Chemical Share Price Target From 2025 to 2030

PCBL Chemical Share Price Target From 2025 to 2030: Stock market investment is a cautious evaluation, deep understanding of the company’s business fundamentals, and familiarity with the overall industry trends. Among the stocks that enjoy both analysts’ as well as retail investors’ attention is PCBL Chemical Ltd. With its diversified business in the chemicals and specialty carbon black division, the company has proved to be robust, innovative, and scalable – all the signs of a good multibagger stock in the making.

Here in this article, we will provide PCBL Chemical’s fundamentals as of today, recent share performance, technicals, institutional holding, and share price targets between 2025 and 2030. We will also provide frequently asked questions (FAQs) to assist investors in making an informed choice regarding the stock.

Company Overview and Market Position

PCBL Chemical Ltd. (formerly Phillips Carbon Black Ltd.) is a top specialty chemicals company with a specific focus on carbon black and performance chemicals for various industrial and consumer applications like tires, plastics, coatings, inks, and batteries. It has a strong domestic presence and is expanding its global reach aggressively.

With increasing emphasis by India on infrastructure, automobile growth, and manufacturing, carbon black and specialty chemicals demand will increase. PCBL will benefit most from these megatrends with its:

- State-of-the-art R&D capabilities

- Green production practices

- Strong customer ties

- Growing high-margin specialty black segment business

- Growing exports and overseas associations

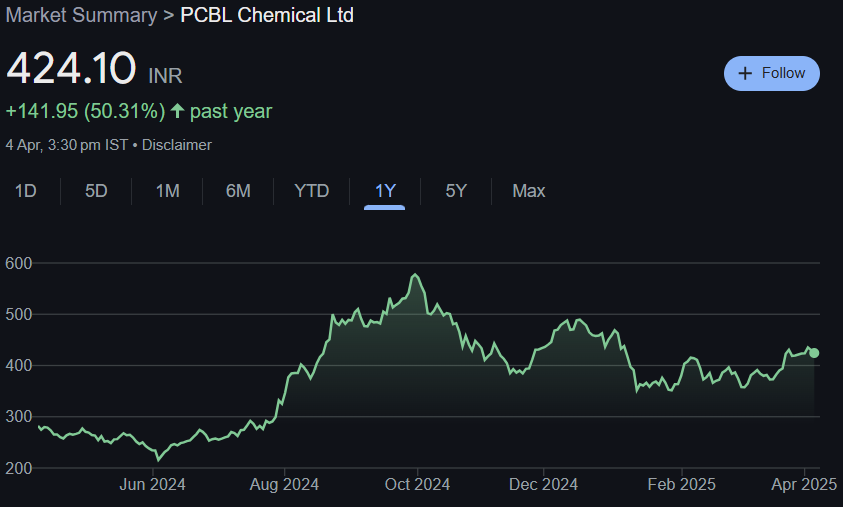

Recent Market Performance

Let’s look at the most relevant recent numbers to analyze PCBL’s performance and prevailing market sentiment:

- Current Share Price: ₹424.10

52-Week High: ₹584.40

52-Week Low: ₹209.00 - Market Capitalization: ₹16,012 Cr

- P/E Ratio (TTM): 35.92

- Industry P/E: 45.52

- EPS (TTM): ₹4.20

- Book Value: ₹101.03

- Dividend Yield: 1.30%

- Debt-to-Equity Ratio: 1.29

- Return on Capital (ROC): 13.13%

- 1-Year Price Growth: +50.31%

PCBL has been a good performer for the year with over 50% stock price growth. It is reasonably priced on P/E compared to the industry average, indicating room for growth.

Technical Analysis – What Do the Indicators Say?

An understanding of the technical indicators gives an insight into the short- and medium-term movement of the stock.

- RSI (14): 60.4, Neutral-Bullish (not overbought)

- MACD: 12.2, Bullish, above signal line

- ADX: 18.7, Small trend in formation

- ROC (21 Days): 16.4, Negative momentum

- MFI (Money Flow Index): 66.0, Neutral to Slightly Overbought

- ATR (Average True Range): 16.8, Moderate volatility

- ROC (125 Days): -21.7, Reflects correction of price in mid-term

- Momentum Score: 51.49, Technically neutral

PCBL technical indicators suggest that the stock is consolidating with favorable undertones. It is not over-sold, and there is room for further going-up movement in the short to medium term, as long as volumes pick up and macro sentiment is good.

