KEC International Share Price Target From 2025 to 2030

KEC International Share Price Target From 2025 to 2030: Investment in the stock market needs keen insight into the company fundamentals, technical signals, industrial growth, and vision for the long term. The KEC International Ltd. is a company that has never lost sight of the retail as well as institutional investors. It is a high-ranked infrastructure construction and engineering company with international presence.

Epic as it has been in its pioneering leadership in transmission of power, railways, civil, smart infrastructure, and cable, KEC International is one of India’s highest-rated businesses in the infrastructure growth epic. As India is only making stupendous investments into core infrastructure, electrification, and smart cities, companies like KEC are destined to perform phenomenally in the next five years.

This article provides detailed analysis of the recent performance of KEC International, share basics, technicals, and share price targets projections for the future time frame 2025-2030. It attempts to assist long-term investors as well as short-term speculators in making well-informed decisions.

Company Profile and Position in the Market

KEC International Ltd., as part of RPG Group, is operational across more than 100 nations and has established some iconic infrastructures across the globe. Its divisions are:

- Transmission & Distribution (T&D)

- Railways

- Civil Infrastructure (Industrial, Commercial, and Residential)

- Urban Infrastructure

- Oil & Gas pipelines

- Smart Infrastructure & Cables

KEC has decent execution strength, order book diversification, and decent promoter group behind it. As India prioritized infrastructure development as one of its key economic drivers, the future for the players in the EPC looks promising.

Recent Stock Performance Snapshot

Below is a snapshot of the recent market facts of KEC International:

- Open Price: ₹731.55

- Day High: ₹740.00

- Day Low: ₹682.00

- Market Capitalization: ₹18,380 Cr

- P/E Ratio (TTM): 40.49

- Industry P/E: 3.64

- Debt to Equity Ratio: 0.85

- Return on Capital Employed (ROCE): 8.34%

- Earnings per Share (EPS): ₹17.07

- Dividend Yield: 0.58%

- Book Value: ₹189.94

- 52-Week High: ₹1,313.25

- 52-Week Low: ₹648.60

The stock has fallen by 8.55% in the past one year, providing long-term investors with a chance to buy at lower levels.

Technical Analysis – Bullish or Bearish Stock?

Momentum Score:

- 25.9 → Technical weakness.

- Below 35 is bearish.

MACD (12, 26, 9):

- -6.0, signal -3.3 → Extremely bearish signal since MACD is below the signal line and mid line.

RSI (Relative Strength Index):

- 39.3 → Not oversold yet, but close to that zone.

ADX (Average Directional Index):

- 20.8 → Weak trend. Extremely strong trends tend to have an ADX of more than 25.

MFI (Money Flow Index):

- 81.4 → Shows the stock is overbought and can see short-term pullbacks.

ATR (Average True Range):

- 44.5 → Suggests high volatility.

ROC (Rate of Change):

- Day ROC (21): -1.3

- Day ROC (125): -33.2

It is an indicator of chronic weakness in medium- and long-term momentum. Still, investors having a one-year perspective can utilize such corrections as an entry opportunity.

