Diffusion Engineers Share Price Target Tomorrow 2025 To 2030

Diffusion Engineers Limited, established in 1982 and headquartered in Nagpur, India, is a prominent player in the industrial engineering sector. The company specializes in manufacturing welding consumables, wear plates, and heavy engineering equipment, catering to core industries such as mining, cement, and steel. Beyond manufacturing, Diffusion Engineers offers specialized repair and reconditioning services, enhancing the longevity and efficiency of heavy machinery. Diffusion Engineers Share Price on NSE as of 25 April 2025 is 259.25 INR.

Diffusion Engineers Share Market Overview

- Open: 259.00

- High: 264.00

- Low: 255.00

- Previous Close: 259.20

- Volume: 17,577

- Value (Lacs): 45.94

- 52 Week High: 489.96

- 52 Week Low: 168.00

- Mkt Cap (Rs. Cr.): 978

- Face Value: 10

Diffusion Engineers Share Price Chart

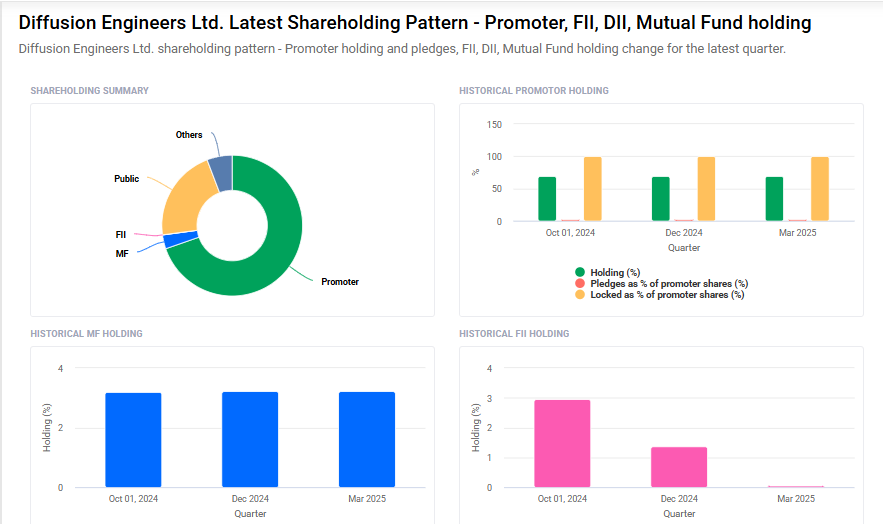

Diffusion Engineers Shareholding Pattern

- Promoters: 69.7%

- FII: 0%

- DII: 9%

- Public: 21.3%

Diffusion Engineers Share Price Target Tomorrow 2025 To 2030

| Diffusion Engineers Share Price Target Years | Diffusion Engineers Share Price |

| 2025 | ₹490 |

| 2026 | ₹550 |

| 2027 | ₹610 |

| 2028 | ₹680 |

| 2029 | ₹740 |

| 2030 | ₹800 |

Diffusion Engineers Share Price Target 2025

Here are four key factors that could influence the growth of Diffusion Engineers’ share price by 2025:

1. Consistent Revenue and Profit Growth

Diffusion Engineers has demonstrated steady financial growth over recent years. In the fiscal year 2023-24, the company’s revenue increased by 10.4% to ₹2,856 million, up from ₹2,587 million in the previous year. Moreover, the net profit saw a significant rise of 39.1%, reaching ₹308 million compared to ₹221 million in FY23. Over the past five years, the company has achieved a compound annual growth rate (CAGR) of 16.2% in revenue and 31.1% in net profit . This consistent performance reflects the company’s strong operational capabilities and market demand for its products.

2. Strong Market Debut and Investor Confidence

The company’s Initial Public Offering (IPO) was met with robust investor interest, being subscribed 114.5 times. Upon listing, the shares debuted at ₹188 apiece, marking a premium of nearly 12% over the issue price . This enthusiastic reception indicates strong investor confidence in the company’s prospects and can positively influence its share price trajectory.

