Salasar Techno Share Price Target Tomorrow 2025 To 2030

Salasar Techno Engineering Ltd., established in 2001 and headquartered in Ghaziabad, India, is a leading infrastructure company specializing in customized steel fabrication and engineering solutions. The company offers a comprehensive range of services, including engineering, procurement, fabrication, galvanization, and turnkey project execution, catering to sectors such as telecommunications, power transmission, railways, and renewable energy. Salasar’s product portfolio encompasses telecommunication towers, solar module mounting structures, smart city poles, and heavy steel structures. Salasar Techno Share Price on NSE as of 9 May 2025 is 8.25 INR.

Salasar Techno Share Market Overview

- Open: 8.33

- High: 8.50

- Low: 8.20

- Previous Close: 8.32

- Volume: 2,834,756

- Value (Lacs): 233.58

- 52 Week High: 23.28

- 52 Week Low: 7.80

- Mkt Cap (Rs. Cr.): 1,422

- Face Value: 1

Salasar Techno Share Price Chart

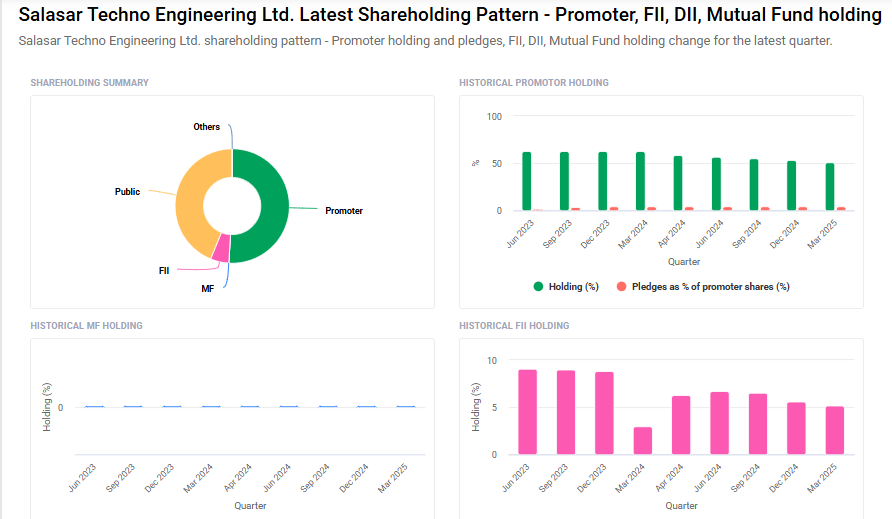

Salasar Techno Shareholding Pattern

- Promoters: 51%

- FII: 5.2%

- DII: 0%

- Public: 43.8%

Salasar Techno Share Price Target Tomorrow 2025 To 2030

| Salasar Techno Share Price Target Years | Salasar Techno Share Price |

| 2025 | ₹25 |

| 2026 | ₹35 |

| 2027 | ₹45 |

| 2028 | ₹60 |

| 2029 | ₹70 |

| 2030 | ₹80 |

Salasar Techno Share Price Target 2025

Salasar Techno share price target 2025 Expected target could ₹25. Here are four key factors that could influence Salasar Techno Engineering Ltd.’s share price target for 2025:

-

Robust Revenue Growth

In the third quarter of FY2024–25, Salasar Techno Engineering reported a consolidated revenue of ₹375.89 crore, marking a 23.51% increase compared to the same period the previous year. This significant growth indicates strong demand for the company’s engineering and EPC services, which could positively impact its share price. -

Strategic Merger with EMC Limited

The company has approved a merger with its wholly owned subsidiary, EMC Limited, which specializes in power transmission and distribution projects. This amalgamation is expected to streamline operations, consolidate resources, and expand technical expertise, enabling Salasar Techno to undertake larger, more complex projects. Such strategic moves can enhance investor confidence and potentially drive share price growth. -

Expansion into Renewable Energy Sector

Salasar Techno Engineering is actively offering comprehensive solutions in the renewable energy sector, including wind and solar energy projects. By diversifying its portfolio and aligning with global sustainability trends, the company positions itself for long-term growth, which may reflect positively on its stock performance. -

Strong Order Book

As of the end of Q1 FY2024–25, Salasar Techno Engineering reported a robust order book valued at ₹2,401.9 crore. A healthy pipeline of projects across core sectors indicates sustained business momentum, which can be a key driver for future revenue and profitability, thereby influencing the share price favorably.

Salasar Techno Share Price Target 2030

Salasar Techno share price target 2030 Expected target could ₹80. Here are four key risks and challenges that could impact Salasar Techno Engineering Ltd.’s share price target by 2030:

-

High Stock Volatility

Salasar Techno Engineering’s stock exhibits significant volatility, with a weekly fluctuation rate of approximately 11%, surpassing 75% of Indian stocks. This high volatility can lead to unpredictable share price movements, making it challenging for investors to anticipate returns accurately. -

Exposure to Market Risks

The company faces market risks, including fluctuations in foreign exchange rates, interest rates, and commodity prices. These factors can adversely affect the company’s financial performance, especially given its operations in multiple sectors and geographies. -

Challenges in Renewable Energy Sector

While expanding into renewable energy projects, Salasar Techno Engineering must navigate challenges such as inconsistent energy supply due to variable sunlight and wind conditions. Additionally, the financial viability of renewable technologies remains a concern, potentially affecting project profitability. -

Underperformance Relative to Market Expectations

The company’s earnings growth has been slower than the broader market, leading to concerns about its high Price-to-Earnings (P/E) ratio. If this trend continues, it may result in a reevaluation of the company’s valuation, potentially impacting its share price negatively.

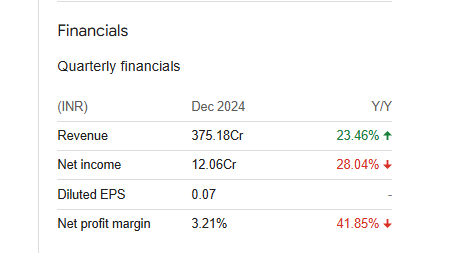

Salasar Techno Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 12.08B | 20.25% |

| Operating expense | 1.22B | 21.53% |

| Net income | 529.33M | 31.77% |

| Net profit margin | 4.38 | 9.50% |

| Earnings per share | — | — |

| EBITDA | 1.22B | 33.44% |

| Effective tax rate | 26.50% | — |

Read Also:- Akme Fintrade Share Price Target Tomorrow 2025 To 2030