Federal Bank Share Price Target From 2025 to 2030

Federal Bank Share Price Target From 2025 to 2030: Stock investment in banking is characterized by high finance analysis, economic well-being, and industry performance measurement experience. Of India’s top private sector banks, Federal Bank Ltd. has been a top player, generating the interest of institutional and retail investors.

With a good past performance, cautious management, and increasing confidence from the investors, Federal Bank’s share performance has raised many eyebrows among the market analysts. The following article attempts to provide an in-depth analysis of Federal Bank Ltd., its recent performance, technical as well as fundamental, and share price targets for the years 2025-2030.

Company Overview and Market Position

Kerala-headquartered Federal Bank Ltd. is India’s leading private sector bank with customer orientation and healthy regional franchise. It has strengthened its asset base and enriched digital touch points without compromising on profitability in good health.

Strengths of Federal Bank are:

- Pan-India presence with increasing focus on SME and retail businesses.

- Adequate back-end digital strength to sustain customer acquisition and reduce cost-to-income.

- Good asset quality and lower NPAs compared to peers.

- Strong institutional faith as captured in escalating mutual fund and domestic institutional holder increases.

Last Performance of Stock Market

- Last Traded Price: ₹195.53

- 52-Week High: ₹217.00

- 52-Week Low: ₹148.00

- Market Cap: ₹48,020 Crores

- P/E Ratio: 11.96 (Industry P/E ~12.77)

- Dividend Yield: 0.61%

- EPS (TTM): ₹16.45

- Book Value: ₹132.45

- Face Value: ₹2

The stock has appreciated +26.52% in the past one year, reflecting increasing demand from investors and good fundamentals. The stock price is now ranging between ₹195, reflecting the formation of the base before the next bull run.

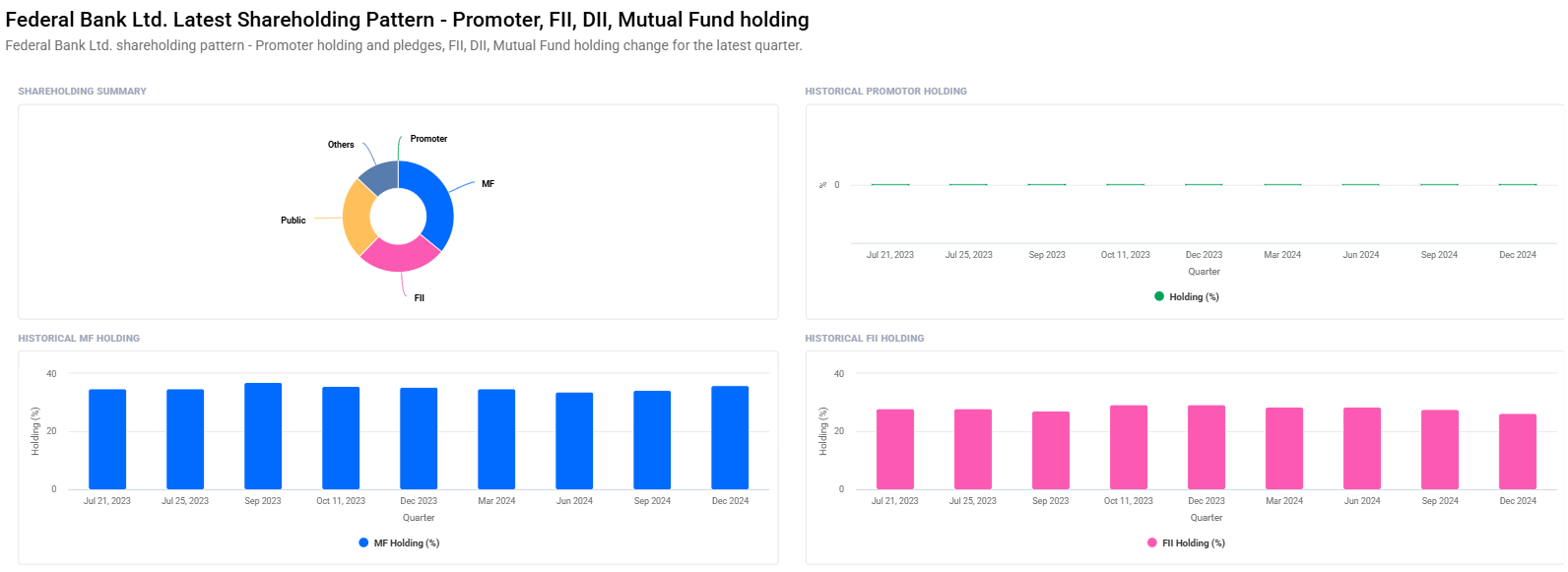

Ownership Pattern and Institutional Faith

Shareholding pattern as of Dec 2024 quarter reflects:

- Mutual Funds: 35.89% (vs 34.28%)

- Foreign Institutions (FII/FPI): 28.32% (vs 27.72%)

- Retail and Others: 24.78%

- Other Domestic Institutions: 13.01%

Though FII/FPI holdings have fallen moderately, mutual fund schemes have increased in holding as well as number (from 39 to 41 schemes). This reflects long-term institutional confidence in Federal Bank’s future.

