Garware Hi-Tech Films Share Price Target From 2025 to 2030

Garware Hi-Tech Films Share Price Target From 2025 to 2030: Stock market investment is a mixture of intuition, time, and deep understanding of the underlying of a company, sentiment of the market, and growth channels. A firm that has been gaining the interest of retail and institutional investors alike is Garware Hi-Tech Films Ltd. With its cutting-edge polyester films and niche product lines, Garware Hi-Tech Films has a domain space which is favorable for manifold industries ranging from packaging and electronics to automobiles and agriculture.

With rising demand for high-performance films, innovation technology, and eco-friendly packaging solutions, Garware Hi-Tech Films will become more profitable in the long run. In this exhaustive analysis, we will employ the company’s recent financial statistics, recent share price trends, technical analysis, pattern of ownership, and project share price targets between 2025 and 2030.

Company Overview and Market Position

Garware Hi-Tech Films Ltd. is the market leader in the production of polyester films in India. The company has established its niche by developing high-quality, value-added polyester films to address the packaging, industrial, automotive, and sun control requirements.

Drivers for Growth:

- Multi-purpose application: Polyester films have extensive usage in FMCG, electronics, automotive, agricultural, and industrial packaging.

- Export Opportunity: Garware’s export business is on a growth path supported by quality approvals and long-term global relations.

- Innovation: Sustained R&D focus helps the company introduce new and value-added products.

- Low Debt: With debt-equity ratio of only 0.01, Garware is a high fiscal discipline company.

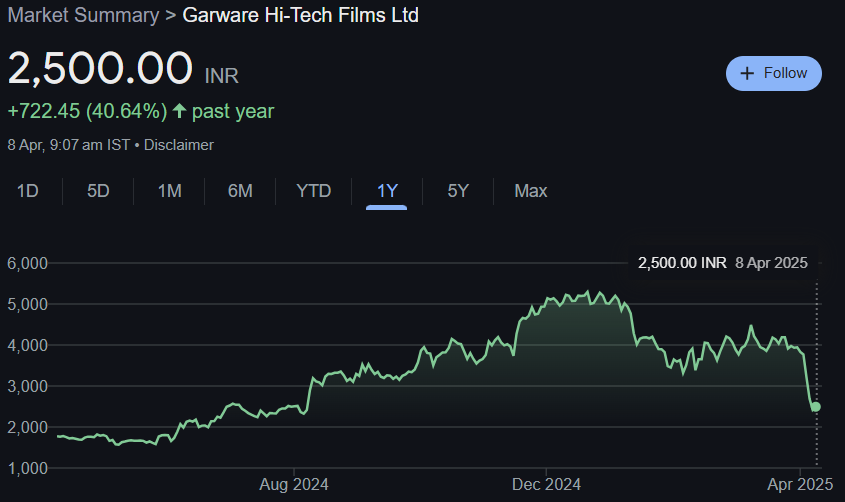

Recent Stock Performance

Performance of Garware Hi-Tech Films stock over recent one year has been oscillating but stable. With irregular oscillations, the company has exhibited promising long-term trend.

- Current Price: ₹2,500.00

- 52-Week High: ₹5,378.10

- 52-Week Low: ₹1,513.25

- Market Capitalization: ₹5,810 Cr

- P/E Ratio (TTM): 18.66

- Dividend Yield: 0.40%

- Book Value: ₹959.64

- EPS (TTM): ₹133.96

- P/B Ratio: 2.54

- ROE: 13.74%

The company has achieved a +40.64% one-year return, reflecting increased investor confidence in the growth and operational stability of the company.

Technical Analysis – Current Trend

Even though Garware Hi-Tech Films fundamentals are decent, short-term technical signals indicate a bearish situation:

- Momentum Score: 33.3 (Technically weak)

- RSI (14-Day): 21.9 (Oversold zone – likely bounce back)

- MFI (Money Flow Index): 26.9 (Oversold zone)

- MACD: -259.1 (Bearish, below signal and center line)

- ATR (Average True Range): 285.1 (High volatility)

- ADX: 19.3 (Strong trend)

- ROC (Rate of Change – 21 day): -41.5

All these indicators point towards the stock being in an oversold and technically weak position, and thus a good prospect for long-term investors who would like to buy on dips and accumulate.

