Union Bank Share Price Target Tomorrow 2025 To 2030

Union Bank of India is a prominent public sector bank headquartered in Mumbai, Maharashtra. Established on November 11, 1919, by Seth Sitaram Poddar, the bank has grown to become one of India’s leading financial institutions. It offers a comprehensive range of banking services, including personal and corporate banking, loans, insurance, and wealth management, catering to over 153 million customers across the country. Union Bank Share Price on NSE as of 28 April 2025 is 124.51 INR.

Union Bank Share Market Overview

- Open: 128.52

- High: 129.45

- Low: 122.78

- Previous Close: 128.52

- Volume: 13,496,266

- Value (Lacs): 16,862.23

- 52 Week High: 172.50

- 52 Week Low: 68.00

- Mkt Cap (Rs. Cr.): 95,374

- Face Value: 10

Union Bank Share Price Chart

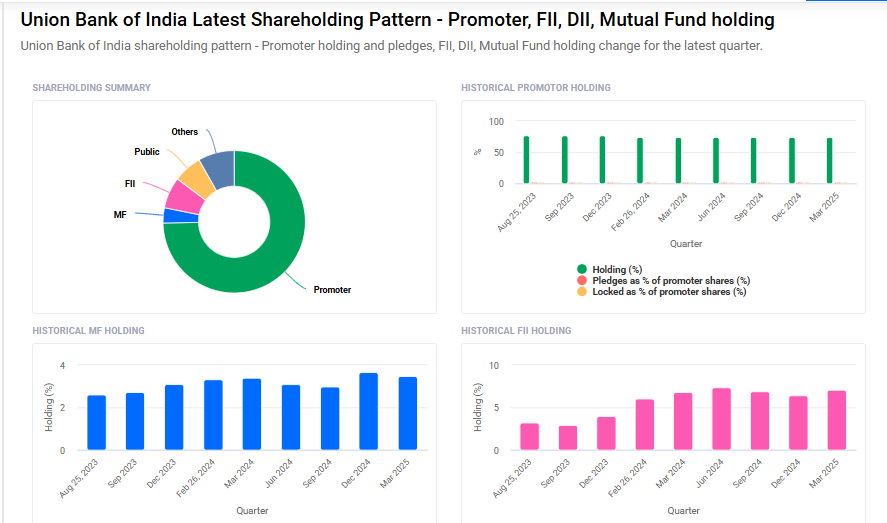

Union Bank Shareholding Pattern

- Promoters: 74.8%

- FII: 7.1%

- DII: 11.6%

- Public: 6.5%

Union Bank Share Price Target Tomorrow 2025 To 2030

| Union Bank Share Price Target Years | Union Bank Share Price |

| 2025 | ₹180 |

| 2026 | ₹200 |

| 2027 | ₹220 |

| 2028 | ₹240 |

| 2029 | ₹260 |

| 2030 | ₹280 |

Union Bank Share Price Target 2025

Here are 4 key factors that could influence the growth of Union Bank of India’s share price by 2025:

1. Economic Growth and Government Spending

India’s economy is projected to grow at over 6% in FY25, driven by domestic demand and government capital expenditure (capex). This economic expansion can increase credit demand, benefiting banks like Union Bank. Additionally, sustained government spending, particularly in infrastructure, can further boost economic activity and credit growth.

2. Focus on Digital Banking and Technology

Union Bank has been investing in digital banking initiatives to enhance customer experience and operational efficiency. The adoption of advanced technologies can attract tech-savvy customers, reduce costs, and improve profitability, positively impacting the bank’s share price.

3. Asset Quality and Non-Performing Assets (NPAs)

Maintaining a healthy asset quality is crucial for Union Bank’s growth. The bank’s provision coverage ratio stands at 75.63%, indicating strong provisioning practices. However, any significant increase in NPAs could affect profitability and investor confidence, potentially impacting the share price.

