Rajnandini Metal Share Price Target Tomorrow 2025 To 2030

Rajnandini Metal Limited is an Indian company specializing in the manufacturing and trading of high-grade copper products. Established in 2010 and headquartered in Rewari, Haryana, the company offers a range of products including copper rods, annealed bare copper wires, fine copper wires, bunched copper wires, and submersible wires and cables. Serving various industries such as steel, automotive, engineering, construction, chemical, and electronics, Rajnandini Metal has expanded its business scope to 15 countries, building relationships with numerous buyers and suppliers worldwide. Rajnandini Metal Share Price on NSE as of 17 May 2025 is 4.86 INR.

Rajnandini Metal Share Market Overview

- Open: 4.86

- High: 4.86

- Low: 4.86

- Previous Close: 4.77

- Volume: 112,926

- Value (Lacs): 5.49

- VWAP: 4.86

- UC Limit: 4.86

- LC Limit: 4.67

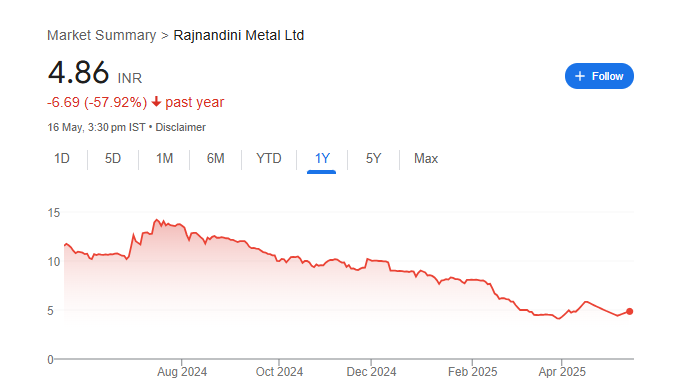

- 52 Week High: 14.90

- 52 Week Low: 3.98

- Mkt Cap (Rs. Cr.): 134

- Face Value: 1

Rajnandini Metal Share Price Chart

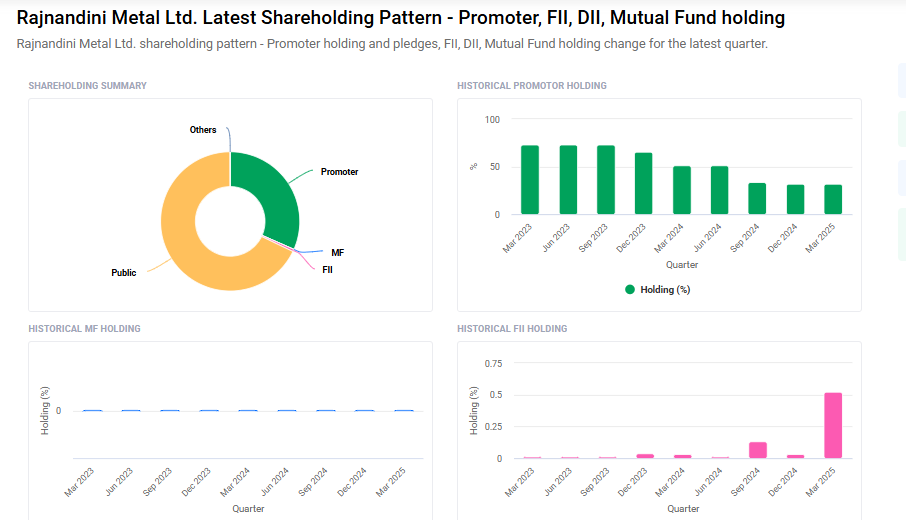

Rajnandini Metal Shareholding Pattern

- Promoters: 31.6%

- FII: 0.5%

- DII: 0%

- Public: 67.9%

Rajnandini Metal Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹15 |

| 2026 | ₹22 |

| 2027 | ₹30 |

| 2028 | ₹40 |

| 2029 | ₹50 |

| 2030 | ₹60 |

Rajnandini Metal Share Price Target 2025

Rajnandini Metal share price target 2025 Expected target could ₹15. Here are 5 key factors influencing the growth outlook and share price target of Rajnandini Metal Ltd for 2025:

1. Revenue Growth and Profitability Trends

Over the past three years, Rajnandini Metal has achieved a commendable revenue growth of approximately 24.33%, indicating robust top-line expansion. Additionally, the company has maintained a healthy Return on Equity (ROE) of 36.77% during this period, reflecting efficient utilization of shareholders’ funds.

