Bansisons Tea Share Price Target Tomorrow 2025 To 2030

Bansisons Tea Industries Limited is a small-cap company based in Siliguri, West Bengal, engaged in the tea plantation and production business. Established in 1987, the company primarily focuses on leasing tea gardens for plucking green leaves and derives revenue from this activity. Despite its long-standing presence in the industry, Bansisons Tea has faced financial challenges, reporting a net loss of ₹0.16 crore in FY24 and showing a poor profit growth of -226.44% over the past three years. Bansisons Tea Share Price on NSE as of 29 May 2025 is 5.60 INR.

Bansisons Tea Share Market Overview

- Market Cap: ₹ 3.54 Cr.

- Current Price: ₹ 5.60

- High / Low: ₹ 8.90 / 3.80

- Book Value: ₹ 9.35

- Dividend Yield: 0.00 %

- ROCE: -2.66 %

- ROE: -2.66 %

- Face Value: ₹ 10.0

Bansisons Tea Share Price Chart

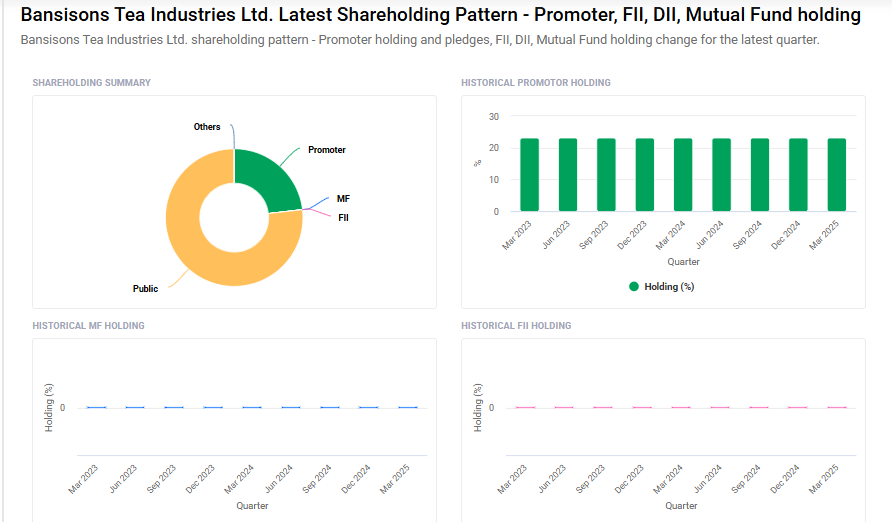

Bansisons Tea Shareholding Pattern

- Promoters: 23.2%

- FII: 0%

- DII: 0%

- Public: 76.9%

Bansisons Tea Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹10 |

| 2026 | ₹20 |

| 2027 | ₹30 |

| 2028 | ₹40 |

| 2029 | ₹50 |

| 2030 | ₹60 |

Bansisons Tea Share Price Target 2025

Bansisons Tea share price target 2025 Expected target could ₹10. Here are five key factors that could influence Bansisons Tea Industries Ltd (BANSTEA)’s share price target by 2025:

-

Volatile Financial Performance

Bansisons Tea has faced financial challenges, reporting a net loss of ₹0.16 crore in FY24 and showing a poor profit growth of -226.44% over the past three years. Such financial instability can impact investor confidence and share price. -

Low Promoter Holding

As of March 2025, the promoter holding in the company stands at 23.15%. A lower promoter stake may raise concerns about the promoters’ commitment to the company’s long-term growth, potentially affecting stock performance. -

Market Capitalization and Liquidity Constraints

With a market capitalization of ₹3.54 crore as of April 17, 2025, Bansisons Tea is a micro-cap stock. Such companies often face liquidity issues, making their stock prices more susceptible to volatility. -

Exposure to Climate Risks

Being in the tea industry, the company’s operations are vulnerable to climate conditions. Adverse weather patterns can affect tea production, impacting revenues and profitability. -

Regulatory and Policy Changes

Changes in government policies related to agriculture, exports, and environmental regulations can influence the company’s operations and profitability. Staying compliant and adapting to new regulations is crucial for sustained growth.

Bansisons Tea Share Price Target 2030

Bansisons Tea share price target 2030 Expected target could ₹60. Here are five key risks and challenges that could impact Bansisons Tea Industries Ltd’s (BANSTEA) share price target by 2030:

-

Climate Dependency and Agricultural Risks

As a tea producer, the company’s output and quality are highly dependent on weather conditions. Erratic rainfall, rising temperatures, or natural disasters can significantly disrupt cultivation and reduce yields, impacting revenue. -

Weak Financial Health

Bansisons Tea has shown negative profit growth and minimal returns over recent years. If the company continues to struggle with profitability, it may face difficulty attracting investors and sustaining long-term operations. -

Limited Market Presence and Brand Recognition

Compared to major tea brands in India, Bansisons Tea has low brand visibility and market share. Without aggressive marketing or expansion strategies, the company may find it challenging to grow in a highly competitive industry. -

Low Promoter Stake

With promoter holding at just around 23%, investor confidence may be affected. A low promoter stake can signal a lack of strong long-term commitment, raising concerns about strategic direction and governance. -

Regulatory and Export Policy Uncertainty

Government policies regarding agriculture, labor, and exports can change, especially as climate and trade policies evolve. Any unfavorable changes could increase operational costs or restrict access to international markets.

Read Also:- FSL Share Price Target Tomorrow 2025 To 2030