Emcure Share Price Target Tomorrow 2025 To 2030

Emcure Pharmaceuticals Limited is a leading Indian pharmaceutical company headquartered in Pune, Maharashtra. Established in 1981 by Satish Mehta, Emcure is dedicated to developing, manufacturing, and globally marketing a broad range of pharmaceutical products across various therapeutic areas, including gynecology, cardiology, oncology, and HIV treatments. The company has a significant presence in over 70 countries and employs more than 10,000 professionals worldwide. Emcure Share Price on NSE as of 16 April 2025 is 949.50 INR.

Emcure Share Market Overview

- Open: 944.90

- High: 962.30

- Low: 916.20

- Previous Close: 919.45

- Volume: 164,243

- Value (Lacs): 1,563.26

- UC Limit: 0.00

- LC Limit: 0.00

- 52 Week High: 1,580.00

- 52 Week Low: 889.00

- Mkt Cap (Rs. Cr.): 18,035

- Face Value: 10

Emcure Share Price Chart

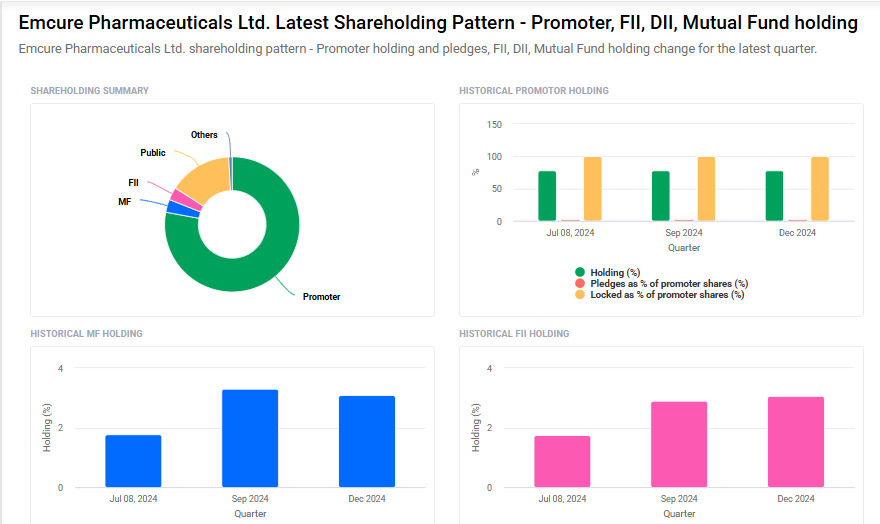

Emcure Shareholding Pattern

- Promoters: 77.9%

- FII: 3.1%

- DII: 3.9%

- Public: 15.2%

Emcure Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹1600

- 2026 – ₹1800

- 2027 – ₹2000

- 2028 – ₹2200

- 2030 – ₹2400

Major Factors Affecting Emcure Share Price

Here are six key factors that influence the share price of Emcure Pharmaceuticals Ltd:

1. Strong IPO Performance and Investor Demand

Emcure’s initial public offering (IPO) in July 2024 was met with significant enthusiasm, being oversubscribed nearly 68 times. The stock debuted with a 34.9% increase, reflecting strong investor confidence in the company’s focus areas like women’s healthcare and HIV treatments.

2. Revenue Growth vs. Profitability Challenges

While Emcure’s revenue grew at an annual rate of 6.6% between FY22 and FY24, its profit after tax declined by 13.3% during the same period. This indicates that despite increasing sales, the company faces challenges in maintaining profitability.

3. Valuation Metrics and Market Perception

Emcure’s stock is currently trading at a price-to-earnings (P/E) ratio of 36.6, which is slightly below the industry average of 40.4. This suggests that while the stock is relatively valued, investors are cautious due to the company’s profitability trends.

4. Operational Expenses Impacting Margins

The company allocates a significant portion of its operating revenue to expenses, with 19.41% towards employee costs and 3.56% towards interest expenses. These high operational costs can impact the company’s profit margins and, consequently, its share price.

5. Limited Public Shareholding (Low Free Float)

Post-IPO, Emcure has a low free float of approximately 10%, meaning a smaller portion of shares is available for public trading. This limited availability can lead to higher stock price volatility and affect liquidity.

6. Regulatory Environment and Intellectual Property Risks

Emcure operates in a sector subject to stringent government regulations, including price controls and patent laws. Changes in these regulations or challenges in enforcing intellectual property rights can adversely affect the company’s operations and stock performance:

Risks and Challenges for Emcure Share Price

Here are six key risks and challenges that could impact the share price of Emcure Pharmaceuticals Ltd:

1. Declining Profit Margins Despite Revenue Growth

While Emcure’s revenue increased by 11% year-on-year in FY24, its profit after tax decreased by 6%. This indicates that rising operational costs are affecting the company’s profitability, which could concern investors.

2. Regulatory Compliance and Quality Control Risks

Operating in the pharmaceutical industry requires strict adherence to quality standards. Any lapses in manufacturing or quality control can lead to regulatory actions, product recalls, or legal issues, potentially harming the company’s reputation and financial standing.

3. High Competition Leading to Price Erosion

Emcure produces many off-patent generic drugs, which face intense competition. This competitive environment can lead to price reductions, impacting the company’s revenue and profit margins.

4. Supply Chain Disruptions and Cost Fluctuations

The company relies on various raw materials and third-party suppliers. Any disruptions in the supply chain or increases in material costs can affect production schedules and profitability.

5. Legal Liabilities from Past Operations

Despite demerging its U.S. business, Emcure still faces significant legal challenges, including ongoing civil procedures and antitrust litigation in the U.S. These legal issues could result in financial liabilities and affect investor confidence.

6. Limited Public Shareholding (Low Free Float)

After its IPO, only about 10% of Emcure’s shares are available for public trading. This low free float can lead to higher stock price volatility and may limit liquidity for investors.

Read Also:- Arihant Capital Share Price Target Tomorrow 2025 To 2030