KIOCL Share Price Target Tomorrow 2025 To 2030

KIOCL Limited, formerly known as Kudremukh Iron Ore Company Limited, is a central public sector enterprise under the Ministry of Steel, Government of India. Established in 1976, the company specializes in iron ore mining, beneficiation, and the production of high-quality iron oxide pellets and pig iron. Headquartered in Bengaluru, KIOCL operates a 3.5 million tonnes per annum pellet plant and a blast furnace unit in Mangaluru, Karnataka. KIOCL Share Price on NSE as of 18 April 2025 is 245.00 INR.

KIOCL Share Market Overview

- Open: 244.25

- High: 248.80

- Low: 241.27

- Previous Close: 245.36

- Volume: 60,284

- Value (Lacs): 148.14

- VWAP: 245.18

- UC Limit: 294.43

- LC Limit: 196.28

- 52 Week High: 511.70

- 52 Week Low: 209.84

- Mkt Cap (Rs. Cr.): 14,934

- Face Value: 10

KIOCL Share Price Chart

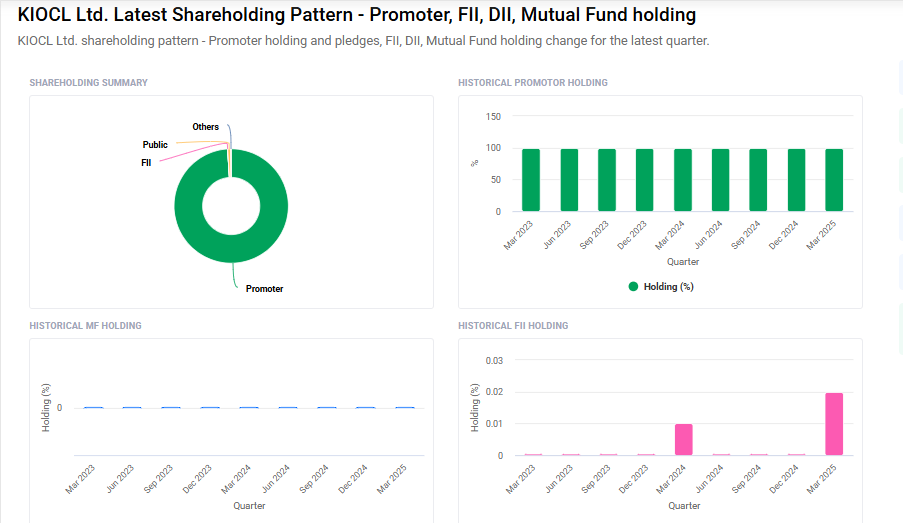

KIOCL Shareholding Pattern

- Promoters: 99%

- FII: 0%

- DII: 0.1%

- Public: 0.9%

KIOCL Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹515

- 2026 – ₹750

- 2027 – ₹935

- 2028 – ₹1046

- 2030 – ₹1350

Major Factors Affecting KIOCL Share Price

-

Iron Ore Prices in the Global Market

KIOCL is mainly involved in the production and export of iron ore pellets. So, changes in global iron ore prices have a direct impact on its earnings. If prices rise, the company earns more, which can boost the share price. But when prices fall, revenues can drop, leading to a dip in the stock’s value. -

Export Demand and Global Trade

A big part of KIOCL’s business depends on exports. If demand for iron ore pellets increases in countries like China or the Middle East, the company benefits. However, if global trade slows down or importers reduce orders, it can negatively affect the company’s income and share performance. -

Government Policies and Mining Approvals

Since KIOCL is a public sector company, its operations are closely tied to government policies and clearances. Delays in mining permissions, changes in environmental laws, or restrictions on mining can slow down production and impact the stock price. -

Company’s Financial Results

Quarterly earnings, revenue growth, profit margins, and debt levels all influence investor confidence. Strong financial results usually attract more investors, pushing the price up. On the other hand, poor results or increasing expenses can hurt the share price. -

Steel Industry Trends

KIOCL’s products are mainly used in steelmaking. So, if the steel industry is booming, demand for iron ore pellets increases. This helps the company grow and positively impacts the stock. But if steel production slows down, demand for pellets may also fall, affecting revenue and share price. -

Foreign Exchange Rates

Since KIOCL earns a good part of its revenue from exports, changes in the value of the Indian rupee compared to foreign currencies (like the US dollar) can affect earnings. A weaker rupee means higher income from exports, while a stronger rupee can reduce the value of overseas earnings.

Risks and Challenges for KIOCL Share Price

-

Volatility in Iron Ore Prices

The price of iron ore in the global market is unpredictable and often influenced by international demand, supply chain issues, and economic conditions. A sudden drop in iron ore prices can reduce KIOCL’s revenue, which may lead to a fall in its share price as investor confidence weakens. -

Delays in Mining Approvals

As a mining and pellet manufacturing company, KIOCL depends heavily on timely approvals and environmental clearances from the government. Any delays or rejections in getting mining leases or renewals can slow down production, leading to lower income and negatively affecting the share price. -

Overdependence on Export Market

A large portion of KIOCL’s earnings comes from exports. This means that any disruption in global trade, such as shipping issues, import restrictions, or lower demand from key countries, can have a big impact on its business. This poses a risk to steady revenue and stock stability. -

Foreign Exchange Risk

Since KIOCL earns much of its revenue in foreign currency, fluctuations in the value of the Indian rupee can impact profits. If the rupee strengthens too much against the dollar or other currencies, the company’s earnings from exports may shrink, affecting its financial results and share price. -

Operational and Maintenance Challenges

Running pellet plants and mining operations involves high maintenance and operating costs. If the company faces equipment issues, labor shortages, or rising costs without a matching increase in prices, it could hurt profit margins and put pressure on the stock value. -

Dependence on Steel Sector Performance

KIOCL’s iron ore pellets are mainly used in the steel industry. If the steel sector faces a slowdown due to weak construction or infrastructure activity, demand for pellets may reduce. This can directly affect KIOCL’s sales and bring down the share price.

Read Also:- Dolphin Offshore Share Price Target Tomorrow 2025 To 2030