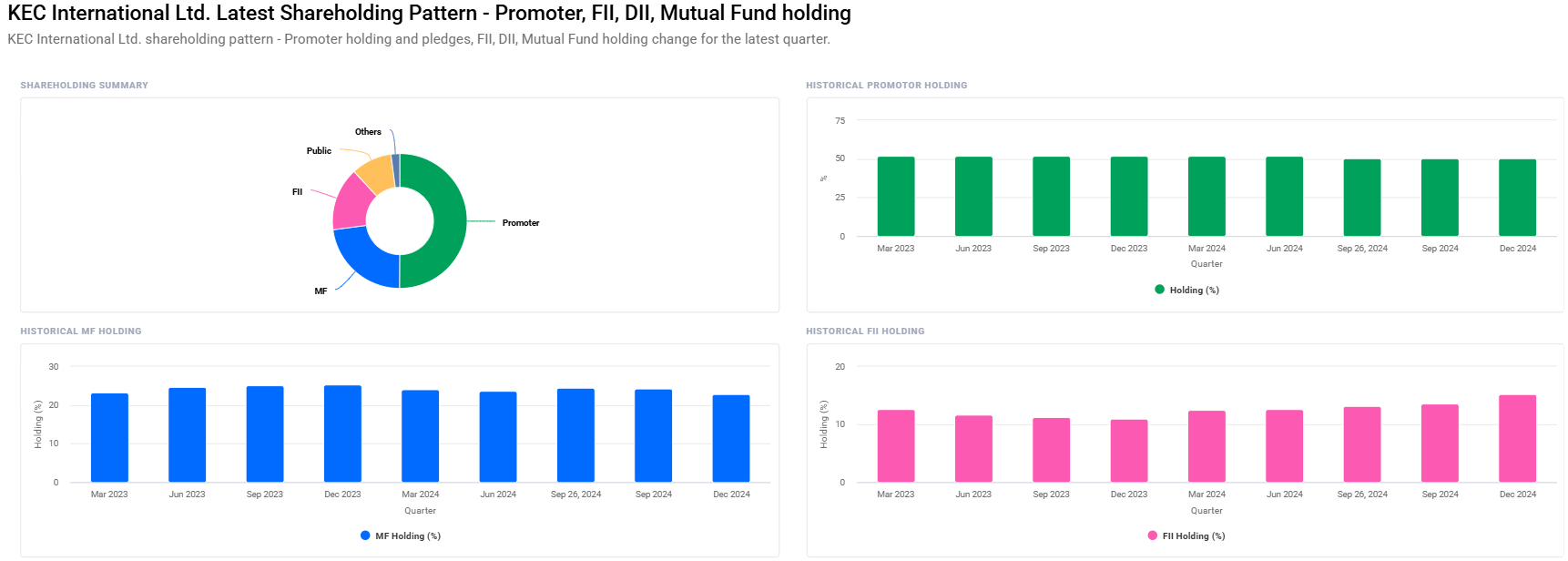

Ownership Pattern and Institutional Confidence

Shareholding (Dec Quarter Update):

- Promoters: 50.10% (Remained Stable)

- Mutual Funds: 22.84% (Dipped marginally)

- Foreign Institutional Investors (FII/FPI): Up from 13.60% to 15.20%

- Retail & Others: 9.79%

- Other Domestic Institutions: 2.06%

Institutional Action

- Number of FII/FPI investors rose from 278 to 299.

- Mutual fund schemes went up from 25 to 26.

- Institutional holding rose from 39.93% to 40.11%.

The above figures exhibit rising institutional confidence, more significantly of foreign investors, reflecting long-term optimism despite short-term price realignments.

KEC International Share Price Targets (2025-2030)

As the company has good fundamentals, sectoral winds, and technical positioning, here’s the price trend outlook:

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹1350 |

| 2026 | ₹2050 |

| 2027 | ₹2750 |

| 2028 | ₹3450 |

| 2029 | ₹4150 |

| 2030 | ₹4850 |

These are on conservative assumptions of growth and are macroeconomic trends, industry growth, and company performance.

Investment Strategy Depending on Risk Appetite

Short-Term Investors (1-2 Years)

- Risk: High

- Strategy: Wait for breakout above ₹750 to take reversal of trend. Short-term volatility may still dominate.

- Target: ₹1350

Medium-Term Investors (3-5 Years)

- Risk: Moderate

- Strategy: Invest on dips, especially at ₹650–₹700 levels.

- Target: ₹3450-₹4150

Long-Term Investors (5+ Years)

- Risk: Low

- Strategy: Buy and hold. Implement SIP (Systematic Investment Plan) strategy to reduce cost average.

- Target: ₹4850+

Risks and Challenges

Though the company’s future is bright, investors have to exercise caution regarding:

- Debt Levels: High debt to equity ratio of 0.85.

- Low ROCE: Poor industry ROCE of 8.34%, needs improvement.

- Global Slowdown: Any infra projects slowdown on account of macroeconomic stress can hurt revenues.

- Competitive Pressure: EPC space is competitive with numerous players fighting for orders.

FAQs – KEC International Share Price Analysis

Q1: Is KEC International a good long-term investment?

A: Yes, because of its dominance in the infrastructure sector, diversified business franchise, and increasing emphasis on India development, it is a good long-term investment.

Q2: Why was the share price of KEC International falling recently?

A: The stock is suffering from short-term technical weakness and sector headwinds. Additionally, high volatility and profit booking at the higher level are the reasons behind the correction.

Q3: What will be the growth drivers of KEC International in the future?

A: The growth drivers will be rising infrastructure spending, railway electrification, foreign orders, smart cities, and orders for renewable transmission.

Q4: What do investors need to know before investing?

A: Investors need to monitor order book visibility, leverage, operating margins, and technical breakout levels around ₹750–₹800.

Q5: Good time to buy KEC International stock?

A: For everyone who can hold on to wait in the longer term (till 2030), investment at present prices (~₹690) now is a good time to invest.

KEC International Ltd. is a good bet for investors believing that the story of India’s infrastructure growth will materialize. While the stock can be said to have lost steam in the short term, institutional investors such as FIIs are gaining confidence as reflected by increasing holdings by them.

Technically weak, otherwise, the stock is well placed with great promoter base, order book diversification, and exposure to some of the world’s and the nation’s most coveted infra opportunities. Being a long-term investor, this is the moment to accumulate shares and taste the fruit of value appreciation for the next half decade. This is a game of patience, and whoever sticks it out to 2030 will be handsomely rewarded.