Dolphin Offshore Share Price Target Tomorrow 2025 To 2030

Dolphin Offshore Enterprises (India) Limited is a leading provider of underwater services to the Indian oil and gas industry. Established in 1979 by Rear Admiral Kirpal Singh, the company offers a range of services including diving and underwater engineering, vessel operations, rig and ship repairs, marine logistics, and fabrication. Dolphin Offshore has developed a diversified portfolio for undertaking turnkey projects involving sub-sea and marine services, and functions as an engineering, procurement, and construction (EPC) contractor. Dolphin Offshore Share Price on BOM as of 17 April 2025 is 346.70 INR.

Dolphin Offshore Share Market Overview

- Open: 346.70

- High: 346.70

- Low: 346.70

- Previous Close: 339.95

- Volume: 556

- Value (Lacs): 1.93

- VWAP: 346.70

- UC Limit: 346.70

- LC Limit: 333.15

- 52 Week High: 948.70

- 52 Week Low: 201.00

- Mkt Cap (Rs. Cr.): 1,386

- Face Value: 1

Dolphin Offshore Share Price Chart

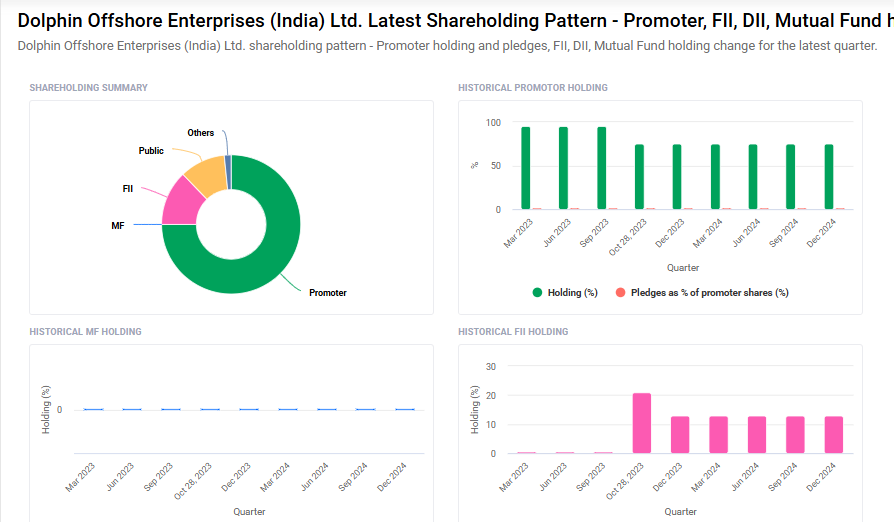

Dolphin Offshore Shareholding Pattern

- Promoters: 75%

- FII: 12.8%

- DII: 1.6%

- Public: 10.6%

Dolphin Offshore Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹950

- 2026 – ₹1050

- 2027 – ₹1150

- 2028 – ₹1250

- 2030 – ₹1350

Major Factors Affecting Dolphin Offshore Share Price

Here are 6 Factors Affecting Dolphin Offshore Share Price:

-

Performance of Oil and Gas Industry

Dolphin Offshore works mainly in the oil and gas sector, offering support services for offshore projects. So, when the oil and gas industry is doing well, it brings more business opportunities. A strong industry outlook often increases investor interest and helps boost the company’s share price. -

Company’s Project Orders and Contracts

The number and size of contracts Dolphin Offshore secures can directly impact its revenue. New projects, especially from big clients, show the company’s strength and potential for future growth. These announcements often attract investors and lead to a rise in the share price. -

Crude Oil Price Movements

Since Dolphin Offshore supports the energy sector, fluctuations in global crude oil prices play a big role. Higher oil prices usually mean more exploration and drilling activities, which increases demand for the company’s services. If oil prices drop sharply, it may lead to fewer projects and affect the share price. -

Financial Performance and Debt Levels

Investors closely watch the company’s earnings, cash flow, and debt. If Dolphin Offshore reports good profits and keeps debt under control, it builds trust in the market. Poor financial results or rising debts, however, can raise concerns and bring the share price down. -

Government Policies and Offshore Regulations

Changes in government rules related to offshore drilling, energy exploration, or environmental regulations can influence how Dolphin Offshore operates. Supportive policies may help the company grow, while stricter laws or delays in approvals can affect performance and share value. -

Global Market Trends and Economic Sentiment

Broader market trends and investor mood also play a role. If global markets are performing well and investors are confident in the oil and energy sector, Dolphin Offshore’s stock may benefit. During uncertain times, even good companies may see a drop in share price due to overall market pressure.

Risks and Challenges for Dolphin Offshore Share Price

Here are 6 Risks and Challenges for Dolphin Offshore Share Price:

-

Dependence on Oil and Gas Sector

Dolphin Offshore mainly provides services to the oil and gas industry. If that sector faces a slowdown—due to low oil prices or reduced global demand—the company may receive fewer contracts. This directly impacts revenue and can put pressure on the share price. -

Volatility in Crude Oil Prices

The global oil market is known for frequent ups and downs. If crude oil prices fall sharply, oil companies may cut down on new projects and offshore drilling. This could reduce the demand for Dolphin Offshore’s services and cause uncertainty among investors. -

Project Delays and Cost Overruns

Offshore projects are often complex and can face delays due to technical issues, weather, or logistical challenges. If Dolphin Offshore experiences delays or spends more than planned, it can affect profitability. Investors may see this as a risk, which can lower the stock price. -

High Operational and Maintenance Costs

Working offshore involves high costs, including safety measures, specialized equipment, and skilled manpower. If costs continue to rise without a matching increase in revenue, the company’s profit margins could shrink, which may negatively affect the share price. -

Regulatory and Environmental Risks

The offshore sector is highly regulated. New environmental laws, safety standards, or government restrictions can increase compliance costs or limit operations. Any failure to meet these standards can result in fines or operational setbacks, which can impact stock performance. -

Financial Stress and Debt Burden

If Dolphin Offshore has a high level of debt or faces cash flow problems, it may struggle to fund ongoing projects or invest in new ones. Financial stress can reduce investor confidence and increase the risk of stock price decline, especially if the company shows signs of instability.

Read Also:- Samhi Hotels Share Price Target Tomorrow 2025 To 2030