HDFC Bank Share Price Target Tomorrow 2025 To 2030

HDFC Bank is one of the most trusted and well-established private sector banks in India. Its shares are popular among both long-term investors and traders because of the bank’s consistent performance and strong financial health. Over the years, HDFC Bank has shown steady growth in profits, a stable balance sheet, and efficient management, which supports its share price. HDFC Bank Share Price on NSE as of 22 April 2025 is 1,960.00 INR.

HDFC Bank Share Market Overview

- Open: 1,935.00

- High: 1,970.60

- Low: 1,935.00

- Previous Close: 1,927.10

- Volume: 22,980,875

- Value (Lacs): 450,815.82

- VWAP: 1,957.15

- UC Limit: 2,119.80

- LC Limit: 1,734.40

- 52 Week High: 1,970.60

- 52 Week Low: 1,426.80

- Mkt Cap (Rs. Cr.): 1,501,136

- Face Value: 1

HDFC Bank Share Price Chart

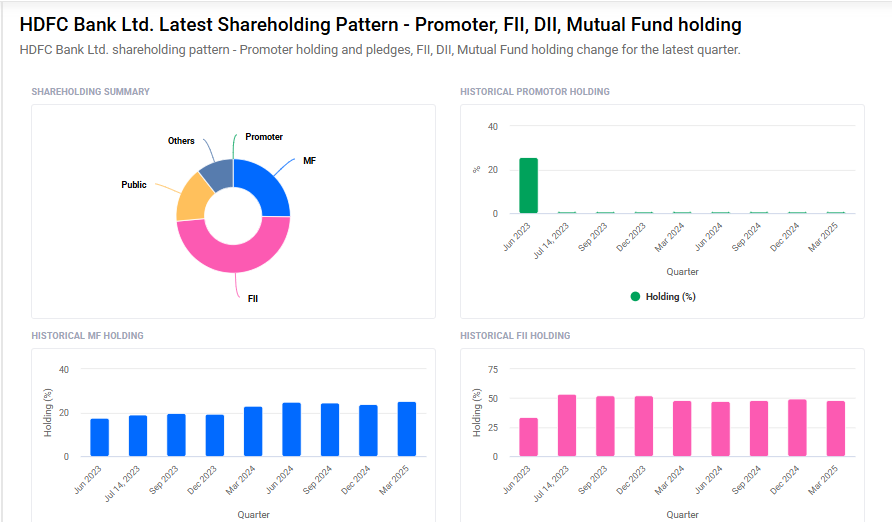

HDFC Bank Shareholding Pattern

- Promoters: 0%

- FII: 48.3%

- DII: 35.9%

- Public: 15.8%

HDFC Bank Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹1970

- 2026 – ₹2400

- 2027 – ₹2800

- 2028 – ₹3200

- 2030 – ₹3600

Major Factors Affecting HDFC Bank Share Price

Here are six key factors that influence the share price of HDFC Bank:

1. Strong Financial Performance

HDFC Bank’s consistent financial growth plays a significant role in its share price. In the fourth quarter of FY25, the bank reported a standalone net profit of ₹17,616 crore, surpassing analyst expectations. This robust performance boosts investor confidence and positively impacts the stock price.

2. Loan and Deposit Growth

The bank’s ability to grow its loans and deposits affects its profitability and, consequently, its share price. As of March 2025, HDFC Bank’s gross advances grew by 4% sequentially, and deposits increased by 5.9%, totaling ₹27.15 trillion. A healthy loan-to-deposit ratio indicates efficient use of funds, which investors view favorably.

3. Asset Quality and Non-Performing Assets (NPAs)

Maintaining low levels of NPAs reflects the bank’s effective risk management. In Q4 FY25, HDFC Bank’s gross NPAs declined to 1.33% from 1.42% in the previous quarter, indicating improved asset quality. Such improvements can lead to positive investor sentiment and a rise in share price.

4. Market Capitalization and Investor Confidence

HDFC Bank’s market capitalization reflects its size and investor confidence. As of April 22, 2025, the bank’s market cap stood at ₹15.01 lakh crore, making it India’s second-largest company by market value. A high market cap often attracts institutional investors, supporting the share price.

5. Analyst Ratings and Price Targets

Positive analyst ratings and increased price targets can influence investor decisions. Brokerages like Jefferies and Emkay Global have raised their target prices for HDFC Bank to ₹2,340 and ₹2,200 respectively, citing strong earnings and growth potential.

6. Macroeconomic Factors and Regulatory Policies

Economic indicators and regulatory decisions impact the banking sector. For instance, the Reserve Bank of India’s liquidity measures can affect funding costs for banks. Additionally, a weakening U.S. dollar enhances foreign investment in emerging markets like India, benefiting banks such as HDFC Bank.

Risks and Challenges for HDFC Bank Share Price

Here are six key risks and challenges that could impact the share price of HDFC Bank:

1. Pressure on Profit Margins

After merging with HDFC Ltd., HDFC Bank’s net interest margin (NIM) declined from over 4% to 3.4%. This drop is due to higher borrowing costs and a larger share of low-yield home loans. Lower margins can reduce profits and affect investor confidence.

2. High Loan-to-Deposit Ratio

The bank’s loan-to-deposit ratio (LDR) rose significantly post-merger, reaching 104% in March 2024. Although it improved to 96.5% by March 2025, it remains higher than desired. A high LDR means the bank is lending more than it has in deposits, which can strain liquidity and increase funding costs.

3. Regulatory Compliance Issues

HDFC Bank received warning letters from SEBI for non-compliance in its custody and merchant banking operations. Such regulatory issues can harm the bank’s reputation and lead to increased scrutiny, potentially affecting its stock performance.

4. Rising Retail Loan Defaults

There has been an increase in defaults, especially in personal loans and micro-credit segments. This trend is concerning as it can lead to higher non-performing assets (NPAs) and necessitate increased provisions, impacting profitability.

5. Intense Competition from Fintechs

Digital-only banks and fintech companies are offering competitive services, putting pressure on traditional banks like HDFC to innovate and maintain their market share. This competition can lead to reduced fees and interest margins.

6. Foreign Investor Selling

Foreign Institutional Investors (FIIs) hold a significant portion of HDFC Bank’s shares. If FIIs withdraw investments due to global economic factors, it can lead to a decline in the bank’s share price.

Read Also:- ACC Share Price Target Tomorrow 2025 To 2030