Happiest Minds Share Price Target Tomorrow 2025 To 2030

Happiest Minds Technologies is an Indian IT company that focuses on helping businesses with digital transformation. Started in 2011, the company offers services like cloud computing, cybersecurity, data analytics, and software development. Happiest Minds works with clients from different industries, such as banking, healthcare, and retail, to make their technology stronger and smarter. Happiest Minds Share Price on NSE as of 28 May 2025 is 605.90 INR.

Happiest Minds Share Market Overview

- Open: 608.85

- High: 610.25

- Low: 603.00

- Previous Close: 608.20

- Volume: 119,184

- Value (Lacs): 721.24

- 52 Week High: 956.00

- 52 Week Low: 519.30

- Mkt Cap (Rs. Cr.): 9,214

- Face Value: 2

Happiest Minds Share Price Chart

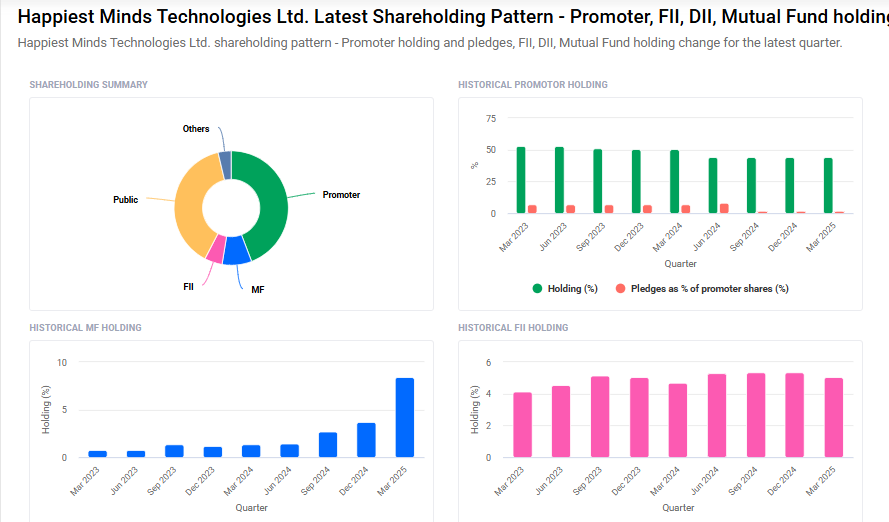

Happiest Minds Shareholding Pattern

- Promoters: 44.2%

- FII: 5%

- DII: 10.6%

- Public: 38.7%

- Others: 1.5%

Happiest Minds Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹960 |

| 2026 | ₹1000 |

| 2027 | ₹1050 |

| 2028 | ₹1115 |

| 2029 | ₹1180 |

| 2030 | ₹1242 |

Happiest Minds Share Price Target 2025

Happiest Minds share price target 2025 Expected target could ₹960. Here are five key factors that could influence Happiest Minds Technologies’ share price target by 2025:

-

Strong Revenue and Earnings Growth

Happiest Minds is projected to achieve a compound annual growth rate (CAGR) of approximately 20% through FY2025, driven by robust demand in digital services. This growth trajectory is expected to enhance earnings per share (EPS), reflecting a positive outlook for profitability. -

Strategic Acquisitions Expanding Capabilities

The company’s acquisition of PureSoftware Technologies for ₹779 crores has bolstered its presence in key sectors like BFSI, healthcare, and retail. This strategic move not only augments Happiest Minds’ service offerings but also extends its global footprint, potentially leading to increased revenue streams. -

Focus on High-Growth Digital Segments

Happiest Minds’ emphasis on digital transformation services, including cloud computing, cybersecurity, and analytics, positions it well to capitalize on the growing demand for such solutions. The company’s specialization in these high-growth areas is anticipated to drive sustained business expansion. -

Expansion into Generative AI and Emerging Technologies

The establishment of a dedicated Generative AI business unit signifies Happiest Minds’ commitment to innovation. By investing in emerging technologies, the company aims to offer cutting-edge solutions, thereby attracting new clients and enhancing its competitive edge. -

Analyst Confidence and Positive Market Sentiment

Analysts have expressed optimism regarding Happiest Minds’ future performance, with forecasts indicating a 25% annual growth in earnings and a 13.3% increase in revenue. Such positive projections contribute to favorable market sentiment, potentially influencing the company’s share price positively.

Happiest Minds Share Price Target 2030

Happiest Minds share price target 2030 Expected target could ₹1242. Here are five key risks and challenges that could impact Happiest Minds Technologies’ share price target by 2030:

-

Intense Competition in the IT Services Sector

Happiest Minds faces significant competition from both domestic and global IT service providers, including major players like Infosys, Wipro, and TCS. This intense rivalry can lead to pricing pressures, deal renegotiations, and challenges in client retention, potentially affecting revenue growth and profitability. -

Regulatory and Compliance Risks

Operating across multiple geographies exposes Happiest Minds to varying regulatory environments. Changes in data protection laws, such as the General Data Protection Regulation (GDPR) in Europe or the Digital Personal Data Protection Act in India, can impose additional compliance costs and operational challenges, impacting business operations and financial performance. -

Currency Fluctuation Risks

With approximately 80-85% of its revenue generated from international markets, particularly the USA, Happiest Minds is susceptible to foreign exchange fluctuations. Adverse currency movements can affect profitability, despite the company’s hedging strategies. -

Employee Attrition and Talent Acquisition

The IT services industry is characterized by high employee turnover. While Happiest Minds has managed to reduce its attrition rate, any increase could lead to higher recruitment and training costs, and potential disruptions in service delivery, affecting client satisfaction and operational efficiency. -

Integration Challenges Post-Acquisitions

Happiest Minds has made several acquisitions to expand its capabilities. However, integrating new companies can present challenges such as cultural alignment, operational integration, and realizing expected synergies. Any difficulties in these areas could impact the anticipated benefits and affect shareholder value.

Happiest Minds Financials Statement

| (INR) | 2025 | Y/Y change |

| Revenue | 20.61B | 26.85% |

| Operating expense | 4.30B | 32.84% |

| Net income | 1.85B | -25.66% |

| Net profit margin | 8.96 | -41.40% |

| Earnings per share | 12.26 | -23.51% |

| EBITDA | 3.54B | 16.84% |

| Effective tax rate | 27.71% | — |

Read Also:- Zomato Share Price Target Tomorrow 2025 To 2030