Deep Industries Share Price Target From 2025 to 2030

Deep Industries Share Price Target From 2025 to 2030: Investment in the share market is not just following the price action now—it’s a question of what the company will do in the future, the fundamentals, the technicals, the industry position, and the possibilities. One such fairly new stock that has been gaining investor attention more and more is Deep Industries Ltd., which is among India’s leading companies engaged in the oil and gas infrastructure services business.

With more national emphasis on energy self-reliance, rising domestic consumption of natural gas, and efforts by the government for indigenous exploration of energy resources, Deep Industries stands to gain significantly over the next ten years. Below is a comprehensive analysis of Deep Industries Ltd., covering stock performance, fundamentals, technicals, and share price forecasts from 2025 to 2030.

Company Overview: Deep Industries Ltd.

Deep Industries Ltd. provides turnkey project management to the oil and gas sector. The company provides natural gas compression services, work-over rigs, drilling rigs, and gas dehydration systems. Stable top-line growth, diversified business, and growing presence in India’s energy space make it a credible investment opportunity.

Key Highlights:

- Low Debt: 0.12 debt-to-equity ratio indicating good financial health.

- Strong Promoter Holding: 63.49% promoter holding, which remained unchanged in the previous quarter.

- Industry P/E vs Company P/E: Deep Industries’ P/E is 19.79, which is far higher than the industry P/E of 7.05, reflecting investors’ confidence in the company.

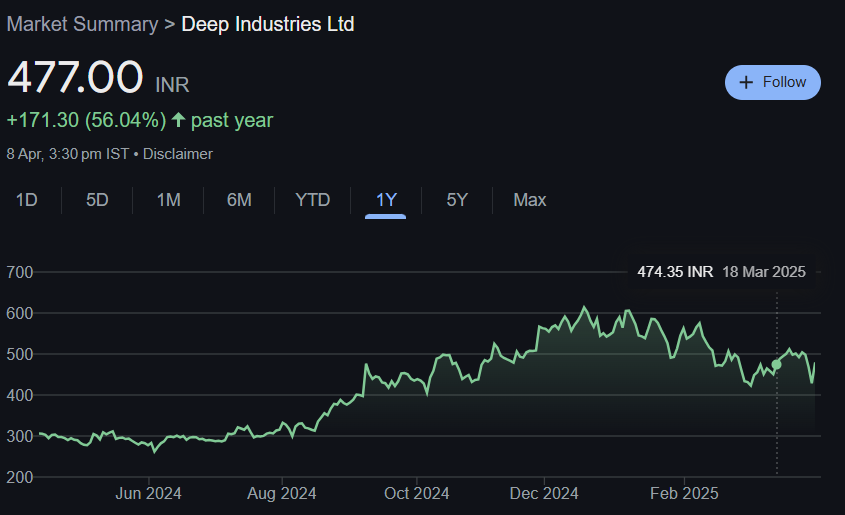

Recent Stock Market Performance and Key Facts

The following is the recent stock market performance of Deep Industries:

- Open Price: (₹440.80 & ₹468.90 on different trading dates)

- Day High: (₹498.25)

- Day Low: (₹440.80)

- 52-Week High: (₹624.40)

- 52-Week Low: (₹243.00)

- Market Cap: (₹3,062 Cr)

- P/E Ratio (TTM): 19.73

- EPS (TTM): ₹24.25

- Dividend Yield: 0.51%

- Book Value: ₹234.96

- Volume: 29,383

- Total Traded Value: ₹1.38 Cr

Market Sentiment: The stock has faced some selling pressure recently but still has solid retail and domestic institution buying support. FIIs have lowered holding modestly, whereas foreign investor numbers are greater.

Technical Analysis – Short-Term Neutral, Long-Term Optimistic

Momentum Indicators:

- Momentum Score: 40.2 – Technically neutral.

- RSI (14): 49 – Evenly balanced, not overbought or oversold.

- MACD (12, 26, 9): -3.6 (below signal line) – Bearish signal.

- ROC (21-day): 5.0 – Positive upmove.

- MFI: 72 – Overbought zone, pullback possible.

- ADX: 16.2 – Shows weak trend.

Conclusion: Deep Industries is not strong upmove today, but positive ROC and relative strength show heavy trading by investors in the stock. Since it has very high MFI, even short-run retracement can be possible, hence good entry is given to long-run investors.

