Coal India Share Price Target Tomorrow 2025 To 2030

Coal India Limited is one of the largest coal-producing companies in the world and plays a very important role in meeting India’s energy needs. It supplies coal mainly to power plants, helping the country generate electricity for homes, industries, and businesses. As a government-owned company, Coal India benefits from strong support and has a wide network of mines across India. Coal India Share Price on NSE as of 28 April 2025 is 392.65 INR.

Coal India Share Market Overview

- Open: 400.30

- High: 404.00

- Low: 389.65

- Previous Close: 399.85

- Volume: 7,337,588

- Value (Lacs): 28,847.73

- 52 Week High: 543.55

- 52 Week Low: 226.85

- Mkt Cap (Rs. Cr.): 242,287

- Face Value: 10

Coal India Share Price Chart

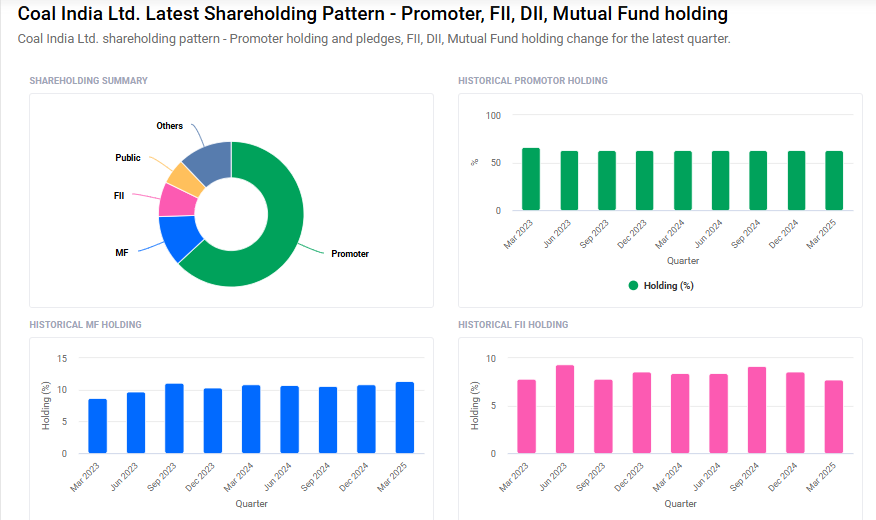

Coal India Shareholding Pattern

- Promoters: 63.1%

- FII: 7.7%

- DII: 23.5%

- Public: 5.7%

Coal India Share Price Target Tomorrow 2025 To 2030

| Coal India Share Price Target Years | Coal India Share Price |

| 2025 | ₹550 |

| 2026 | ₹600 |

| 2027 | ₹650 |

| 2028 | ₹700 |

| 2029 | ₹750 |

| 2030 | ₹800 |

Coal India Share Price Target 2025

Here are 4 key factors that could influence the growth of Coal India’s share price by 2025:

1. Growing Energy Demand in India

India’s energy demand is steadily rising with the country’s growing economy, industrialization, and urbanization. Coal remains a major source of energy, and as the largest coal producer in India, Coal India stands to benefit from this increasing need, supporting its future revenue growth.

2. Government Support for Domestic Coal Production

The Indian government continues to push for higher domestic coal production to reduce reliance on imports. Coal India, being a government-owned company, is a key player in this plan. More production targets and policy support could drive Coal India’s performance and positively impact its share price.

3. Improved Efficiency and Modernization Efforts

Coal India is working on improving its mining efficiency by introducing better technologies and automation. These efforts can help lower production costs, increase output, and improve profit margins, all of which are favorable for its stock growth.

4. Strong Dividend Payouts

Coal India is known for offering attractive dividend payouts to shareholders. Stable or increasing dividends make the stock more appealing to long-term investors, helping maintain positive sentiment around Coal India’s shares.

Coal India Share Price Target 2030

Here are 4 risks and challenges that could impact Coal India’s share price target by 2030

1. Shift Toward Renewable Energy

As the world moves toward cleaner energy sources like solar and wind, the demand for coal could slowly decline. If India also speeds up its clean energy plans, Coal India might face reduced demand, which could hurt its long-term growth and share price.

2. Environmental Regulations and Policies

Stricter environmental laws to control pollution and carbon emissions could increase Coal India’s operating costs. New taxes, penalties, or mining restrictions could reduce profitability and create challenges for the company’s future.

3. Labour and Operational Challenges

Coal India often faces labor strikes, safety issues, and mining delays, which can affect production levels. These operational problems can impact revenues and create uncertainty around the company’s performance over the long term.

4. Fluctuations in Global Coal Prices

Even though Coal India mainly serves the domestic market, global coal price volatility can influence pricing trends in India too. If prices fall or become unstable, Coal India’s earnings could be affected, leading to pressure on its share price.

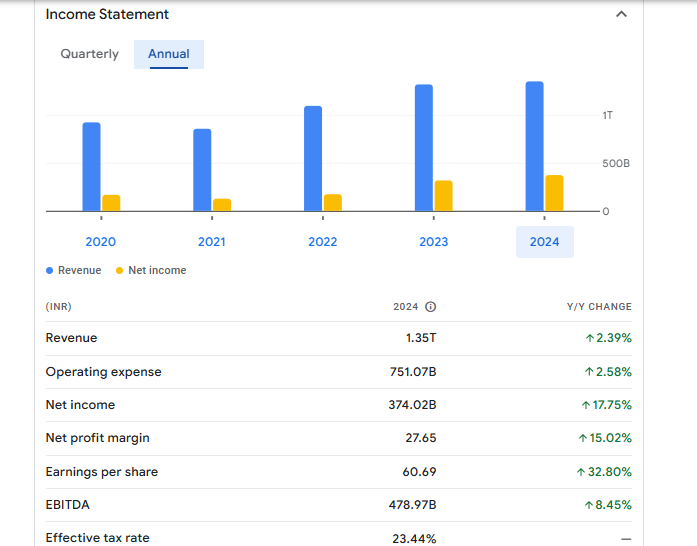

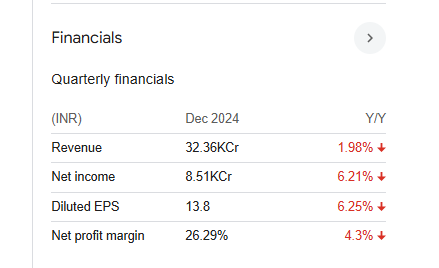

Coal India Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 1.35T | 2.39% |

| Operating expense | 751.07B | 2.58% |

| Net income | 374.02B | 17.75% |

| Net profit margin | 27.65 | 15.02% |

| Earnings per share | 60.69 | 32.80% |

| EBITDA | 478.97B | 8.45% |

| Effective tax rate | 23.44% | — |

Read Also:- South Indian Bank Share Price Target Tomorrow 2025 To 2030