3. Robust Return Ratios Indicating Operational Efficiency

Diffusion Engineers has showcased impressive return ratios, with a three-year average Return on Equity (ROE) and Return on Capital Employed (ROCE) of approximately 17% and 19%, respectively, during FY22-24. In FY24 alone, the ROE and ROCE stood at nearly 19% and 21%, respectively . These figures highlight the company’s efficient use of capital and its ability to generate substantial returns, which are favorable indicators for potential investors.

4. Positive Industry Outlook and Strategic Positioning

The company operates in sectors that are poised for growth, such as infrastructure and industrialization. Analysts have noted that Diffusion Engineers is well-positioned to benefit from increased spending in these areas, suggesting bright prospects for the company . This favorable industry outlook, combined with the company’s strategic positioning, can contribute to its growth and, consequently, its share price appreciation.

Diffusion Engineers Share Price Target 2030

Here are 4 different risks and challenges that could affect the Diffusion Engineers share price target by 2030:

1. Dependence on Specific Industries

Diffusion Engineers mainly serves sectors like infrastructure, manufacturing, and engineering. If these sectors face a slowdown due to economic uncertainty or lower government spending, the demand for the company’s products may reduce. This could impact its revenues and affect the long-term movement of its share price.

2. Raw Material Price Volatility

The company depends on metals and industrial inputs for manufacturing. Fluctuations in raw material prices—especially steel, alloys, or chemicals—can raise production costs. If these increased costs are not passed on to customers, it may hurt profit margins and, in turn, impact investor sentiment.

3. Limited Market Presence Compared to Larger Peers

Diffusion Engineers is still a smaller player in a market that includes several big companies with greater brand recognition and financial strength. Competing against such giants might limit its ability to win large contracts or scale up operations quickly, which could slow share price growth in the long run.

4. Regulatory and Compliance Risks

Being in an industrial manufacturing space, the company must comply with environmental, safety, and labor regulations. Any tightening of these rules or failure to meet standards could lead to penalties, increased costs, or operational disruptions, which may negatively influence the company’s financial performance and its stock valuation.

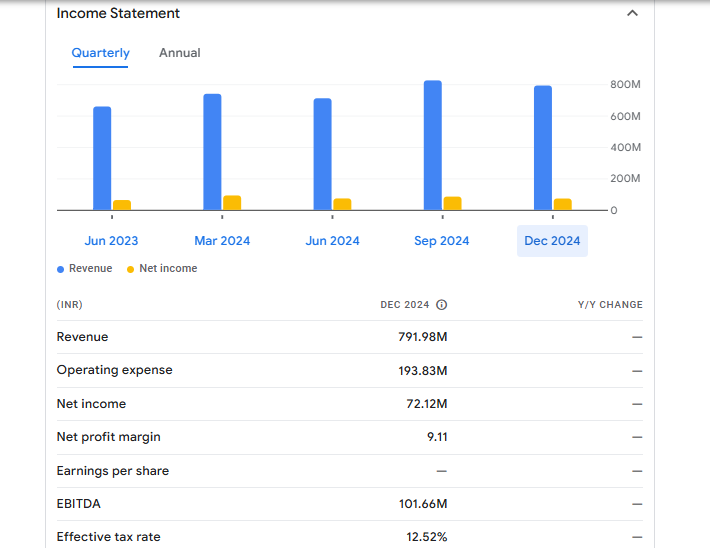

Diffusion Engineers Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 791.98M | — |

| Operating expense | 193.83M | — |

| Net income | 72.12M | — |

| Net profit margin | 9.11 | — |

| Earnings per share | — | — |

| EBITDA | 101.66M | — |

| Effective tax rate | 12.52% | — |

Read Also:- Manba Finance Share Price Target Tomorrow 2025 To 2030