Broadcom Share Price Target Tomorrow 2025 To 2030

Broadcom Inc. is a global technology company known for making advanced semiconductor and software products. Based in the United States, Broadcom designs chips that help power devices like smartphones, data centers, and networking systems. It also offers software solutions for security, storage, and cloud computing. The company plays a big role in the fast-growing fields of artificial intelligence and 5G technology. Broadcom Share Price on NSE as of 17 May 2025 is 228.61 USD.

Broadcom Share Market Overview

- Open: 231.03

- Previous Close: 232.32

- High: 234.46

- Low: 226.39

- Dividend Yield: 1.02

- P/E ratio: 110.24

- 52 Week High: 1,847.71

- 52 Week Low: 130.29

- Mkt. Cap ($ Billion): 1,071.53

Broadcom Share Price Chart

Broadcom Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | USD 260 |

| 2026 | USD 340 |

| 2027 | USD 420 |

| 2028 | USD 500 |

| 2029 | USD 580 |

| 2030 | USD 660 |

Broadcom Share Price Target 2025

Broadcom share price target 2025 Expected target could USD 260. Here are five key factors influencing Broadcom Inc.’s (AVGO) share price outlook for 2025:

1. Artificial Intelligence (AI) Revenue Growth

Broadcom’s AI-related revenue surged to $12.2 billion in fiscal year 2024, marking a 220% year-over-year increase. This growth is driven by strong demand for Broadcom’s custom AI accelerators and Ethernet products, positioning the company as a significant player in the AI hardware market.

2. Strong Financial Performance

In its latest earnings report, Broadcom reported a 45% increase in adjusted earnings and a 25% rise in sales. The company also announced a $10 billion stock buyback plan, reflecting confidence in its semiconductor and infrastructure software offerings.

3. Strategic Acquisitions and Integration

Broadcom completed its $69 billion acquisition of VMware in November 2023, expanding its presence in the enterprise software market. The successful integration of VMware’s virtualization and cloud computing services is expected to enhance Broadcom’s product portfolio and revenue streams.

4. Analyst Ratings and Price Targets

Analysts have given Broadcom a consensus rating of “Buy,” with price targets ranging from $200 to $300. This optimistic outlook is based on Broadcom’s strong position in the AI sector and its robust financial performance.

5. Market Trends and Investor Sentiment

Broadcom’s stock has experienced significant gains, rising over 10% amid a broader surge in the chip designer industry. The company’s shares have been consolidating since December following a 24% spike driven by strong earnings. This positive momentum reflects strong institutional interest and investor confidence in Broadcom’s growth prospects.

Broadcom Share Price Target 2030

Broadcom share price target 2030 Expected target could USD 660. Here are five key risks and challenges that could impact Broadcom Inc.’s (AVGO) share price trajectory through 2030:

1. Geopolitical and Tariff Risks

Broadcom’s global supply chain exposes it to geopolitical tensions, particularly between major economies like the U.S. and China. Newly imposed tariffs could affect Broadcom’s global supply chain and increase manufacturing costs.

2. Integration Challenges from Acquisitions

Broadcom’s aggressive acquisition strategy, including the $69 billion VMware deal, introduces execution risk as it integrates new businesses. Successfully merging operations, cultures, and systems is complex and could lead to unforeseen costs or disruptions.

3. Intensifying Competition in AI and Semiconductors

The AI chip market is highly competitive, with players like Nvidia, AMD, and emerging startups vying for dominance. Broadcom faces intense competition in both semiconductor and software markets, which could pressure its market share and margins.

4. Regulatory and Antitrust Scrutiny

As Broadcom expands its footprint in both hardware and software sectors, it may attract increased regulatory attention. Unpredictable tech regulations and antitrust rulings could pose challenges to its growth strategies.

5. Valuation Concerns Amid Market Volatility

Broadcom’s stock has experienced significant gains, but valuation concerns persist. The company’s stock is trading near its historical highs, and any broader slowdown in tech spending could impact growth rates in the near term.

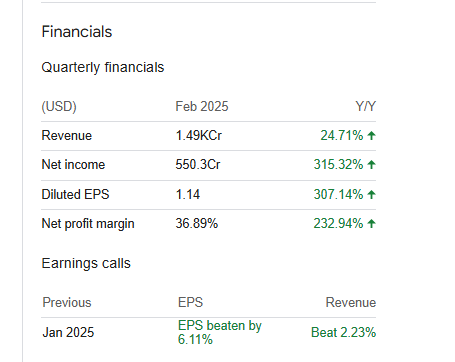

Broadcom Financials Statement

| (USD) | 2024 | Y/Y change |

| Revenue | 51.57B | 43.99% |

| Operating expense | 23.28B | 130.67% |

| Net income | 5.90B | -58.14% |

| Net profit margin | 11.43 | -70.92% |

| Earnings per share | 4.87 | 15.27% |

| EBITDA | 25.36B | 25.55% |

| Effective tax rate | 37.80% | — |

Read Also:- Rajnandini Metal Share Price Target Tomorrow 2025 To 2030