2. Financial Health and Debt Management

The company’s debt-to-equity ratio stands at 1.77, suggesting a moderate level of leverage. While this indicates that the company is utilizing debt to finance its growth, it also underscores the importance of effective debt management to ensure long-term financial stability.

3. Market Valuation and Investor Sentiment

As of May 16, 2025, Rajnandini Metal’s share price is ₹4.86, with a market capitalization of ₹134.37 crore. The stock has experienced a decline of approximately 49.32% over the past six months, reflecting cautious investor sentiment.

4. Operational Efficiency and Profit Margins

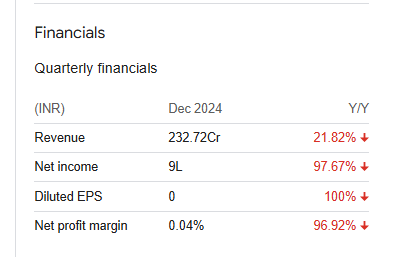

The company’s net profit margin is reported at 1.26%, indicating a relatively thin margin. This suggests that while the company is generating revenue growth, there may be challenges in translating this into substantial net profits, highlighting the need for improved operational efficiency.

5. Industry Position and Competitive Landscape

Rajnandini Metal operates in the metals sector, engaging in the manufacturing and trading of copper rods, wires, and other non-ferrous metals. The company’s performance is influenced by global commodity prices, demand-supply dynamics, and competition from both domestic and international players.

Rajnandini Metal Share Price Target 2030

Rajnandini Metal share price target 2030 Expected target could ₹60. Here are five key risks and challenges that could impact Rajnandini Metal Ltd’s share price target for 2030:

1. High Debt Levels and Cash Flow Concerns

As of September 2024, Rajnandini Metal carried a debt of ₹862.2 million, with limited cash reserves, indicating potential liquidity challenges. Additionally, the company reported negative free cash flow of ₹213 million in the previous year, suggesting difficulties in converting profits into cash, which could affect its ability to service debt and fund operations.

2. Profitability Pressures Amid Market Volatility

The company’s net sales have shown fluctuations, with a 16.63% year-on-year decline reported in September 2024. Such volatility in revenue streams can lead to inconsistent profitability, making it challenging to sustain growth and investor confidence over the long term.

3. Susceptibility to Commodity Price Fluctuations

Operating in the metals sector, Rajnandini Metal is inherently exposed to the volatility of global commodity prices. Significant fluctuations in the prices of raw materials like copper can impact production costs and profit margins, especially if the company is unable to pass these costs onto customers.

4. Intense Industry Competition and Technological Disruption

The metals industry is highly competitive, with numerous players vying for market share. Additionally, rapid technological advancements and the emergence of alternative materials could disrupt traditional metal usage, potentially affecting demand for the company’s products.

5. Regulatory and Environmental Compliance Risks

Increasing environmental regulations and sustainability standards may require Rajnandini Metal to invest in cleaner technologies and processes. Failure to comply with such regulations could lead to legal penalties and reputational damage, while compliance may entail significant capital expenditure.

Rajnandini Metal Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 12.12B | 17.84% |

| Operating expense | 265.00M | 11.77% |

| Net income | 152.40M | 11.40% |

| Net profit margin | 1.26 | -5.26% |

| Earnings per share | — | — |

| EBITDA | 299.70M | 12.75% |

| Effective tax rate | 12.31% | — |

Read Also:- Maruti Suzuki Share Price Target Tomorrow 2025 To 2030