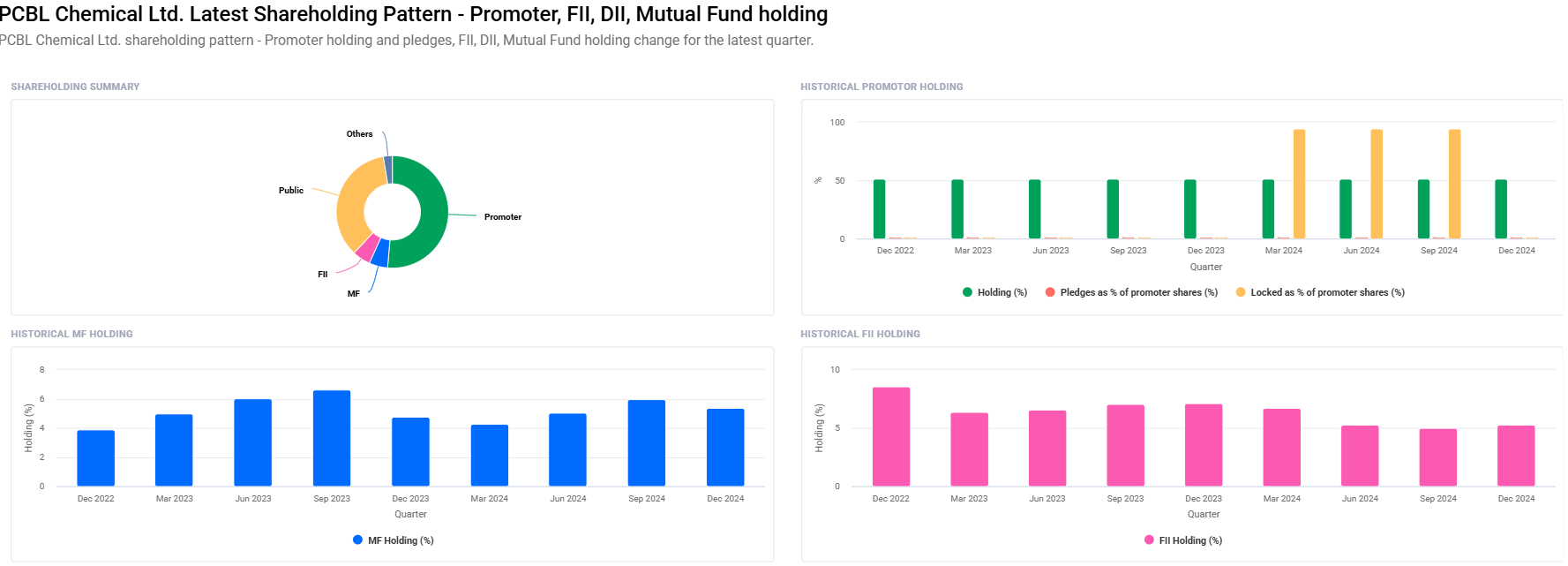

Ownership and Institutional Confidence

Observing the shareholding pattern gives us an idea of how favorable big investors are about the stock:

- Promoters: 51.41% (no change)

- Retail & Others: 36.67%

- Mutual Funds: 5.36% (down)

- Foreign Institutions (FII/FPI): 5.23% (up)

- Other Domestic Institutions: 1.33%

Points to note:

- FII holdings went up from 4.99% to 5.24%

- Mutual Fund holdings went down from 6.00% to 5.36%

- Institutional Investors went up from 13.03% to 13.18%

This divergent trend is a reflection of increased foreign optimism and some re-allocation by domestic MFs, possibly indicative of portfolio rebalancing as opposed to negative sentiment.

PCBL Chemical Share Price Target (2025 to 2030)

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹600 |

| 2026 | ₹1000 |

| 2027 | ₹1400 |

| 2028 | ₹1800 |

| 2029 | ₹2200 |

| 2030 | ₹2600 |

These targets take into account sustainable earnings growth expansion, margin improvement, and revenue growth in new geographies and segments. If macros continue, PCBL is well placed to be an outgainer in the chemical sector.

Investment Strategy

Short-Term Investors (1-2 Years)

- Entry Point: Accumulate at ₹420-₹440

- Exit Point: ₹600+ in 2025

- Risk Level: Medium

- Strategy: Wait for a breakout above ₹450; momentum can take it above ₹500 soon.

Mid-Term Investors (3-5 Years)

- Entry Point: Buy on dips, SIP strategy recommended

- Exit Point: ₹1400-₹1800

- Risk Level: Low to Medium

- Strategy: Strong buy; hold on during growth periods in specialty and export segments.

Long-Term Investors (5+ Years)

- Entry Point: Best to buy now and hold on

- Exit Point: ₹2600+ in 2030

- Risk Level: Low

- Strategy: Dividends, capital appreciation, and long-term compounding.

Risks to Watch Out For

- Debt Issues: 1.29 debt-to-equity ratio is within boundaries, but an unexpected spike would strain profits.

- Volatility: 52-week price volatility indicates PCBL is prone to industry mood swings.

- Raw Material Prices: Input price volatility could impact margins.

- Regulatory Risks: Environmental regulations and chemical prohibitions can affect business.

- Institutional Behavior: Long-term MF exit could spur investor jitters momentarily.

Frequent Asked Questions (FAQs)

Q1. Is PCBL Chemical Ltd. a good long-term bet?

A: Yes, owing to strong fundamentals, increasing global demand for specialty chemicals, and promoter confidence, PCBL is ready to grow in the long term.

Q2. What is the target share price for PCBL Chemical in 2025?

A: The target share price of ₹600 by 2025, based on steady growth and favorable market environment.

Q3. Why is PCBL stock increasing?

A: High profitability, specialty black innovation, greater FII holding, and positive technical signals are all reasons behind the stock rally.

Q4. What are the primary risks of PCBL Chemical investment?

A: Primary risks are high leverage, fluctuation in commodity prices across the world, and changes in regulations affecting the chemical industry.

Q5. What is the fair valuation band for PCBL by current parameters?

A: PCBL, at a P/E of 35.92 compared to industry average of 45.52, is reasonably priced. Reasonable price in short run is ₹500-₹600.

Q6. Wait or buy now?

A: For long-term, it’s time to buy if you are looking for it. For short-term, wait for breakout or consolidate between ₹420-₹430 before entering.

PCBL Chemical Ltd. is a well-healthy business with a promising future. Though the stock of the company has shown remarkable growth over the past twelve months, its emphasis on innovation, sustainability, and overseas growth provides a long runway for long-term returns.

For long-term patient investors, this could be one of the better mid-cap plays in the specialty chemical space over the next 5-6 years. Diversification and risk management are always the case as always – but if you believe in India’s industrial growth story, PCBL is a name which should be on your watchlist or portfolio.