Orient Green Power Share Price Target Tomorrow 2025 To 2030

Orient Green Power is an Indian company that works in the field of renewable energy. It mainly produces electricity using wind power, helping reduce pollution and support a greener future. The company aims to provide clean and sustainable energy across the country. Over the years, it has expanded its reach by setting up wind farms in different parts of India. Although it has faced some financial ups and downs, Orient Green Power continues to focus on improving its services and growing its clean energy portfolio. Orient Green Power Share Price on NSE as of 19 May 2025 is 13.25 INR.

Orient Green Power Share Market Overview

- Open: 12.99

- High: 13.25

- Low: 12.88

- Previous Close: 12.91

- Volume: 5,112,174

- Value (Lacs): 674.30

- 52 Week High: 34.45

- 52 Week Low: 10.96

- Mkt Cap (Rs. Cr.): 1,547

- Face Value: 10

Orient Green Power Share Price Chart

Orient Green Power Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹25 |

| 2026 | ₹35 |

| 2027 | ₹45 |

| 2028 | ₹55 |

| 2029 | ₹65 |

| 2030 | ₹80 |

Orient Green Power Share Price Target 2025

Orient Green Power share price target 2025 Expected target could ₹25. Here are five key factors influencing the growth prospects of Orient Green Power’s share price by 2025:

1. Diversified Renewable Energy Portfolio

Orient Green Power focuses on wind energy and is expanding into solar and biomass sectors. This diversification positions the company to capitalize on India’s increasing demand for clean energy, potentially enhancing revenue streams and investor confidence.

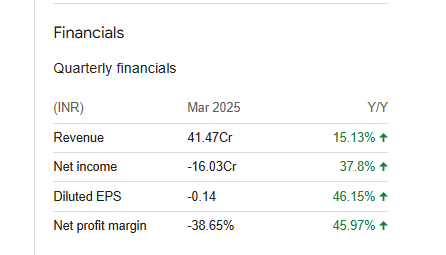

2. Financial Performance and Profitability

The company has faced challenges in profitability, with a reported net loss in the March 2025 quarter despite improved EBITDA figures. Sustained efforts to improve financial metrics are crucial for positive investor sentiment and share price appreciation.

3. Debt Reduction Efforts

Orient Green Power has made strides in reducing its debt levels, which can lead to lower interest expenses and improved financial health. A stronger balance sheet may attract investors seeking stability in the renewable energy sector.

4. Market Valuation Concerns

Analyses suggest that Orient Green Power’s stock may be overvalued by approximately 22% compared to its intrinsic value. This discrepancy could impact investor decisions and share price movements if not addressed through enhanced performance or strategic initiatives.

5. Technical Indicators and Investor Sentiment

Technical analysis indicates potential bullish patterns, such as the “cup and handle” formation, suggesting possible upward momentum. However, these patterns require confirmation through market movements and investor participation to influence share price positively.

Orient Green Power Share Price Target 2030

Orient Green Power share price target 2030 Expected target could ₹80. Here are five key risks and challenges that could impact Orient Green Power’s share price trajectory by 2030:

1. Inconsistent Profitability and Earnings Volatility

Orient Green Power has experienced fluctuating earnings, with periods of declining earnings per share (EPS). Such inconsistencies can undermine investor confidence and hinder long-term share price growth.

2. Debt Management Concerns

The company has faced challenges related to its debt levels, which can strain financial resources and limit operational flexibility. High debt burdens may also affect the company’s ability to invest in new projects or technologies.

3. Operational Efficiency Issues

Orient Green Power has shown signs of inefficiency in utilizing its capital to generate profits, as indicated by a low Return on Capital Employed (RoCE). This suggests potential challenges in operational management and resource allocation.

4. Market Valuation Risks

Analyses suggest that Orient Green Power’s stock may be overvalued by approximately 22% compared to its intrinsic value. This discrepancy could impact investor decisions and share price movements if not addressed through enhanced performance or strategic initiatives.

5. Regulatory and Policy Uncertainties

While the renewable energy sector in India is growing, it is also subject to regulatory changes and policy shifts. Any unfavorable changes in government policies or delays in approvals can pose risks to project execution and profitability.

Orient Green Power Financials Statement

| (INR) | 2025 | Y/Y change |

| Revenue | 2.63B | -2.78% |

| Operating expense | 1.25B | 7.40% |

| Net income | 388.10M | 6.24% |

| Net profit margin | 14.73 | 9.27% |

| Earnings per share | — | — |

| EBITDA | 1.69B | -7.61% |

| Effective tax rate | 3.43% | — |

Read Also:- Paytm Share Price Target Tomorrow 2025 To 2030