IndiaMART Share Price Target Tomorrow 2025 To 2030

IndiaMART InterMESH Ltd. is India’s largest online B2B marketplace, connecting buyers and suppliers across various industries. Established in 1996 and headquartered in Noida, IndiaMART offers a platform where businesses can discover and connect with verified suppliers for a wide range of products and services . As of April 14, 2025, the company’s stock is trading on the NSE under the ticker symbol INDIAMART. IndiaMART has a market capitalization of approximately ₹12,570 crore and maintains a healthy financial profile with minimal debt. IndiaMART Share Price on NSE as of 14 April 2025 is 2,093.95 INR.

IndiaMART Share Market Overview

- Open: 2,064.50

- High: 2,105.75

- Low: 2,018.00

- Previous Close: 1,993.80

- Volume: 102,352

- Value (Lacs): 2,143.15

- VWAP: 2,070.06

- UC Limit: 2,392.55

- LC Limit: 1,595.05

- 52 Week High: 3,198.40

- 52 Week Low: 1,900.10

- Mkt Cap (Rs. Cr.): 12,570

- Face Value: 10

IndiaMART Share Price Chart

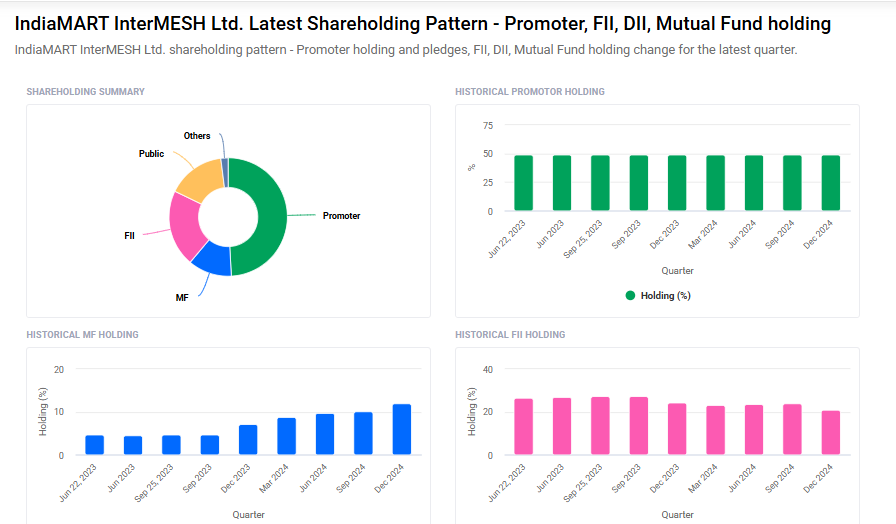

IndiaMART Shareholding Pattern

- Promoters: 49.2%

- FII: 21.1%

- DII: 13.9%

- Public: 15.8%

IndiaMART Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹3200

- 2026 – ₹3700

- 2027 – ₹4200

- 2028 – ₹4900

- 2029 – ₹5400

- 2030 – ₹600

Major Factors Affecting IndiaMART Share Price

Here are six key factors that influence the share price of IndiaMART InterMESH Ltd:

1. Financial Performance

IndiaMART’s share price is closely tied to its financial health. Positive indicators like revenue growth and profitability can boost investor confidence. For instance, the company reported a 21% increase in revenue over the last year, and its earnings per share (EPS) have grown by 5% annually over the past three years.

2. Customer Retention and Churn Rates

As a subscription-based platform, IndiaMART’s revenue depends on retaining paying customers. Recent reports indicate a decline in subscriber numbers and high churn rates, which have raised concerns among investors and led to stock price fluctuations.

3. User Experience and Platform Quality

Improving the user experience can help reduce customer churn and attract high-quality suppliers. Efforts to simplify the platform and onboard better suppliers are aimed at increasing average revenue per user (ARPU) and supporting long-term growth.

4. Competitive Landscape

IndiaMART operates in a competitive B2B e-commerce sector, facing rivals like TradeIndia, Justdial, and Udaan. Increased competition can impact customer acquisition and retention, influencing revenue and share price.

5. Macroeconomic Factors

Broader economic conditions, such as digital ad spending trends and market saturation, can affect IndiaMART’s customer acquisition efforts and revenue growth, thereby impacting its stock performance.

6. Investor Sentiment and Valuation

Investor perceptions of IndiaMART’s future prospects play a significant role in its share price. Analyst ratings and target price adjustments, based on company performance and market conditions, can lead to stock price volatility.

Risks and Challenges for IndiaMART Share Price

Here are six key risks and challenges that could influence the share price of IndiaMART InterMESH Ltd.:

1. Decline in Paying Subscribers

IndiaMART has experienced a decrease in its paying subscriber base, with a net reduction of 3,715 subscribers in a recent quarter. This decline raises concerns about the company’s ability to retain customers, which can impact revenue and investor confidence.

2. Sluggish Revenue Growth

The company’s revenue growth has been slower than expected, with collections growth slowing sharply to 5% year-on-year in Q2FY25. Such sluggish growth may affect the company’s profitability and, consequently, its share price.

3. Overvaluation Concerns

Analysts have indicated that IndiaMART’s stock may be overvalued by approximately 23% compared to its intrinsic value. This overvaluation suggests that the stock price might not accurately reflect the company’s actual financial health, posing a risk of price correction.

4. High Customer Churn

The company faces challenges with high customer churn rates, indicating that a significant number of customers are discontinuing their subscriptions. High churn can lead to decreased revenues and increased costs associated with acquiring new customers.

5. Competitive Market Landscape

IndiaMART operates in a highly competitive B2B e-commerce sector, facing competition from both established players and new entrants. This intense competition can pressure market share and margins, affecting the company’s financial performance and stock valuation.

6. Macroeconomic Factors

Broader economic conditions, such as fluctuations in digital ad spending and market saturation, can impact IndiaMART’s customer acquisition efforts and revenue growth, thereby influencing its stock performance.

Read Also:- Deep Industries Share Price Target From 2025 to 2030