Cipla Share Price Target Tomorrow 2025 To 2030

Cipla Limited is a prominent Indian multinational pharmaceutical company headquartered in Mumbai. Founded in 1935 by Dr. Khwaja Abdul Hamied, Cipla has been committed to making healthcare accessible and affordable. The company offers a wide range of medications across various therapeutic areas, including respiratory, cardiovascular, diabetes, and infectious diseases. Cipla is renowned for its role in providing cost-effective generic medicines, particularly for HIV/AIDS treatment, significantly impacting global health by improving access to essential drugs in developing countries. Cipla Share Price on NSE as of 18 April 2025 is 1,514.10 INR.

Cipla Share Market Overview

- Open: 1,498.00

- High: 1,522.00

- Low: 1,486.00

- Previous Close: 1,496.40

- Volume: 1,211,601

- Value (Lacs): 18,358.18

- VWAP: 1,511.98

- UC Limit: 1,646.00

- LC Limit: 1,346.80

- 52 Week High: 1,702.05

- 52 Week Low: 1,317.25

- Mkt Cap (Rs. Cr.): 122,370

- Face Value: 2

Cipla Share Price Chart

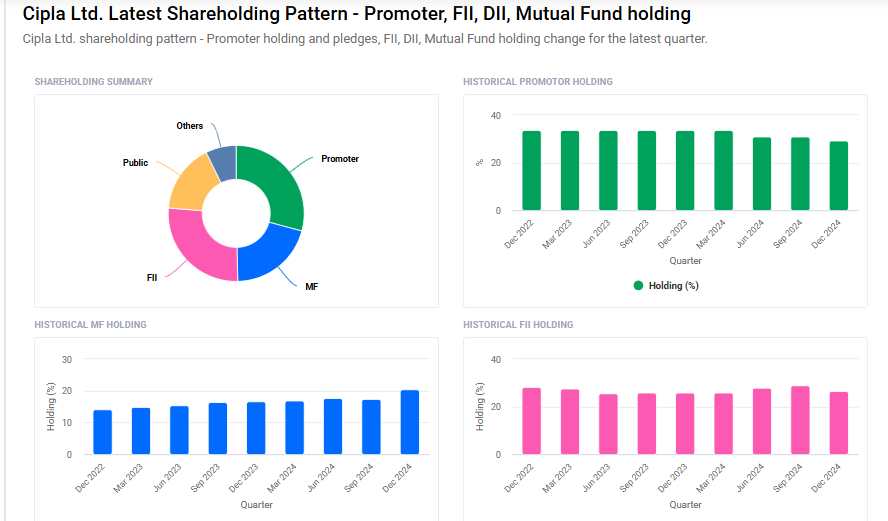

Cipla Shareholding Pattern

- Promoters: 29.2%

- FII: 26.7%

- DII: 27.7%

- Public: 16.4%

Cipla Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹1705

- 2026 – ₹1950

- 2027 – ₹2145

- 2028 – ₹2360

- 2030 – ₹2600

Major Factors Affecting Cipla Share Price

-

Financial Performance and Earnings Growth

Cipla’s share price is significantly influenced by its financial health. For instance, in a recent quarter, the company reported a 49% increase in net profit, driven by strong domestic demand, even though U.S. sales saw a slight decline. Such robust earnings can boost investor confidence and positively impact the stock price. -

Regulatory Approvals and Product Launches

Timely approvals from regulatory bodies like the U.S. FDA are crucial for Cipla. Delays in launching key drugs, such as Abraxane, can postpone revenue generation and affect investor sentiment, potentially leading to stock price fluctuations. -

Global Trade Policies and Tariffs

Changes in international trade policies, especially tariffs imposed by major markets like the U.S., can impact Cipla’s exports. For example, announcements of potential high tariffs on pharmaceutical imports have previously led to declines in Indian pharma stocks, including Cipla. -

Market Valuation Metrics

Cipla’s valuation ratios, such as the Price-to-Earnings (P/E) ratio, play a role in investor decisions. Currently, Cipla’s P/E ratio is around 25, which is lower than the industry average of 35, suggesting the stock may be undervalued compared to its peers. -

Domestic and International Market Demand

The demand for Cipla’s products in both domestic and international markets affects its revenue. Strong demand in India has helped offset weaker sales in North America, showcasing the importance of a diversified market presence. -

Research and Development Initiatives

Cipla’s investment in R&D, especially in developing treatments for prevalent conditions like obesity and diabetes, can open new revenue streams. For instance, the company’s efforts to develop versions of popular weight-loss drugs indicate a strategic move to tap into growing markets.

Risks and Challenges for Cipla Share Price

-

Regulatory and Compliance Issues

Cipla, like other pharmaceutical companies, operates in a heavily regulated industry. Any warning letters, bans, or delays in approvals from regulatory bodies like the U.S. FDA or other international health authorities can seriously impact the company’s reputation and cause a drop in its share price. -

Dependence on Key Markets

Cipla earns a significant portion of its revenue from markets like the U.S. and South Africa. If sales decline in these regions due to policy changes, pricing pressure, or competition, the company’s earnings could take a hit, which may reflect negatively in the share price. -

Intense Competition in the Pharma Sector

The generic drug market is highly competitive, both in India and abroad. With many players offering similar products, Cipla may face pricing pressure. Lower prices can affect profit margins and make it harder for the company to maintain strong financial performance, thereby affecting the stock. -

Currency Exchange Fluctuations

Since Cipla operates internationally, it earns in foreign currencies. Any sharp movements in exchange rates—especially a weakening of foreign currencies against the Indian rupee—can reduce the value of international earnings, which may worry investors and impact the share price. -

Delays in Product Launches

Timely product launches are important for staying ahead in the market. If Cipla faces delays in launching new drugs due to research setbacks or lack of approvals, it may lose market share or revenue opportunities, which can negatively influence investor sentiment. -

Legal and Patent Challenges

Sometimes, Cipla and its competitors face legal challenges regarding drug patents. If the company is forced to stop selling a particular medicine due to a patent dispute, it may lose out on expected revenue. These legal uncertainties can make the share price more volatile.

Read Also:- Nova Agritech Share Price Target Tomorrow 2025 To 2030