Coffee Day Share Price Target Tomorrow 2025 To 2030

Coffee Day Enterprises Limited is an Indian company known for its popular coffee chain, Café Coffee Day (CCD). Founded in 1996 by V.G. Siddhartha, the first CCD outlet opened in Bengaluru, Karnataka. The company operates a vertically integrated coffee business, managing activities from procuring and processing coffee beans to retailing coffee products through various formats. Its operations include café outlets, vending machines, and coffee retail stores across India and internationally. Coffee Day Share Price on NSE as of 8 May 2025 is 30.74 INR.

Coffee Day Share Market Overview

- Open: 30.84

- High: 30.84

- Low: 30.84

- Previous Close: 31.46

- Volume: 3,967

- Value (Lacs): 1.22

- VWAP: 30.84

- 52 Week High: 62.35

- 52 Week Low: 21.38

- Mkt Cap (Rs. Cr.): 651

- Face Value: 10

Coffee Day Share Price Chart

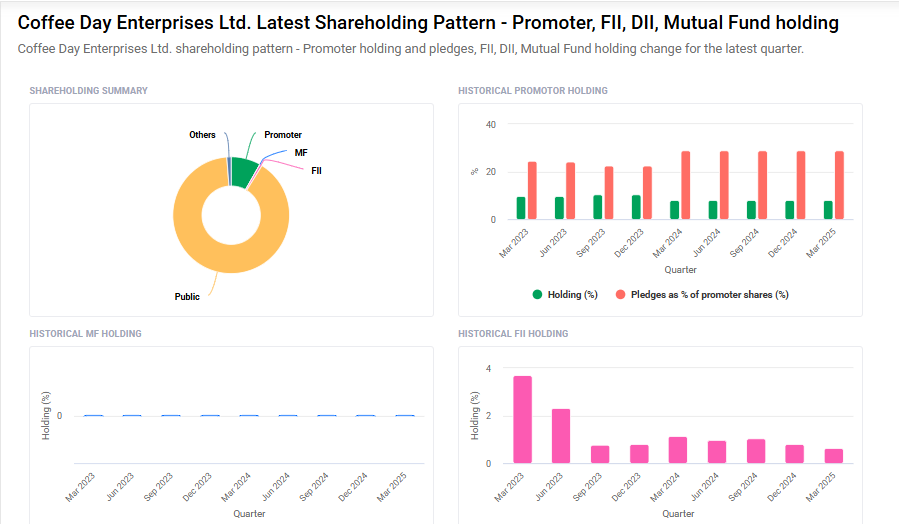

Coffee Day Shareholding Pattern

- Promoters: 8.2%

- FII: 0.6%

- DII: 1.2%

- Public: 90%

Coffee Day Share Price Target Tomorrow 2025 To 2030

| Coffee Day Share Price Target Years | Coffee Day Share Price |

| 2025 | ₹65 |

| 2026 | ₹80 |

| 2027 | ₹100 |

| 2028 | ₹120 |

| 2029 | ₹140 |

| 2030 | ₹160 |

Coffee Day Share Price Target 2025

Coffee Day share price target 2025 Expected target could ₹65. Here are four key factors that could influence Coffee Day Enterprises’ share price target by 2025:

1. Debt Restructuring and Liquidity Challenges

As of March 2025, Coffee Day Enterprises reported a total default of ₹425.38 crore on loan repayments, attributing the delay to a liquidity crisis. Lenders have issued loan recall notices and initiated legal actions. The company’s ability to manage and restructure its debt obligations will be crucial for restoring investor confidence and stabilizing its share price.

2. Operational Adjustments and Store Optimization

In the third quarter of FY2024-25, the company reduced its store count by 3% as part of efforts to manage debt and streamline operations. While this move aims to improve financial health, it may impact revenue generation in the short term. Effective operational adjustments will be essential for sustainable growth.

3. Market Valuation and Investor Sentiment

Despite financial challenges, some analyses suggest that Coffee Day Enterprises is trading at a significant discount compared to its estimated intrinsic value. For instance, as of May 2025, the stock was considered undervalued by approximately 66%, indicating potential for price appreciation if the company can address its financial issues.

4. Industry Trends and Coffee Consumption

The specialty coffee shop market is projected to grow significantly, with an estimated increase of USD 50.8 billion by 2025. This positive industry trend could benefit Coffee Day Enterprises if the company leverages emerging opportunities and adapts to changing consumer preferences.

Coffee Day Share Price Target 2030

Coffee Day share price target 2030 Expected target could ₹160. Here are four key risks and challenges that could influence Coffee Day Enterprises’ share price target by 2030:

1. Persistent Financial Strain and Debt Obligations

As of March 2025, Coffee Day Enterprises reported a total default of ₹425.38 crore on loan repayments, citing a liquidity crisis. Despite efforts to reduce its debt burden, the company still carried a total debt of ₹12.73 billion at the end of Q3 FY25. Such financial challenges may continue to impact investor confidence and limit the company’s ability to invest in growth opportunities.

2. Operational Challenges and Store Optimization

In an effort to manage costs amid financial difficulties, Coffee Day Enterprises reduced its store count from 454 to 439 in Q3 FY25. While this move aims to streamline operations, it may also affect the company’s market presence and revenue generation capabilities, posing a challenge to long-term growth.

3. Regulatory and Legal Uncertainties

The company faced insolvency proceedings initiated by IDBI Trusteeship Services Ltd in August 2024. Although the National Company Law Appellate Tribunal (NCLAT) set aside these proceedings in February 2025, the episode highlights potential legal and regulatory risks that could arise in the future, affecting the company’s stability and investor sentiment.

4. Market Competition and Changing Consumer Preferences

The coffee retail industry is highly competitive, with numerous players vying for market share. Additionally, evolving consumer preferences towards specialty coffees and premium experiences require continuous innovation and adaptation. Failure to keep pace with these trends may result in loss of market relevance and impact the company’s growth prospects by 2030.

Coffee Day Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 10.23B | 10.52% |

| Operating expense | 5.39B | -43.41% |

| Net income | -3.23B | 15.09% |

| Net profit margin | -31.52 | 23.18% |

| Earnings per share | — | — |

| EBITDA | 1.33B | 146.28% |

| Effective tax rate | 16.67% | — |

Read Also:- SA Tech Software Share Price Target Tomorrow 2025 To 2030