CreditAccess Grameen Share Price Target From 2025 to 2030

CreditAccess Grameen Share Price Target From 2025 to 2030: To invest in the Indian market, it is required to have a clear understanding of the firm’s fundamentals, technicals, and macroeconomic factors behind its growth. One of such stocks which have garnered the attention of institutional as well as retail investors in recent days is CreditAccess Grameen Ltd., one of India’s leading microfinance institutions (MFI). Dedicated to serving the economically underpenetrated rural Indian population, CreditAccess Grameen has continued to grow and has established a solid foundation on which to capitalize on India’s rural development program.

In this article, we’ll explore CreditAccess Grameen Ltd. in detail – its financial performance, recent stock trends, technical indicators, promoter and institutional holdings, and share price target predictions from 2025 to 2030. We’ll also address some frequently asked questions at the end to help investors make an informed decision.

Company Overview

CreditAccess Grameen Ltd. is among India’s largest non-banking financial companies (NBFCs) engaged in the microfinance business. The company has the objective of providing small-ticket loans to women from poor families settled in rural and semi-urban areas with the intention of extending financial inclusion at a deeper level. Customer-centric in its business model with wide reach in rural India, the company remains robust even in the most adverse economic environment.

Key Drivers of Growth:

- Rural economy development and government initiatives targeting women entrepreneurs and self-help groups.

- Regular loan repayment rates in microfinance operations.

- Geographic diversification across a number of Indian states.

- Strong ESG and social impact orientation appealing to socially responsible investors.

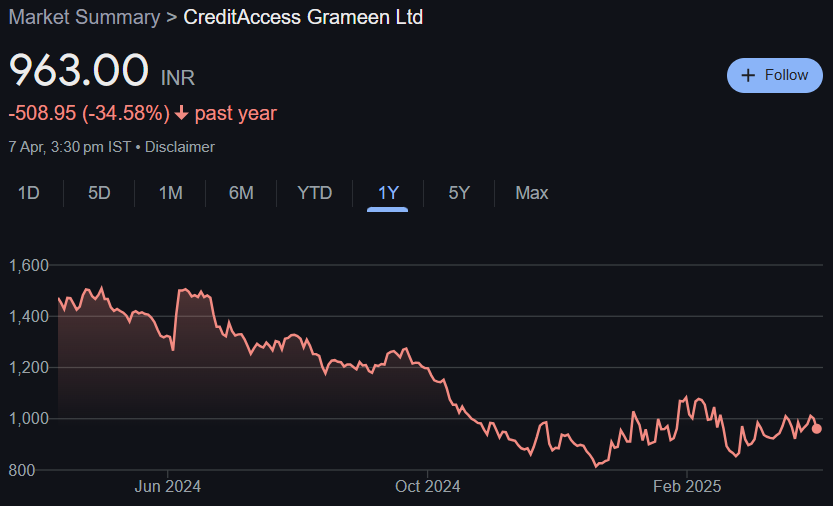

Recent Stock Performance

Below is a snapshot of recent performance numbers for CreditAccess Grameen:

- Current Price: ₹963.00

- Open: ₹930.00

- High: ₹964.00

- Low: ₹920.00

- Previous Close: ₹958.00

- Volume: 6,15,970 shares

- Total Traded Value: ₹58.89 Cr

- Market Cap: ₹15,280 Cr

- P/E Ratio (TTM): 17.34

- EPS (TTM): ₹55.18

- Book Value: ₹437.58

- Dividend Yield: 1.04%

- 52-Week High: ₹1,551.95

- 52-Week Low: ₹750.20

- Day Momentum Score: 48.5 (Technically Neutral)

The stock has fallen by approximately 34.58% in the last year mainly because of market correction and profit booking after the 52-week high. Nevertheless, most investors see this fall as a good entry point due to the company’s strong fundamentals.

Fundamental Strength

CreditAccess Grameen leads the NBFC pack with the following financial and operational parameters:

- Debt to Equity Ratio: 2.74 – Reflects the company using debt efficiently but not over-leveraging.

- Return on Capital (ROC): 19.09% – Satisfactory ROC reflecting efficient use of capital.

- Industry P/E: 2.19 – The stock’s P/E is higher than the industry, reflecting faith in its future earnings.

- Dividend Policy: The company has started paying dividends to shareholders with a dividend yield of 1.04%.

