Adani Power Share Price Target Tomorrow 2025 To 2030

Adani Power Limited, established in 1996 and headquartered in Ahmedabad, Gujarat, is India’s largest private thermal power producer. With an installed capacity of 17,510 MW across 11 power plants in states like Gujarat, Maharashtra, Karnataka, Rajasthan, Chhattisgarh, Madhya Pradesh, Jharkhand, and Tamil Nadu, the company plays a significant role in meeting the nation’s energy needs. Additionally, Adani Power operates a 40 MW solar power plant in Gujarat, reflecting its initial steps towards renewable energy. Adani Power Share Price on NSE as of 26 April 2025 is 549.00 INR.

Adani Power Share Market Overview

- Open: 576.95

- High: 585.55

- Low: 544.25

- Previous Close: 575.85

- Volume: 7,765,708

- Value (Lacs): 42,660.92

- VWAP: 561.65

- UC Limit: 691.00

- LC Limit: 460.70

- 52 Week High: 895.85

- 52 Week Low: 432.00

- Mkt Cap (Rs. Cr.): 211,880

- Face Value: 10

Adani Power Share Price Chart

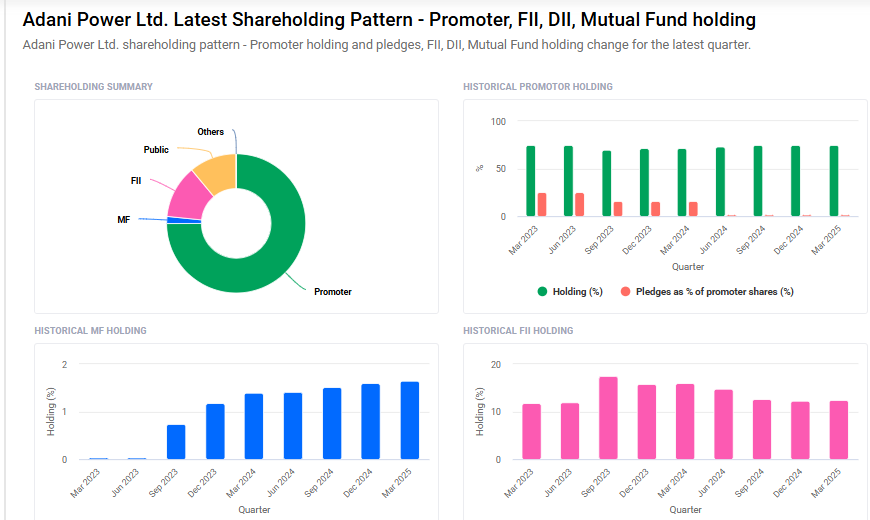

Adani Power Shareholding Pattern

- Promoters: 75%

- FII: 12.4%

- DII: 1.6%

- Public: 11%

Adani Power Share Price Target Tomorrow 2025 To 2030

| Adani Power Share Price Target Years | Adani Power Share Price |

| 2025 | ₹900 |

| 2026 | ₹950 |

| 2027 | ₹1000 |

| 2028 | ₹1050 |

| 2029 | ₹1100 |

| 2030 | ₹1150 |

Adani Power Share Price Target 2025

Here are 4 key factors that could influence the growth of Adani Power’s share price by 2025:

1. Rising Power Demand in India

India’s fast-growing economy and increasing electrification in rural areas are driving up the demand for electricity. Adani Power, being one of the largest private thermal power producers in India, is in a strong position to benefit from this rising energy need, which could help boost its revenues and share value.

2. Expansion of Generation Capacity

Adani Power is expanding its generation capacity by acquiring new plants and modernizing existing ones. These strategic moves can increase the company’s production and efficiency, potentially leading to higher earnings and a positive impact on the stock price.

3. Favorable Government Policies

Government initiatives to support the power sector, including reforms in distribution and long-term power purchase agreements (PPAs), could create a stable business environment. Adani Power stands to benefit from such policies, improving investor confidence.

4. Debt Management and Financial Performance

The company has been working to manage its debt and improve cash flows. A strong balance sheet, along with improved quarterly results, may encourage more investment in the stock and support growth in the share price by 2025.

Adani Power Share Price Target 2030

Here are four risks and challenges that could affect Adani Power’s share price by 2030:

1. Legal and Governance Concerns

Adani Group has faced serious legal issues, including U.S. indictments alleging bribery and fraud related to solar energy contracts. These allegations have raised concerns about the company’s corporate governance practices. Such legal challenges can lead to increased scrutiny from investors and regulators, potentially impacting the company’s reputation and stock performance.

2. Dependence on Coal and Environmental Regulations

Adani Power’s operations are heavily reliant on coal, a fossil fuel subject to stringent environmental regulations. As global and domestic policies increasingly favor renewable energy sources to combat climate change, coal-based power generation may face higher compliance costs and operational restrictions. This shift could affect Adani Power’s profitability and long-term viability.

3. Market Volatility and Investor Sentiment

The company’s stock has experienced significant volatility, partly due to broader concerns about the Adani Group’s financial practices. For instance, the group lost approximately $27 billion in market value following U.S. legal actions. Such fluctuations can erode investor confidence and lead to unpredictable stock performance.

4. Execution Risks in Expansion Plans

Adani Power aims to nearly double its capacity from 17.6 GW to 30.7 GW by 2030. While ambitious, this expansion involves significant capital expenditure and operational challenges. Delays, cost overruns, or logistical issues in these projects could strain the company’s resources and affect its financial health.

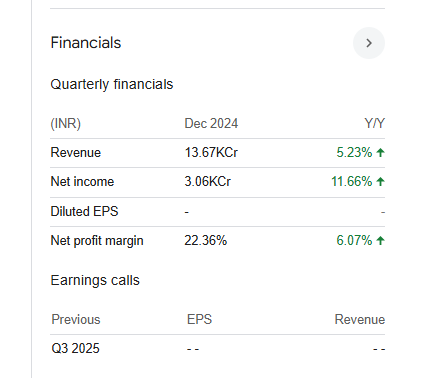

Adani Power Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 136.71B | 5.23% |

| Operating expense | 21.69B | 32.96% |

| Net income | 30.57B | 11.66% |

| Net profit margin | 22.36 | 6.07% |

| Earnings per share | — | — |

| EBITDA | 48.26B | 8.17% |

| Effective tax rate | 27.56% | — |

Read Also:- ITDCEM Share Price Target Tomorrow 2025 To 2030