Technical Analysis – Momentum and Indicators

Federal Bank technical indicators are moderately neutral to bullish:

- MACD (12,26,9): 3.2, Bullish – MACD above center and signal line

- RSI (14): 62.2, Neutral to Bullish – close to overbought

- ADX: 32.7, Trend Strength Present

- Momentum Score: 53.5, Neutral Zone

- ROC (21): 10.5 Positive Momentum

- MFI: 77.8, Overbought – Possible Pullback

- ATR: 4.9, Suggests volatility

Overall, the indicators indicate that the stock is trading with momentum but with caution since MFI indicates overbought levels. With MACD and ROC being bullish, however, any fall would be a buying opportunity.

Federal Bank Share Price Target: 2025 to 2030

Given Federal Bank’s consistent growth, financial data, and industry trends, the following year-by-year estimated share price target is:

Year\tTarget Price Range (₹)\tOutlook

2025\t₹220\tMacro-economic support-led recovery phase

2026\t₹300\tStrong loan growth, digitalization

2027\t₹380\tRising NIMs, healthy ROE/ROA

2028\t₹460\tGrowing institutional participation

2029\t₹540\tRetail and digital banking supremacy

2030\t₹620\tEstablished growth, stable returns, and leadership in core verticals

These targets are exposed to world interest rate volatility, local inflation control, macroeconomic stability, and credit demand. But with the fundamentals of the bank, these targets could be achieved within a long-term investment horizon.

Fundamental Strength and Growth Drivers

Here are a few reasons why Federal Bank is a good bet for the long term:

- Good Management – Strategy towards geographic expansion, retail lending, and digitalization.

- Asset Quality – Gross and Net NPA levels lowest in private banks.

- Return on Capital (ROC) – 12.42%, indicating proper use of capital.

- Book Value Growth – At ₹132.45, indicating revival to intrinsic value.

- EPS Growth – ₹16.45 (TTM), indicating steady rising trend.

- Low P/E Ratio – Reasonably valued relative to industry peers.

- Diversified Lending Portfolio – Adequate exposure sector mix to retail, corporate, and SME.

Investment Strategy – What Should Investors Do?

Short-Term (1–2 Years)

- Risk Level: Moderate

- Strategy: Wait for corrections between ₹185–₹190 to invest.

- Exit Target: ₹220

Medium-Term (3-5 Years)

- Risk Level: Moderate

- Strategy: Buy on dips. Seize industry growth and digitalization.

- Exit Target: ₹300-₹380

Long-Term (5+ Years)

- Risk Level: Low

- Strategy: SIP-based investment strategy to compound wealth.

- Exit Target: ₹540-₹620

Risks and Challenges

Despite the bullish trend, the following risks should be kept in mind by investors:

- Macroeconomic Volatility – Interest rate cycle and inflation impact earnings.

Powervar and Jindal Steel appreciate while Vedanta dips on account of fraud allegations, Cement stocks rise.

- Credit Risk – Retail and SME finance lending in weakening economy may impact asset quality.

- FII Sentiment – Foreign redemption may bring near-term volatility.

- Regulatory Risks – RBI policy and regulatory charges may impact profitability.

FAQs – Federal Bank Share Price Target

Q1: Is Federal Bank a long-term hold stock?

A: Yes, with fundamentals, institutional faith, and progress in the internet, it can make long-term wealth.

Q2: What is Federal Bank’s target price in 2025?

A: Based on current analysis, the target price for 2025 is around ₹220.

Q3: Federal Bank’s target price in 2030?

A: In 2030, the ratio will be ₹620, considering steady growth and good economic times.

Q4: What is 62.2 on RSI?

A: That the stock is quite strong trend but close to overbought.

Q5: Why are FIIs offloading stakes?

A: Maybe temporary foreign portfolio rebalancing. But the number of FII holders has increased, indicating continuous interest.

Q6: What does mutual fund indicate about Federal Bank?

A: Yes. The holdings in the mutual fund increased from 34.28% to 35.89%, so also the schemes holding the stock.

Q7: Is Federal Bank overvalued?

A: No. With a P/E of 11.96, it is below industry levels and shows good valuation.

Q8: What are the short-term risks of the stock?

A: The dangers are technical volatility because of overbought, sectoral negatives, and worldwide market corrections.

Final Verdict – Should You Invest?

Federal Bank Ltd. is an investment-worthy bet as a prospect in India’s private sector banking space. With strong fundamentals, building institutional backing, and a good approach for expanding online, it can benefit from sustained long-term growth.

Though there can be short-term volatility in the market, the long-term investor can look towards Federal Bank as an appropriate portfolio addition. Purchase during correction times would provide them with appropriate entry points and result in earning maximum return in the next 5-6 years.