Mercury Trade Share Price Target Tomorrow 2025 To 2030

Mercury Trade Links Limited is a small but growing company in India that mainly deals with trading of agricultural products like seeds, fertilizers, and pesticides. The company recently changed its focus to the agro-commodity sector, which is a growing industry with strong demand. Mercury Trade is working towards expanding its business and improving its financial performance. It has shown good profit growth in recent quarters and raised funds to support future plans. Mercury Trade Share Price on BOM as of 7 May 2025 is 21.31 INR.

Mercury Trade Share Market Overview

- Open: 20.52

- High: 21.31

- Low: 20.52

- Previous Close: 20.91

- Volume: 10,528

- Value (Lacs): 2.24

- VWAP: 20.66

- UC Limit: 21.73

- LC Limit: 20.89

- 52 Week High: 105.04

- 52 Week Low: 5.56

- Mkt Cap (Rs. Cr.): 29

- Face Value: 10

Mercury Trade Share Price Chart

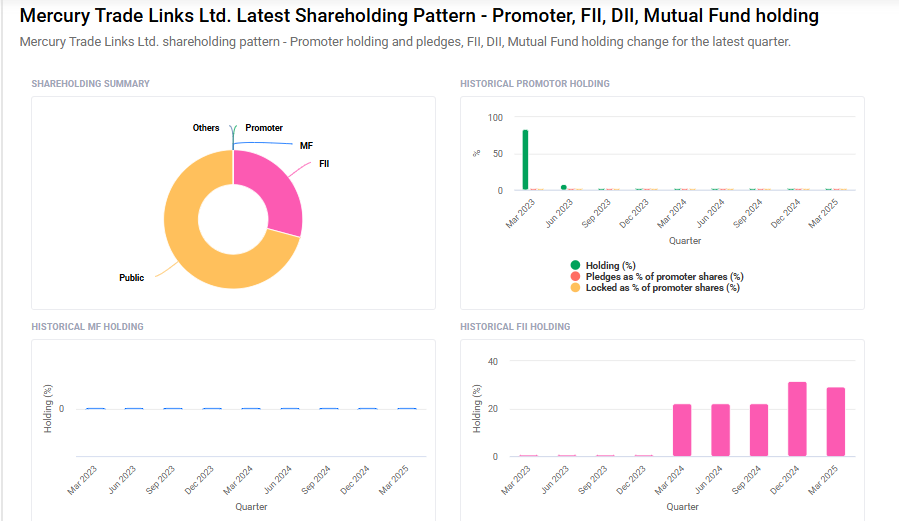

Mercury Trade Shareholding Pattern

- Promoters: 0%

- FII: 29.2%

- DII: 0%

- Public: 70.8%

Mercury Trade Share Price Target Tomorrow 2025 To 2030

| Mercury Trade Share Price Target Years | Mercury Trade Share Price |

| 2025 | ₹110 |

| 2026 | ₹130 |

| 2027 | ₹150 |

| 2028 | ₹170 |

| 2029 | ₹190 |

| 2030 | ₹210 |

Mercury Trade Share Price Target 2025

Mercury Trade share price target 2025 Expected target could ₹110. Here are four key factors that could influence the growth of Mercury Trade Links Ltd. and its share price target for 2025:

1. Robust Revenue and Profit Growth

Mercury Trade Links has demonstrated significant financial growth in recent quarters. For instance, in the quarter ending December 2024, the company reported a net profit of ₹0.58 crore, marking a 48.72% increase from ₹0.39 crore in December 2023. Additionally, sales rose by 159.35% to ₹10.40 crore during the same period . This consistent upward trajectory in revenue and profitability suggests a strong foundation for future growth.

2. Strategic Shift to Agro-Commodity Trading

In 2023, Mercury Trade Links transitioned its business focus to trading agro-products, including fertilizers, pesticides, and various seeds. This strategic pivot positions the company to capitalize on the growing demand in the agricultural sector, potentially leading to increased market share and revenue streams.

3. Successful Capital Raising Initiatives

The company’s rights issue in October 2024, aimed at raising ₹48.95 crore, reflects investor confidence and provides additional capital for expansion and operational enhancements . Such financial initiatives can support the company’s growth objectives and improve its competitive positioning.

4. Strong Return Metrics and Low Debt Levels

Mercury Trade Links boasts impressive financial ratios, with a Return on Capital Employed (ROCE) of 47.4% and a Return on Equity (ROE) of 38.7%. Furthermore, the company’s low debt-to-equity ratio of 0.09 indicates prudent financial management and a solid balance sheet, which can facilitate sustainable growth and investor confidence.

Mercury Trade Share Price Target 2030

Mercury Trade share price target 2030 Expected target could ₹210. Here are 4 key risks and challenges that could impact Mercury Trade Links Ltd.’s share price target by 2030:

1. Limited Market Presence and Low Liquidity

Mercury Trade is a relatively small-cap company with limited public visibility and trading volume. This low liquidity can make the stock more volatile and difficult for large investors to enter or exit positions.

2. Business Concentration Risk

The company’s focus on agro-commodity trading—while promising—also exposes it to sector-specific risks such as changing agricultural policies, weather dependence, and fluctuations in demand and supply of agri-products.

3. Regulatory and Compliance Uncertainty

As a trading and agro-input-related company, Mercury Trade may face strict regulatory oversight from environmental, agricultural, and financial bodies. Any compliance lapses or regulatory shifts can impact operations and profitability.

4. Dependence on External Funding for Growth

Recent growth has been supported by fundraising through rights issues. Overreliance on external funding, without parallel organic revenue growth, could stress the company’s financials or dilute shareholder value in the long run.

Read Also:- Updater Share Price Target Tomorrow 2025 To 2030