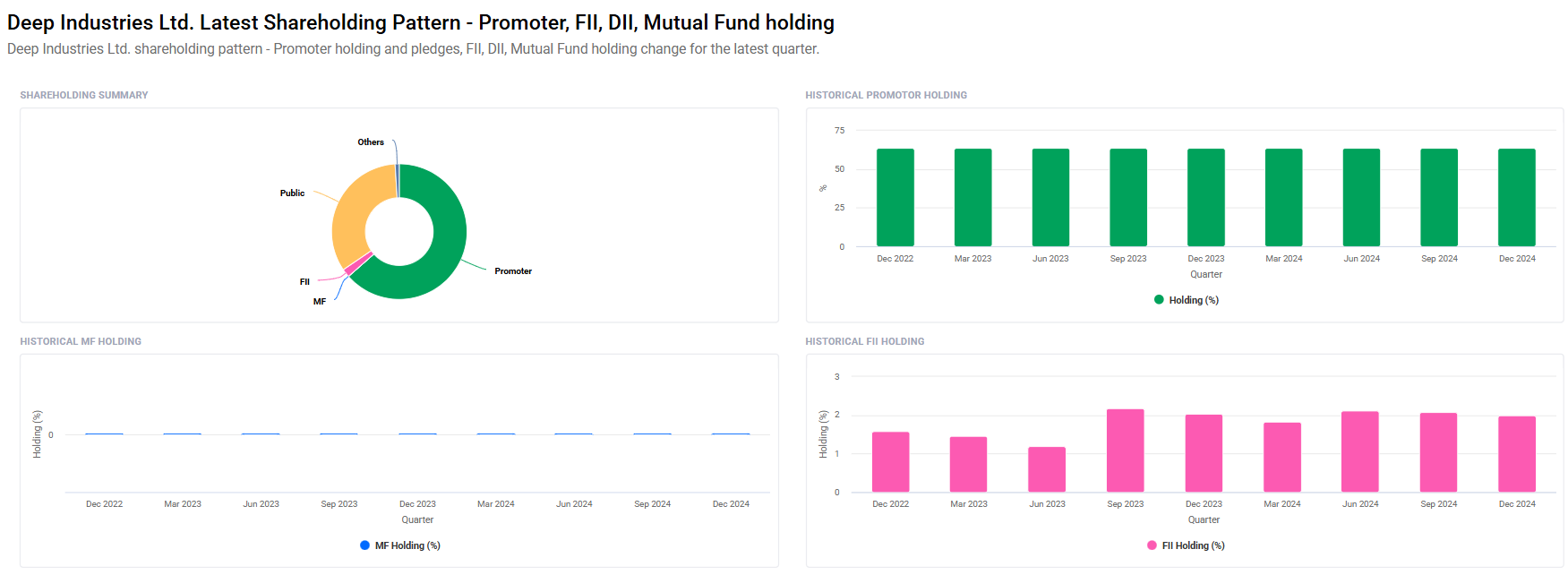

Ownership Structure: Promoter Stability, Institutional Confidence

Stakeholders Holdings

- Promoters: 63.49% (Stable)

- Retail & Others: 33.49%

- FIIs: 1.99% (Down from 2.08%)

- Domestic Institutions: 1.03% (Better than previous quarter)

While there was a marginal decline in FII holding, institutional investors are coming back, which is a sign of growing confidence in the long-term potential of the stock.

Fundamentals Strengths

- Low Debt: Excellent financial prudence with a debt-equity of 0.12.

- High Book Value: ₹234.96 per share, which is a cushion against downside.

- Dividend Policy: Despite 0.51% low dividend yield, periodic payouts reflect stability and profitability.

Share Price Target 2025 to 2030 of Deep Industries

Based on historical performance, industry growth, and technical analysis, following are the share price targets of Deep Industries Ltd.

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹650 |

| 2026 | ₹1050 |

| 2027 | ₹1450 |

| 2028 | ₹1850 |

| 2029 | ₹2250 |

| 2030 | ₹2650 |

These can differ depending on the global energy industry trends, government policies, and the companies’ implementation.

Investment Strategy Based on Investor Type

1. Short-Term Investors (1-2 Years)

- Risk Level: High

- Entry Point: Search for pullbacks around ₹450

- Exit Target: ₹650+

Note: Monitor daily technicals as well as volume trends.

2. Medium-Term Investors (3-5 Years)

- Risk Level: Moderate

- Entry Strategy: Build on dips

- Exit Target: ₹1,450 – ₹1,850

- Reasoning: Anticipating stable earnings and project growth.

3. Long-Term Investors (5+ Years)

- Risk Level: Low

- Strategy: SIP-type investment to weather long-term energy demand

- Exit Target: ₹2,650 or higher

- Upside Potential: Enormous, depending on success of strategy plans.

Risks and Challenges

Even if fundamentals are sound, investors would be well advised to watch out for the following risks

- Commodity Price Volatility: As an oil & gas firm, Deep Industries is exposed to foreign natural gas prices and foreign crude.

- Policy Changes: Policy change in environment or energy has bearing on operations.

- Capital-Intensive Nature: Expansion as well as maintenance of equipment involve heavy capital expenditure.

- Market Sentiment: FIIs unwinding has impact on short-term share price.

Final Verdict: Is Deep Industries Ltd. a Good Investment

Deep Industries Ltd. is a healthy long-term story with good fundamentals, stable promoter group, and rising institutional support. While short-term technicals are indicating consolidation, overall industry trends, i.e., India’s search for energy security, are in the company’s favor.

Long-term investors seeking value in the mid-cap energy sector can look to build Deep Industries Ltd., particularly on dips. The ₹2,650 target share price in 2030 offers a compelling reason to hold long term.

Frequent Asked Questions (FAQs)

Q1. What is the current P/E ratio of Deep Industries Ltd.?

Ans: The trailing twelve-month (TTM) P/E is 19.79, which is higher than the industry average of 7.05, indicating higher investor expectation.

Q2. Is Deep Industries debt-free?

Ans: Not entirely, but its debt-to-equity is 0.12, very healthy and manageable.

Q3. What is the promoter holding in the company?

Ans: Healthy 63.49% promoters holding, and this hasn’t changed in the last quarter.

Q4. Is the stock long-term investable?

Ans: Yes. Low debt, stable revenue base, and growth prospects in the energy segment make Deep Industries a worthwhile long-term investment.

Q5. What is Deep Industries’ 52-week high and low share price?

Ans: The 52-week high share price of the company is ₹624.40 and the 52-week low share price is ₹243.00.

Q6. What will be Deep Industries’ future share price in 2027?

Ans: According to the latest growth estimate, 2027 target is ₹1,450.