Adani Wilmar Share Price Target Tomorrow 2025 To 2030

Adani Wilmar, now known as AWL Agri Business, is one of India’s leading food and FMCG companies. It was started as a partnership between the Adani Group and Wilmar International and became popular for its edible oil brand “Fortune,” which is used in millions of Indian homes. Over time, the company has grown to offer other food products like rice, wheat flour, sugar, and ready-to-cook items. Recently, it has also entered the value-added food segment to serve changing consumer needs. Adani Wilmar Share Price on NSE as of 28 May 2025 is 267.70 INR.

Adani Wilmar Share Market Overview

- Open: 261.45

- High: 276.25

- Low: 257.20

- Previous Close: 258.75

- Volume: 6,702,440

- Value (Lacs): 17,935.73

- 52 Week High: 403.95

- 52 Week Low: 231.55

- Mkt Cap (Rs. Cr.): 34,779

- Face Value: 1

Adani Wilmar Share Price Chart

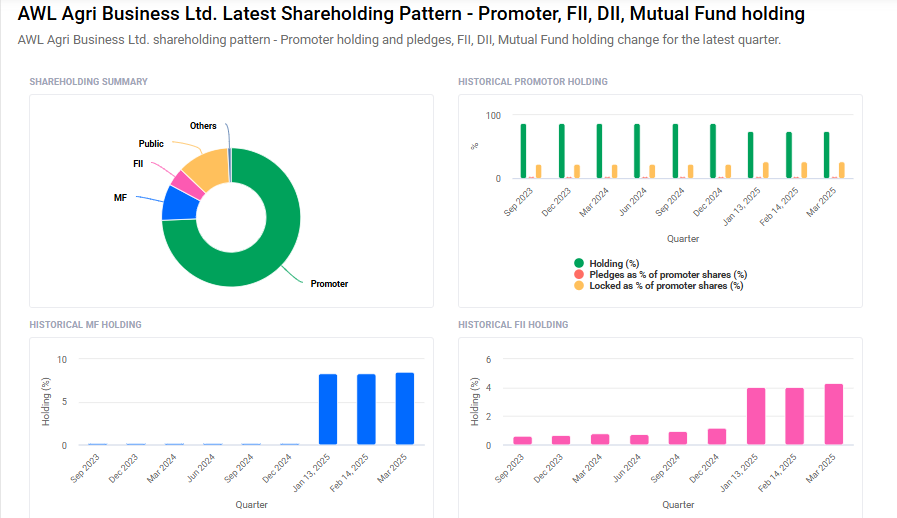

Adani Wilmar Shareholding Pattern

- Promoters: 74.4%

- FII: 4.3%

- DII: 8.9%

- Public: 12.1%

- Others: 0.4%

Adani Wilmar Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹410 |

| 2026 | ₹480 |

| 2027 | ₹550 |

| 2028 | ₹618 |

| 2029 | ₹685 |

| 2030 | ₹742 |

Adani Wilmar Share Price Target 2025

Adani Wilmar share price target 2025 Expected target could ₹410. Here are five key factors that could influence Adani Wilmar’s (now AWL Agri Business) share price target by 2025:

-

Robust Growth in Edible Oils Segment

AWL’s edible oils division, contributing over 80% of its revenue, experienced a significant 45% surge in demand, particularly for sunflower and mustard oils. This strong performance underscores the company’s dominant position in the essential cooking oil market, bolstering its revenue and profitability. -

Expansion into Value-Added Food Products

The acquisition of GD Foods, known for the ‘Tops’ brand of sauces and condiments, aligns with AWL’s strategy to diversify into high-margin, value-added food segments. This move is expected to enhance product offerings and contribute positively to the company’s financial growth. -

Increased Urban Consumption and Digital Channels

AWL anticipates a 10% sales growth driven by rising urban consumption, facilitated by income tax reductions and the proliferation of quick grocery delivery platforms like Blinkit and Zepto. The company’s focus on premium products and bundled offers through these digital channels is poised to capture a larger market share. -

Strategic Rebranding and Operational Focus

Following Adani Group’s exit, AWL’s rebranding to AWL Agri Business signifies a renewed focus on its core competencies in the agri-food sector. This strategic shift is expected to streamline operations and strengthen the company’s market position. -

Positive Analyst Outlook and Market Sentiment

Analysts have expressed optimism about AWL’s future performance, with Nuvama assigning a ‘Buy’ rating and a target price of ₹424, indicating a potential upside of 57% from current levels. This positive sentiment reflects confidence in the company’s growth trajectory.

Adani Wilmar Share Price Target 2030

Adani Wilmar share price target 2030 Expected target could ₹742. Here are 5 key risks and challenges that could impact Adani Wilmar’s (now AWL Agri Business) share price target by 2030:

-

Volatility in Raw Material Prices

Adani Wilmar heavily depends on imports of edible oils like palm, soybean, and sunflower oils. Any sharp fluctuation in global commodity prices or supply chain disruptions can impact input costs and profit margins, especially in a price-sensitive market like India. -

Regulatory and Policy Risks

Changes in government policies regarding import duties, price controls, or agricultural subsidies can directly affect the company’s cost structure and competitive edge. For instance, caps on edible oil prices or changes in packaging regulations can limit profitability. -

Intense Market Competition

The Indian FMCG and edible oil sectors are highly competitive, with both domestic players (like Patanjali, Marico) and multinational brands. Adani Wilmar needs constant innovation and marketing efforts to maintain and grow its market share, which could strain resources. -

Brand Perception and Group-Related Risks

Though Adani Wilmar has rebranded to AWL Agri Business, past affiliations with the Adani Group might still influence investor sentiment, especially if broader group companies face scrutiny or controversies that spill over into AWL’s reputation. -

Climate and Environmental Factors

As an agri-based business, AWL is exposed to risks like poor monsoons, crop failures, and climate change. Such environmental challenges can impact raw material availability, pricing, and overall supply chain efficiency.

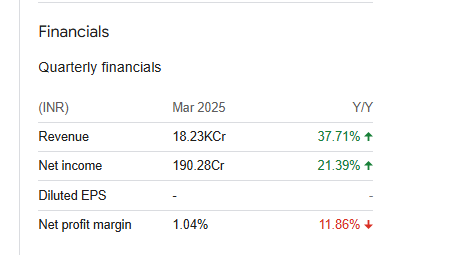

Adani Wilmar Financials Statement

| (INR) | 2025 | Y/Y change |

| Revenue | 636.72B | 24.21% |

| Operating expense | 54.48B | 6.17% |

| Net income | 12.25B | 727.81% |

| Net profit margin | 1.92 | 562.07% |

| Earnings per share | 9.44 | 570.41% |

| EBITDA | 24.81B | 127.75% |

| Effective tax rate | 26.30% | — |

Read Also:- Happiest Minds Share Price Target Tomorrow 2025 To 2030