BHEL Share Price Target Tomorrow 2025 To 2030

Bharat Heavy Electricals Limited (BHEL) is one of India’s largest engineering and manufacturing companies, mainly working in the energy and infrastructure sectors. Established in 1964, BHEL designs and builds equipment for power plants, including boilers, turbines, and generators. It has played a big role in India’s power development by supplying technology and products for both traditional and renewable energy projects. BHEL Share Price on NSE as of 30 April 2025 is 231.10 INR.

BHEL Share Market Overview

- Open: 230.30

- High: 235.20

- Low: 230.24

- Previous Close: 230.31

- Volume: 16,328,906

- Value (Lacs): 37,773.66

- 52 Week High: 335.35

- 52 Week Low: 176.00

- Mkt Cap (Rs. Cr.): 80,550

- Face Value: 2

BHEL Share Price Chart

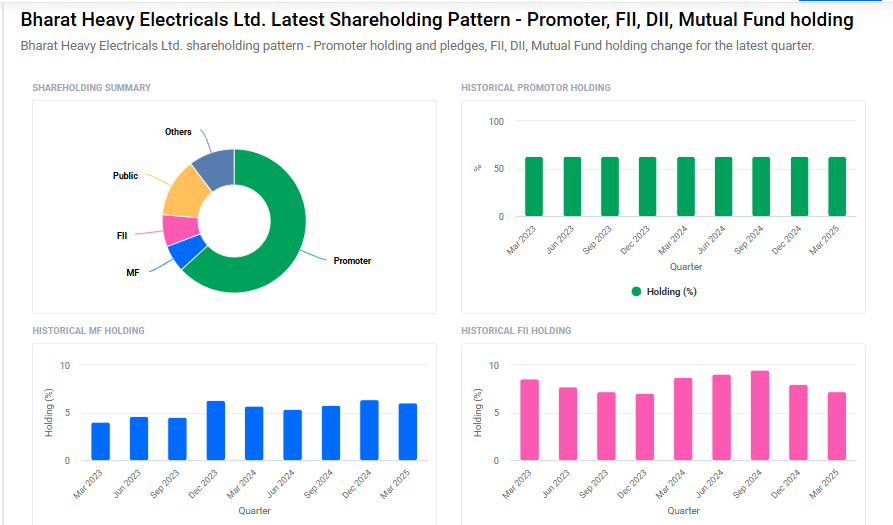

BHEL Shareholding Pattern

- Promoters: 63.2%

- FII: 7.2%

- DII: 16.3%

- Public: 13.3%

BHEL Share Price Target Tomorrow 2025 To 2030

| BHEL Share Price Target Years | BHEL Share Price |

| 2025 | ₹340 |

| 2026 | ₹360 |

| 2027 | ₹380 |

| 2028 | ₹400 |

| 2029 | ₹420 |

| 2030 | ₹440 |

BHEL Share Price Target 2025

Here are four key factors that could influence the growth of Bharat Heavy Electricals Limited (BHEL) and its share price target for 2025:

1. Expansion into Renewable Energy

BHEL is actively diversifying into renewable energy sectors such as solar and wind power. The company’s investments in green energy projects and its focus on clean energy solutions are expected to be significant growth drivers. This strategic shift aims to reduce dependence on traditional coal-based power plants and align with global sustainability trends.

2. Government Initiatives and Policies

As a public sector enterprise, BHEL stands to benefit from the Indian government’s emphasis on infrastructure development and self-reliance in manufacturing, particularly under initiatives like ‘Atmanirbhar Bharat’. Supportive policies and increased public sector spending on power and infrastructure projects could positively impact BHEL’s order book and revenue.

3. Technological Advancements and R&D

BHEL’s focus on research and development, including the adoption of technologies like Artificial Intelligence (AI) and the Internet of Things (IoT), aims to enhance operational efficiency and product offerings. Such technological advancements can lead to improved competitiveness and open new revenue streams.

4. Financial Performance and Order Book Growth

The company’s financial health, including its ability to secure new contracts and manage its order book effectively, plays a crucial role in its growth trajectory. Analysts have observed a significant increase in BHEL’s order inflow and order book size, indicating a positive outlook for revenue growth.

BHEL Share Price Target 2030

Here are four key Risks and Challenges that could impact BHEL’s (Bharat Heavy Electricals Limited) share price target by 2030:

-

Dependence on Thermal Power Projects

BHEL has traditionally relied on thermal power for a large portion of its business. With the global shift toward renewable energy and stricter environmental regulations, the demand for thermal projects may decline, affecting future growth. -

Slow Project Execution and Order Delays

The company has faced delays in project execution and order finalization in the past, which can impact revenue recognition, cash flow, and investor sentiment if not improved. -

Intense Competition and Technological Obsolescence

Increasing competition from private players and global companies, along with the need to upgrade technology, could challenge BHEL’s ability to win new contracts and maintain margins. -

Fluctuations in Government Policies and Spending

As a public sector enterprise, BHEL’s growth is closely tied to government infrastructure spending. Any slowdown or change in government priorities may directly affect its order book and financial performance.

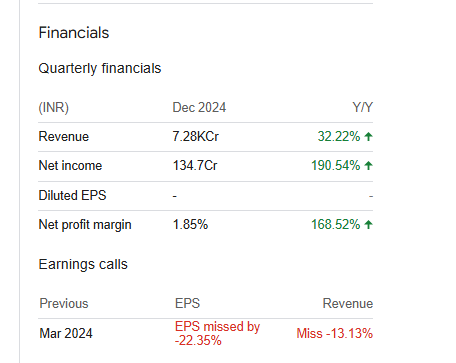

BHEL Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 238.93B | 2.26% |

| Operating expense | 66.37B | -0.64% |

| Net income | 2.82B | -56.86% |

| Net profit margin | 1.18 | -57.86% |

| Earnings per share | 0.75 | -41.86% |

| EBITDA | 4.93B | 5.08% |

| Effective tax rate | -16.30% | — |

Read Also:- IRB Infra Share Price Target Tomorrow 2025 To 2030