4. Interest Rate Environment and Credit Demand

The Reserve Bank of India’s monetary policy decisions influence interest rates, affecting loan demand and margins. A favorable interest rate environment can stimulate credit growth, benefiting banks like Union Bank. Conversely, rising rates may dampen loan demand and compress margins, posing challenges to growth.

Union Bank Share Price Target 2030

Here are 4 risks and challenges that could impact Union Bank of India’s share price target by 2030:

1. Macroeconomic Factors and Slowdown Risks

A slowdown in India’s economy could result in slower credit demand, which would directly affect the bank’s growth. In the event of a global recession or domestic economic crisis, businesses and individuals might reduce borrowing, impacting Union Bank’s profitability and share performance.

2. Regulatory Changes and Compliance Costs

Frequent regulatory changes and compliance requirements in the banking sector could increase operational costs for Union Bank. The introduction of stricter norms on lending, capital requirements, or NPAs could put additional pressure on the bank’s margins and reduce profitability.

3. Non-Performing Assets (NPAs) and Asset Quality

A significant increase in NPAs remains a major challenge for Union Bank, as it could impact the bank’s profitability and ability to distribute dividends. If there is a rise in bad loans, the bank may need to increase provisions, negatively impacting its bottom line and, subsequently, its share price.

4. Technological Disruptions and Cybersecurity Risks

With the growing reliance on digital banking, Union Bank faces increased risks from cybersecurity breaches and technological disruptions. Any major cyberattack could lead to financial losses, reputational damage, and loss of customer trust, all of which would affect the bank’s stock value in the long run.

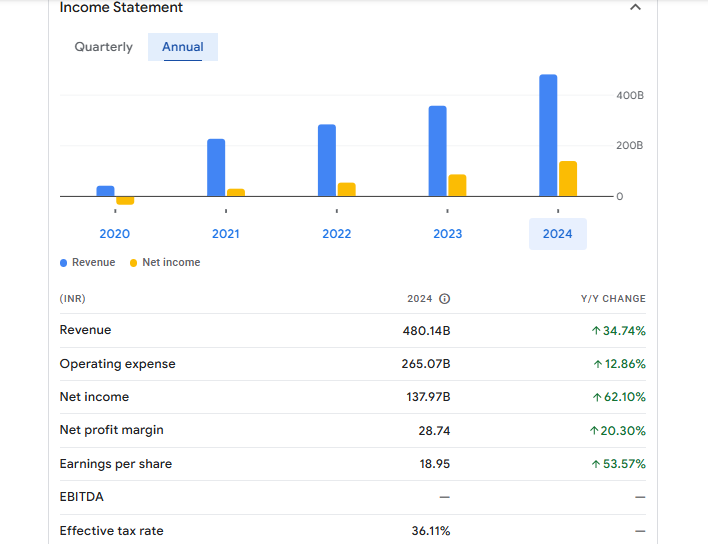

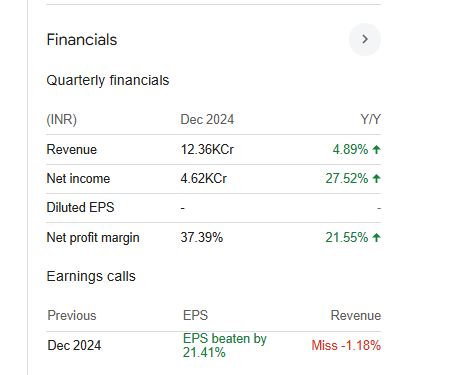

Union Bank Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 480.14B | 34.74% |

| Operating expense | 265.07B | 12.86% |

| Net income | 137.97B | 62.10% |

| Net profit margin | 28.74 | 20.30% |

| Earnings per share | 18.95 | 53.57% |

| EBITDA | — | — |

| Effective tax rate | 36.11% | — |

Read Also:- Patel Engineering Share Price Target Tomorrow 2025 To 2030