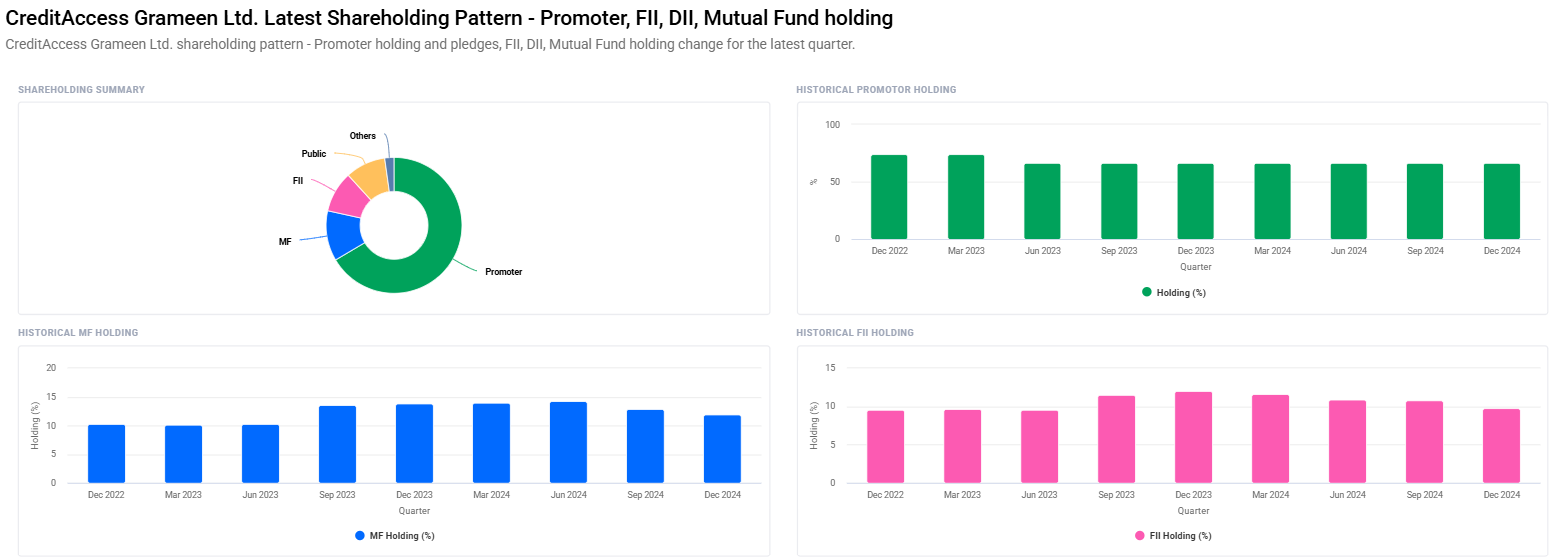

Shareholding Pattern

The promoter holding pattern as of the December 2024 quarter is as under:

- Promoters: 66.50% (marginal decline from 66.54%)

- Mutual Funds: 11.95% (declined from 12.84%)

- Foreign Institutions (FII/FPI): 9.76% (declined from 10.76%)

- Retail and Others: 9.57%

- Other Domestic Institutions: 2.23%

Although there has been a marginal decline in institutional holdings, mutual fund schemes have increased from 22 to 23, indicating selective institutional optimism.

Technical Analysis – Momentum Indicators

For technical indicator enthusiasts, this is the stock’s current status:

- MACD (12,26,9): 8.7 (Above center and signal line – Bullish)

- MACD Signal: 5.6 (Positive crossover – Buy signal)

- ADX: 22.0 (Weak trend, neither strongly bullish nor bearish)

- RSI (14): 49.1 (Neutral zone – neither oversold nor overbought)

- ROC (21): 3.9 (Positive, indicating small bullish momentum)

Interpretation: The stock is consolidating. Although there is no clear trend, the MACD and ROC are reflecting early signs of bullishity, i.e., accumulation might be going on.

CreditAccess Grameen Share Price Target (2025 to 2030)

We will split the projected share price targets year-wise on technical and fundamental parameters:

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹1600 |

| 2026 | ₹2400 |

| 2027 | ₹3200 |

| 2028 | ₹4000 |

| 2029 | ₹4800 |

| 2030 | ₹5600 |

Investment Strategy by Investor Type

Short-Term Traders (1-2 Years)

- Risk Level: High

- Recommendation: Wait for a breakout above ₹1,000–₹1,050 level. Hedge with stop-losses.

- Target: ₹1,600 by 2025

Medium-Term Investors (3-5 Years)

- Risk Level: Moderate

- Recommendation: Buy on dips, especially below ₹950. Keep a close watch on quarterly performance and rural loan growth figures.

- Target: ₹3,200-₹4,000 by 2027-2028

Long-Term Investors (5+ Years)

- Risk Level: Low to Moderate

- Recommendation: Best option for SIP strategy. Fingers crossed for multi-bagger returns in case India’s rural economy remains on a high-growth path.

- Target: ₹5,600 by 2030

Risks and Concerns

Despite healthy fundamentals, the following are some concerns that investors should look out for:

- Regulatory Risk: Microfinance firms and NBFCs are tightly regulated by the RBI. Changes in policies can impact margins and lending standards.

- Asset Quality Concerns: Non-performing asset (NPA) risk in rural lending cannot be entirely eliminated, especially in the case of monsoon failures or economic downturns.

- Macroeconomic Trends: Rising interest rates and inflation can soften the rural clients’ capacity to borrow and repay.

- Declining Institutional Holdings: A small drop in FII and MF holding may suggest short-term problems.

Verdict: Invest in CreditAccess Grameen?

CreditAccess Grameen Ltd. is a fundamentally strong company in a high-growth sector that aligns with India’s vision of financial inclusion. Even though there has been a recent correction in the stock price, it is a good long-term gamble because:

- Sustained revenue expansion

- Healthy loan recovery channels

- Strong promoter backing

- Diversified fund source

The share price will bounce back and can deliver handsome returns by 2030, especially for long-term investors.

FAQs – CreditAccess Grameen Share Price Target

Q1. Is CreditAccess Grameen a good stock to buy today?

Yes, the price level of around ₹960 is an attractive entry point for long-term investors, especially since the stock has corrected from 52-week high.

Q2. What will be the estimated CreditAccess Grameen share price in 2025?

The stock would move towards ₹1,600 in 2025 with the resumption of rural credit demand and better profitability.

Q3. Will the share of CreditAccess Grameen touch ₹5,000 by 2030?

Yes, if the growth story of the company remains unchanged and the business is augmented further, there are possibilities that the share price could touch ₹5,600 by 2030.

Q4. Why did the stock drop by over 34% during the previous year?

The decline must have been primarily because of profit booking, macroeconomic movements, and declining FII holding. These are, however, short-term issues.

Q5. What are the biggest risks of investing in CreditAccess Grameen?

Regulatory challenges, rural default rates on loans, and changing institutional sentiment are top risks.

Q6. What is the long-term potential for CreditAccess Grameen?

Positive. Strong fundamentals, social mission focus, and rural Indian economic development position the company for long-term appreciation.