GCM Commodity Share Price Target Tomorrow 2025 To 2030

GCM Commodity & Derivatives Limited is a financial services company based in Mumbai, India. Established in 2005, the company specializes in commodity broking and investments in National Spot Exchange Limited (NSEL) products, aiming to provide arbitrage opportunities and liquidity to investors. As a trading-cum-clearing member of NSEL, GCM Commodity offers clients access to a range of short-term commodity contracts. The company is also involved in trading and investing in equity shares and securities, operating in both the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) equity segments. GCM Commodity Share Price on NSE as of 29 May 2025 is 4.92 INR.

GCM Commodity Share Market Overview

- Open: 4.92

- High: 4.92

- Low: 4.92

- Previous Close: 4.92

- Value (Lacs): 0.00

- VWAP: 4.92

- 52 Week High: 9.88

- 52 Week Low: 3.25

- Mkt Cap (Rs. Cr.): 3

- Face Value: 10

GCM Commodity Share Price Chart

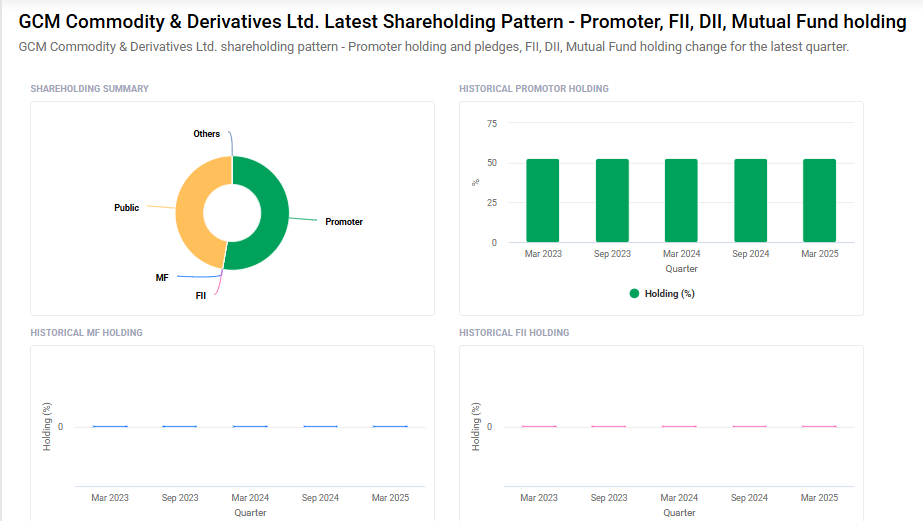

GCM Commodity Shareholding Pattern

- Promoters: 52.7%

- FII: 0%

- DII: 0%

- Public: 47.3%

GCM Commodity Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹10 |

| 2026 | ₹20 |

| 2027 | ₹30 |

| 2028 | ₹40 |

| 2029 | ₹50 |

| 2030 | ₹60 |

GCM Commodity Share Price Target 2025

GCM Commodity share price target 2025 Expected target could ₹10. Here are five key factors that could influence GCM Commodity & Derivatives Ltd’s (GCMCOMM) share price target by 2025:

-

Revenue Growth and Profitability

In FY2024, GCM Commodity & Derivatives Ltd reported a total revenue of approximately ₹3.96 crore. However, the company faced a net loss of ₹0.68 crore during the same period. The ability to improve profitability will be crucial for enhancing investor confidence and driving share price growth. -

Promoter Holding Stability

As of March 2025, promoters held a 52.74% stake in the company, indicating a stable ownership structure. Consistent promoter holding can be perceived positively by investors, suggesting confidence in the company’s long-term prospects. -

Market Capitalization and Liquidity

With a market capitalization of ₹3.65 crore as of May 2025, GCM Commodity is categorized as a micro-cap stock. Such companies often experience higher volatility and liquidity constraints, which can impact share price movements. -

Valuation Metrics

The company’s Price-to-Earnings (P/E) ratio stands at -7.12, and the Price-to-Book (P/B) ratio is 0.26. These valuation metrics suggest that the stock is trading at a discount compared to its book value, which might attract value investors if the company demonstrates improved financial performance. -

Operational Focus and Business Model

GCM Commodity & Derivatives Ltd is engaged in trading and investments in equity shares, operating in both the BSE and NSE equity segments. The company’s focus on capital market activities means its performance is closely tied to market conditions. A favorable market environment could enhance trading volumes and profitability.

GCM Commodity Share Price Target 2030

GCM Commodity share price target 2030 Expected target could ₹60. Here are five key risks and challenges that could affect GCM Commodity & Derivatives Ltd’s share price target by 2030:

-

Weak Financial Performance

GCM Commodity has reported consistent net losses in recent financial years, including a loss of ₹0.68 crore in FY2024. If this trend continues, it could erode investor confidence and limit the company’s growth potential over the long term. -

Low Market Capitalization and Liquidity Issues

With a market capitalization of under ₹4 crore, the company is a micro-cap stock. Such stocks often face low trading volumes and high price volatility, making them riskier and less attractive for large institutional investors. -

Dependence on Market Conditions

The company is involved in trading and investing in equity markets. Its performance is heavily dependent on overall market trends and economic cycles. A downturn in capital markets can directly affect revenue and profitability. -

Limited Business Diversification

GCM Commodity’s core operations are focused on securities trading and investment. A lack of diversified revenue streams could pose a risk if there is any disruption in the equity or commodity markets. -

Regulatory Compliance and Governance Risks

As a financial market participant, the company must adhere to SEBI regulations and other compliance frameworks. Any non-compliance, audit issues, or governance lapses could lead to penalties and negatively impact its reputation and share value.

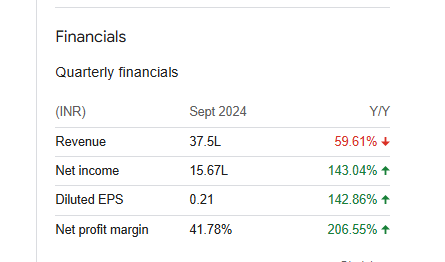

GCM Commodity Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 39.57M | 1,383.50% |

| Operating expense | 4.85M | 59.80% |

| Net income | -6.80M | -196.55% |

| Net profit margin | -17.18 | -106.51% |

| Earnings per share | — | — |

| EBITDA | — | — |

| Effective tax rate | -0.09% | — |

Read Also:- Bansisons Tea Share Price Target Tomorrow 2025 To 2030