Jupiter Wagons Share Price Target Tomorrow 2025 To 2030

Jupiter Wagons Limited is an Indian company that designs and manufactures railway wagons, coaches, and related components. It plays an important role in supporting the country’s railway infrastructure by supplying modern and durable transport solutions. The company is also expanding into new areas like electric vehicles and defense equipment, which shows its efforts to grow and innovate. Jupiter Wagons Share Price on NSE as of 21 May 2025 is 393.00 INR.

Jupiter Wagons Share Market Overview

- Open: 408.95

- High: 414.90

- Low: 390.20

- Previous Close: 411.20

- Volume: 3,942,552

- Value (Lacs): 15,468.60

- 52 Week High: 748.10

- 52 Week Low: 270.05

- Mkt Cap (Rs. Cr.): 16,655

- Face Value: 10

Jupiter Wagons Share Price Chart

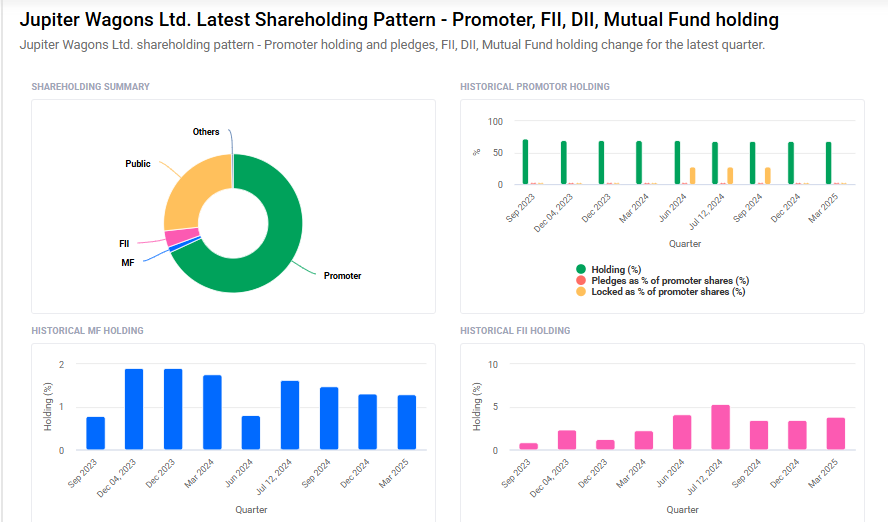

Jupiter Wagons Shareholding Pattern

- Promoters: 68.1%

- FII: 3.9%

- DII: 1.7%

- Public: 26.3%

Jupiter Wagons Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹750 |

| 2026 | ₹950 |

| 2027 | ₹1150 |

| 2028 | ₹1350 |

| 2029 | ₹1550 |

| 2030 | ₹1750 |

Jupiter Wagons Share Price Target 2025

Jupiter Wagons share price target 2025 Expected target could ₹750. Here are 5 key factors affecting the growth of Jupiter Wagons’ share price target for 2025:

-

Government Infrastructure Spending: Jupiter Wagons heavily relies on railway and infrastructure projects. Increased government spending under initiatives like “Make in India” and modernization of Indian Railways can significantly boost the company’s order book and revenue.

-

Order Book and Execution Capabilities: A robust and growing order book from both Indian Railways and private sector clients can drive top-line growth. Timely execution and delivery of these orders will influence investor sentiment positively.

-

Expansion into New Segments: Jupiter Wagons has shown interest in expanding into electric mobility and defense manufacturing. Success in diversifying product offerings could unlock new revenue streams and enhance valuations.

-

Raw Material Costs and Supply Chain Stability: Fluctuations in the prices of steel and other key materials can affect profit margins. Efficient cost management and a stable supply chain will be critical to sustaining earnings growth.

-

Regulatory and Policy Environment: Changes in government policies, import/export regulations, and railway procurement norms can either support or hinder growth. Favorable policies can act as catalysts for share price appreciation.

Jupiter Wagons Share Price Target 2030

Jupiter Wagons share price target 2030 Expected target could ₹1750. Here are 5 key Risks and Challenges that could impact Jupiter Wagons’ share price target for 2030:

-

Dependence on Government Orders: A large portion of Jupiter Wagons’ revenue comes from Indian Railways and other public sector contracts. Any slowdown in government infrastructure spending or delays in tender allocations can severely affect growth prospects.

-

Cyclicality of the Railway Sector: The railway and freight wagon industry is cyclical in nature. Economic downturns or reduced cargo movement could lead to lower demand for wagons and rolling stock, impacting revenue and profitability.

-

Execution and Capacity Constraints: Rapid expansion or diversification (e.g., into electric mobility or defense) poses execution risks. Delays or inefficiencies in scaling up operations could hurt margins and investor confidence.

-

Raw Material Price Volatility: Rising costs of key inputs like steel and aluminum can squeeze margins if not offset by pricing power or operational efficiencies. Prolonged inflation in input costs can erode profitability.

-

Technological Disruption and Competition: Emergence of new technologies in rail logistics or increased competition from domestic and global players may pressure Jupiter Wagons to innovate and invest heavily, impacting margins and market share.

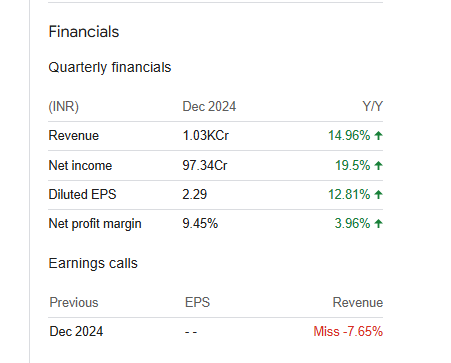

Jupiter Wagons Financials Statement

| (INR) | 2025 | Y/Y change |

| Revenue | 36.44B | 76.17% |

| Operating expense | 3.42B | 31.90% |

| Net income | 3.32B | 174.50% |

| Net profit margin | 9.10 | 55.82% |

| Earnings per share | 8.24 | — |

| EBITDA | 4.89B | 94.37% |

| Effective tax rate | 25.09% | — |

Read Also:- JBM Auto Share Price Target Tomorrow 2025 To 2030