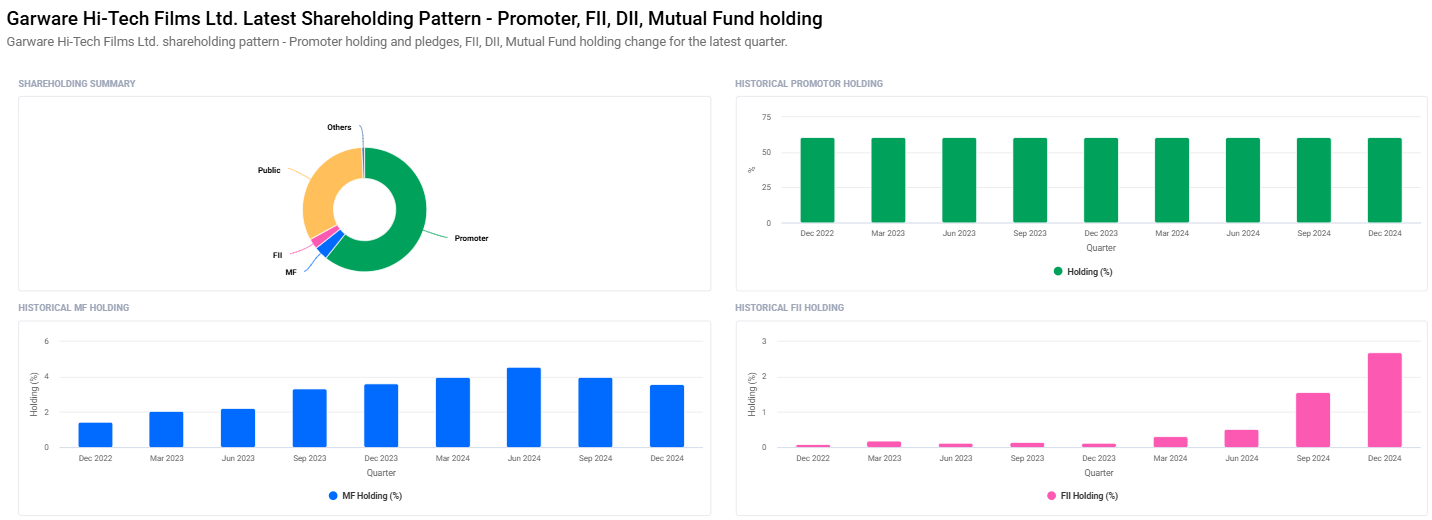

Ownership Structure and Institutional Sentiment

Ownership pattern of Garware Hi-Tech Films demonstrates stability and increasing institutional confidence:

- Promoters: 60.72%

- Retail and Others: 32.27%

- Mutual Funds: 3.59%

- Foreign Institutions (FII/FPI): 2.69%

- Other Domestic Institutions: 0.74%

Latest Changes (as of Dec 2024 quarter):

- FII/FPI holding rose from 1.56% to 2.69%.

- Mutual fund holding reduced marginally from 3.98% to 3.59%, whereas the number of MF schemes rose from 13 to 16.

- Institutional investor holding in total rose from 6.04% to 7.02%.

- Promoter holding remained stationary, reflecting rock-solid faith in the company.

All these numbers reflect increased institutional faith, especially of foreign investors-a good sign for the future of long-term players.

Garware Hi-Tech Films Share Price Target (2025 to 2030)

Based on both intrinsic pillars and industry tailwinds, and existing and upcoming drivers of growth, the following share price targets are approximated:

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹5500 |

| 2026 | ₹9500 |

| 2027 | ₹13500 |

| 2028 | ₹17500 |

| 2029 | ₹21500 |

| 2030 | ₹25500 |

These targets take into account steady performance, rising world demand, and steady macroeconomic environment.

Investment Strategy: Short-term vs Long-term

Short-Term Investors (1-2 years)

- Risk Level: High

- Advice: Avoid aggressive buying until RSI and MACD revert.

- Strategy: Wait for reversal above ₹2,700 to buy.

- Exit Target: ₹5,500 (by 2025)

Medium-Term Investors (3-5 years)

- Risk Level: Moderate

- Recommendation: Buy dips; anticipate cyclical price movement.

- Strategy: Gradually build position with 2027 target horizon.

- Exit Target: ₹13,000–₹17,500

Long-Term Investors (5+ years)

- Risk Level: Low

- Recommendation: Strong buy for long-term holders of market cycles.

- Strategy: Invest and hold; ride structural growth and export tailwinds.

- Exit Target: ₹25,500+ (by 2030)

Risks and Challenges

While the future looks bright, it is wise to watch out for the potential pitfalls:

- Raw Material Volatility: Petrol derivative prices can affect margins.

- Forex Fluctuations: Being an exporter, currency exchange rate fluctuations can affect profitability.

- Global Competition: The polyester film industry is global with players.

- Technological Disruption: A move towards biodegradable or alternative materials can affect demand.

Frequent Asked Questions (FAQs)

1. Is Garware Hi-Tech Films a safe long-term investment?

Yes, long-term investors receive solid fundamentals, rising global demand, and steady innovation from Garware. With near-zero debt and healthy promoter holding, the company has a sound financial base.

2. Why does the current RSI and MACD indicate bearish?

Short-term market sentiment technical indicators. RSI and MACD indicate that the stock is oversold and hence will correct in the near future.

3. What are the most important points for distinguishing Garware Hi-Tech Films from peers?

Garware is differentiated on the basis of its innovation-led product basket, strong export market base, and tradition of quality. It has high margin specialty films that distinguish it from commoditized peers.

4. What are the growth drivers in Garware?

Packaging, automotive, electronics, and solar segments are large consumers of polyester films, and all of them are going to increase at a high rate during the next two years.

5. Why is it a good thing for the investors to have a low debt-to-equity ratio?

The low debt-to-equity reflects financial strength and low cost of interest, such that the company will be in a position to invest heavily on growth and innovations.

6. Is institutional investment an indication that the stock has faith?

There is increase in holding by FIIs, mutual funds, and local institutions, which is a sign of increased confidence regarding the future of the stock.

7. What can influence the future performance of the stock?

Geopolitical considerations, raw material prices, exchange rate fluctuations, or global demand for polyester films can affect the financials of the company.

Final Verdict – Should You Invest in Garware Hi-Tech Films?

Garware Hi-Tech Films Ltd. is a good long-term investment opportunity for those wanting to reap India’s growth in industry and exports. With sound finances, state-of-the-art products, zero debt, and increasing institutional interest, the stock can deliver humongous returns by 2030.