Paras Defence Share Price Target Tomorrow 2025 To 2030

Paras Defence and Space Technologies Ltd., established in 1972 and headquartered in Navi Mumbai, is a leading Indian company specializing in defense and space engineering. The company focuses on designing, developing, manufacturing, testing, and commissioning a wide range of products and systems for defense and space applications. Its operations are categorized into two main segments: Optics & Optronic Systems and Defence Engineering. The Optics & Optronic Systems division produces critical components such as space optics, infrared lenses for night vision devices, and hyperspectral cameras. Paras Defence Share Price on NSE as of 6 May 2025 is 1,373.60 INR.

Paras Defence Share Market Overview

- Open: 1,372.20

- High: 1,395.80

- Low: 1,326.40

- Previous Close: 1,347.80

- Volume: 1,547,331

- Value (Lacs): 21,285.09

- 52 Week High: 1,592.70

- 52 Week Low: 681.50

- Mkt Cap (Rs. Cr.): 5,542

- Face Value: 10

Paras Defence Share Price Chart

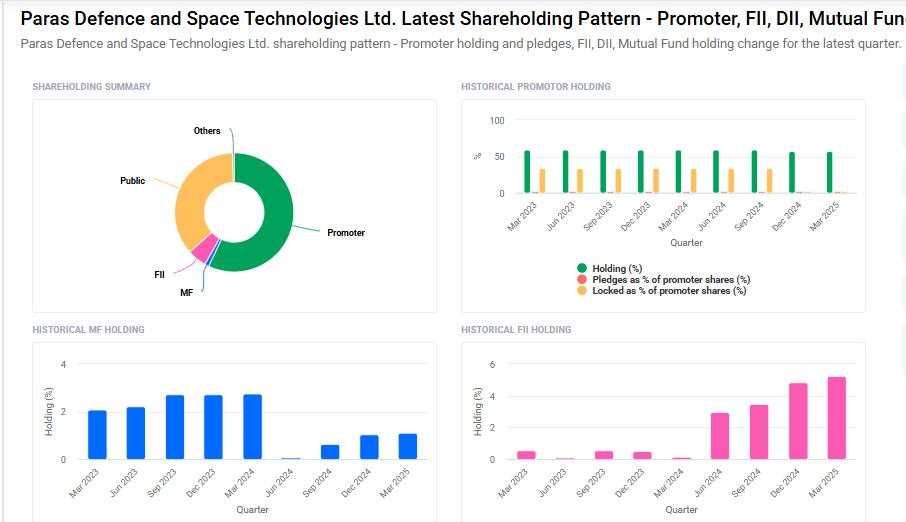

Paras Defence Shareholding Pattern

- Promoters: 57.1%

- FII: 5.2%

- DII: 1.5%

- Public: 36.2%

Paras Defence Share Price Target Tomorrow 2025 To 2030

| Paras Defence Share Price Target Years | Paras Defence Share Price |

| 2025 | ₹1600 |

| 2026 | ₹2200 |

| 2027 | ₹2800 |

| 2028 | ₹3400 |

| 2029 | ₹6000 |

| 2030 | ₹6600 |

Paras Defence Share Price Target 2025

Paras Defence share price target 2025 Expected target could ₹1600. Here are four key factors that could influence the growth of Paras Defence and Space Technologies Ltd. and its share price target for 2025:

1. Robust Order Book and Revenue Growth

Paras Defence has demonstrated strong financial performance, with a revenue growth of 73% in Q1 FY2025 and an order book exceeding ₹600 crore as of March 31, 2024. The company aims to maintain a revenue growth rate of 30-40% and EBITDA margins around 29% for the full year.

2. Government Support and Focus on Indigenization

India’s defense sector is experiencing significant growth, with the government targeting a turnover of ₹1.75 lakh crore by 2025, including ₹35,000 crore in exports. Paras Defence, with its expertise in defense electronics and emphasis on indigenization, is well-positioned to benefit from this trend.

3. Expansion into Space Technologies

The company is increasingly participating in space-tech collaborations, enhancing revenue prospects. Notably, Paras Defence is the exclusive optics supplier to the Indian Space Research Organisation (ISRO), and anticipates the rapidly evolving space sector to offer revenue potential of over ₹1,000 crore by the fiscal year 2025.

4. Positive Analyst Outlook

Analysts have projected a share price target of ₹1,100 – ₹1,350 for Paras Defence by 2025, suggesting confidence in the company’s growth trajectory and strategic initiatives.

Paras Defence Share Price Target 2030

Paras Defence share price target 2030 Expected target could ₹6600. Here are 4 key risks and challenges that could affect the share price target of Paras Defence and Space Technologies Ltd. by 2030:

1. High Dependence on Government Contracts

Paras Defence primarily relies on orders from government agencies like DRDO, ISRO, and the Indian Armed Forces. Any changes in defense budgets, policy shifts, or delays in procurement could significantly impact its revenue stream.

2. Limited Diversification

While the company has made efforts to explore new domains like space technology, its core business is still heavily concentrated in a niche segment. Lack of diversification could pose risks if one segment underperforms.

3. Technological Obsolescence

The defense and aerospace sectors demand continuous innovation. Failure to keep up with emerging technologies or delays in R&D could reduce competitiveness and impact future order inflows.

4. Intense Competition and Global Uncertainty

Paras Defence faces competition from both domestic and international players. Additionally, geopolitical uncertainties and changing international trade dynamics could affect export potential and supply chain reliability.

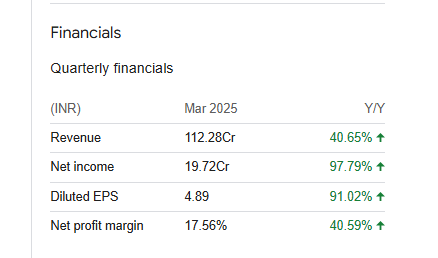

Paras Defence Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 3.73B | 46.89% |

| Operating expense | 1.12B | 20.48% |

| Net income | 634.70M | 97.97% |

| Net profit margin | 17.04 | 34.81% |

| Earnings per share | — | — |

| EBITDA | 1.05B | 105.72% |

| Effective tax rate | 26.46% | — |

Read Also:- Data Patterns Share Price Target Tomorrow 2025 To 2030