Gennex Laboratories Share Price Target Tomorrow 2025 To 2030

Gennex Laboratories Limited is an Indian pharmaceutical company specializing in the production of Active Pharmaceutical Ingredients (APIs). Established in 1995 and headquartered in Hyderabad, the company operates a manufacturing facility in IDA Bollaram, Telangana. Gennex offers a diverse product portfolio that includes expectorants, muscle relaxants, analgesics, and antifungal agents, catering to both domestic and international markets. Gennex Laboratories Share Price on BOM as of 16 April 2025 is 13.35 INR.

Gennex Laboratories Share Market Overview

- Open: 13.39

- High: 13.49

- Low: 13.30

- Previous Close: 13.25

- Volume: 251,532

- Value (Lacs): 33.58

- VWAP: 13.40

- UC Limit: 0.00

- LC Limit: 0.00

- 52 Week High: 29.00

- 52 Week Low: 11.41

- Mkt Cap (Rs. Cr.): 303

- Face Value: 1

Gennex Laboratories Share Price Chart

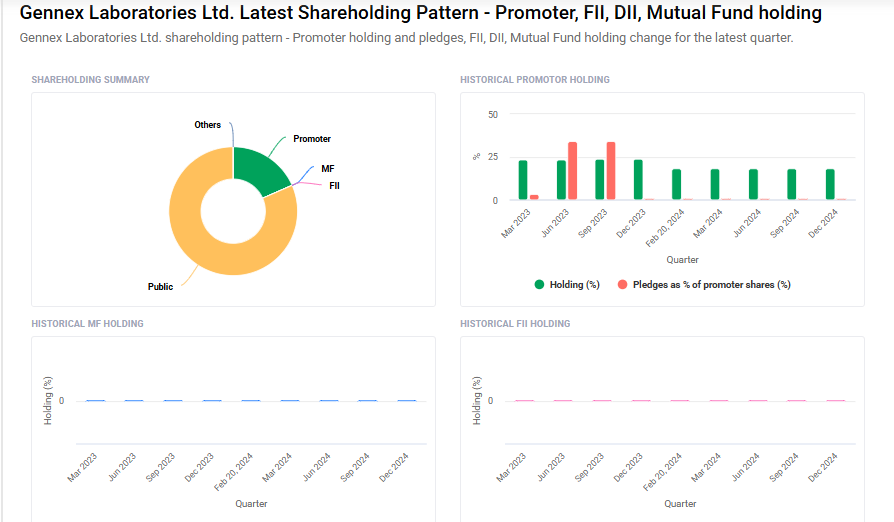

Gennex Laboratories Shareholding Pattern

- Promoters: 18.4%

- FII: 0%

- DII: 0%

- Public: 81.6%

Gennex Laboratories Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹30

- 2026 – ₹35

- 2027 – ₹40

- 2028 – ₹45

- 2030 – ₹50

Major Factors Affecting Gennex Laboratories Share Price

Here are six key factors that influence the share price of Gennex Laboratories Ltd:

1. Strong Revenue and Profit Growth

Gennex Laboratories has shown impressive financial performance, with revenues increasing by 32.18% and earnings per share (EPS) rising by 42.86% year-over-year. Such robust growth often boosts investor confidence and can positively impact the stock price.

2. Debt-Free Status and Healthy Margins

The company operates without any debt, which is a positive sign for financial stability. Additionally, it maintains a strong pre-tax margin of 19%, indicating efficient operations and profitability.

3. Low Promoter Holding

Promoters hold only 18.4% of the company’s shares, which is relatively low. A lower promoter holding can sometimes raise concerns about the promoters’ commitment to the company’s long-term growth.

4. Stock Valuation Concerns

Some analyses suggest that Gennex Laboratories’ stock may be overvalued by approximately 28% compared to its intrinsic value. Overvaluation can lead to stock price corrections if market expectations are not met.

5. Technical Indicators and Market Sentiment

The stock is currently trading below key moving averages, indicating a bearish trend. Technical indicators like these can influence investor sentiment and short-term stock performance.

6. Operational Efficiency Challenges

Despite revenue growth, the company’s return on equity (ROE) stands at 9.09%, which is considered low. This suggests that the company may not be utilizing its equity base efficiently to generate profits.

Risks and Challenges for Gennex Laboratories Share Price

Here are six key risks and challenges that could influence the share price of Gennex Laboratories Ltd:

1. Overvaluation Concerns

Analysts have noted that Gennex Laboratories’ stock may be overvalued by approximately 28% compared to its intrinsic value. Such overvaluation can lead to stock price corrections if market expectations are not met.

2. Low Return on Equity (ROE)

Despite revenue growth, the company’s return on equity (ROE) stands at 9.09%, which is considered low. This suggests that the company may not be utilizing its equity base efficiently to generate profits.

3. Stock Price Volatility

Gennex Laboratories’ stock has experienced significant volatility, reaching a new 52-week low and underperforming its sector. The stock has seen consecutive losses over three days and a substantial decline over the past year, highlighting challenges within the microcap pharmaceuticals segment amid contrasting market trends.

4. Management Efficiency Challenges

The company has faced challenges in management efficiency, which can impact its operational performance and long-term growth prospects. Such issues may raise concerns among investors regarding the company’s ability to sustain its growth trajectory.

5. Market Performance Under Pressure

Gennex Laboratories has underperformed compared to the broader market. The stock has dropped 9.19% over the past three days and 30.34% over the past year, significantly lagging behind the broader market index, the Sensex.

6. Competitive Industry Landscape

Operating in the highly competitive pharmaceutical industry, Gennex Laboratories faces challenges from larger and more established players. This competitive pressure can impact the company’s market share and profitability.

Read Also:- Novo Nordisk Stock Price Prediction Tomorrow 2025 To 2030