Manba Finance Share Price Target Tomorrow 2025 To 2030

Manba Finance Limited is a well-established non-banking financial company (NBFC) based in Mumbai, India, founded in 1996. The company specializes in providing a range of financing solutions, including loans for new and pre-owned two-wheelers, three-wheelers, electric vehicles, as well as personal and small business loans. Manba Finance Share Price on NSE as of 25 April 2025 is 137.95 INR.

Manba Finance Share Market Overview

- Open: 138.00

- High: 140.20

- Low: 136.55

- Previous Close: 137.72

- Volume: 60,748

- Value (Lacs): 83.83

- 52 Week High: 199.80

- 52 Week Low: 119.00

- Mkt Cap (Rs. Cr.): 693

- Face Value: 10

Manba Finance Share Price Chart

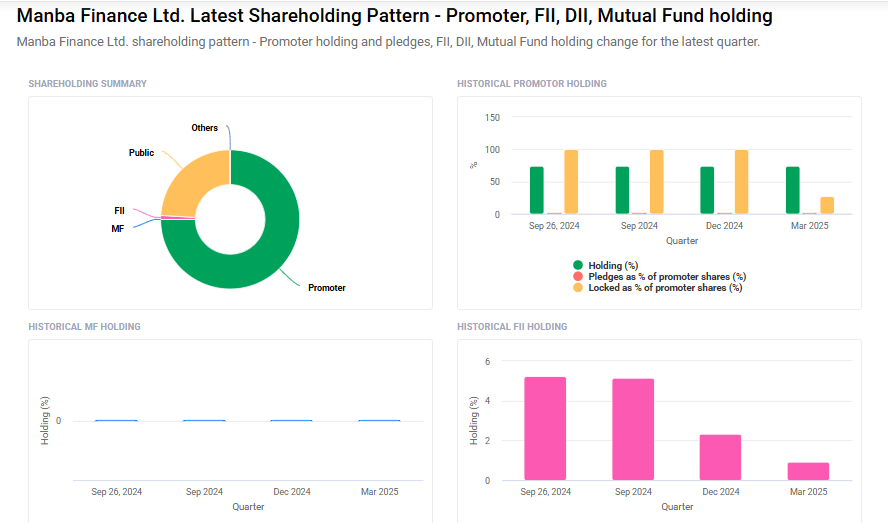

Manba Finance Shareholding Pattern

- Promoters: 75%

- FII: 0.9%

- DII: 0%

- Public: 0.9%

Manba Finance Share Price Target Tomorrow 2025 To 2030

| Manba Finance Share Price Target Years | Manba Finance Share Price |

| 2025 | ₹200 |

| 2026 | ₹220 |

| 2027 | ₹240 |

| 2028 | ₹260 |

| 2029 | ₹280 |

| 2030 | ₹300 |

Manba Finance Share Price Target 2025

Here are four key factors that could influence the growth of Manba Finance’s share price by 2025:

1. Strong Financial Performance

Manba Finance has demonstrated impressive financial growth, with its revenue from operations increasing by 43.26% year-over-year in Q3 FY25, reaching ₹68.87 crore. Additionally, the company’s Profit Before Tax (PBT) grew by 160.81% compared to the same quarter in the previous year, highlighting robust profitability.

2. Significant Growth in Assets Under Management (AUM)

The company’s AUM has seen substantial growth, expanding from ₹49,582.62 lakh in Fiscal 2022 to ₹93,685.54 lakh in Fiscal 2024, reflecting a Compound Annual Growth Rate (CAGR) of 37.46%. This growth indicates an increasing demand for Manba Finance’s lending services.

3. Successful IPO and Positive Market Reception

Manba Finance’s Initial Public Offering (IPO) was met with strong investor interest, being subscribed 224.05 times. The shares listed at nearly a 21% premium over the issue price and continued to gain, trading at 31% higher than the IPO price shortly after listing.

4. Strategic Expansion and Dealer Network

The company operates across 65 locations with 28 branches in five Indian states and has established relationships with over 850 dealers. This extensive network supports its growth in the vehicle financing sector, particularly in two- and three-wheeler segments.

Manba Finance Share Price Target 2030

Here are 4 key risks and challenges that could affect Manba Finance’s share price target by 2030:

1. Economic Slowdowns

If India’s overall economy slows down, people may borrow less money or delay loan repayments. Since Manba Finance mainly deals with vehicle loans, a dip in auto sales or consumer spending can directly impact their earnings and share price.

2. Rising Interest Rates

When interest rates go up, the cost of borrowing increases—for both the company and its customers. This can reduce demand for loans, affect profitability, and possibly create pressure on the stock price in the long term.

3. Credit Risk and NPAs

There’s always a risk that borrowers may not repay their loans on time, especially in unsecured or small-ticket loans. If bad loans (NPAs) rise, it can hurt the company’s financial health and investor confidence.

4. High Competition

The NBFC sector in India is very competitive, with both big banks and digital lenders fighting for market share. Manba Finance must keep innovating and offering value to stay ahead—failure to do so can slow down its growth and affect stock performance.

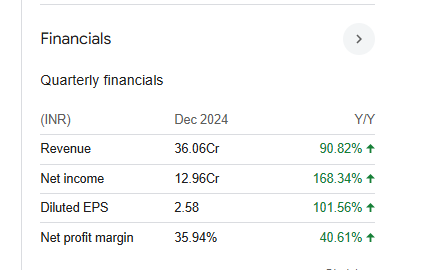

Manba Finance Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 958.14M | 44.18% |

| Operating expense | 566.62M | 32.28% |

| Net income | 314.20M | 89.50% |

| Net profit margin | 32.79 | 31.42% |

| Earnings per share | — | — |

| EBITDA | — | — |

| Effective tax rate | 19.22% | — |

Read Also:- Premier Energies Share Price Target Tomorrow 2025 To 2030